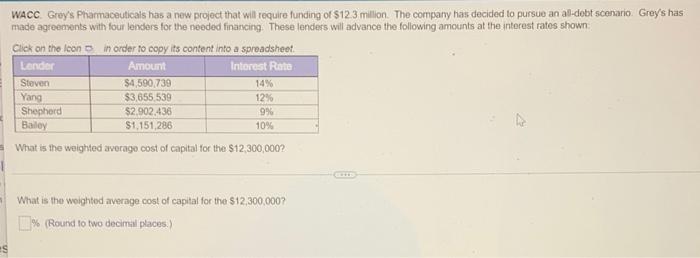

Question: WACC Grey's Pharmaceuticals has a new project that will require funding of $12.3 million. The company has decided to pursue an all-cobt scenario Grey's has

WACC Grey's Pharmaceuticals has a new project that will require funding of $12.3 million. The company has decided to pursue an all-cobt scenario Grey's has made agreements with four londers for the needed financing. These lenders will advance the following amounts at the interest rates shown Click on the icon in order to copy its content into a spreadsheet Lender Amour Interest Rate Steven $4,590739 14% Yang $3,655 539 12% Shepherd $2.902.436 9% Bailey $1.151,286 10% What is the weighted average cost of capital for the $12,300,000? What is the weighted average cost of capital for the $12,300,000? 1% (Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts