Question: WACC. Grey's Pharmaceuticals has a new project that will require funding of $10.8 million. The company has decided to pursue an all-debt scenario. Grey's has

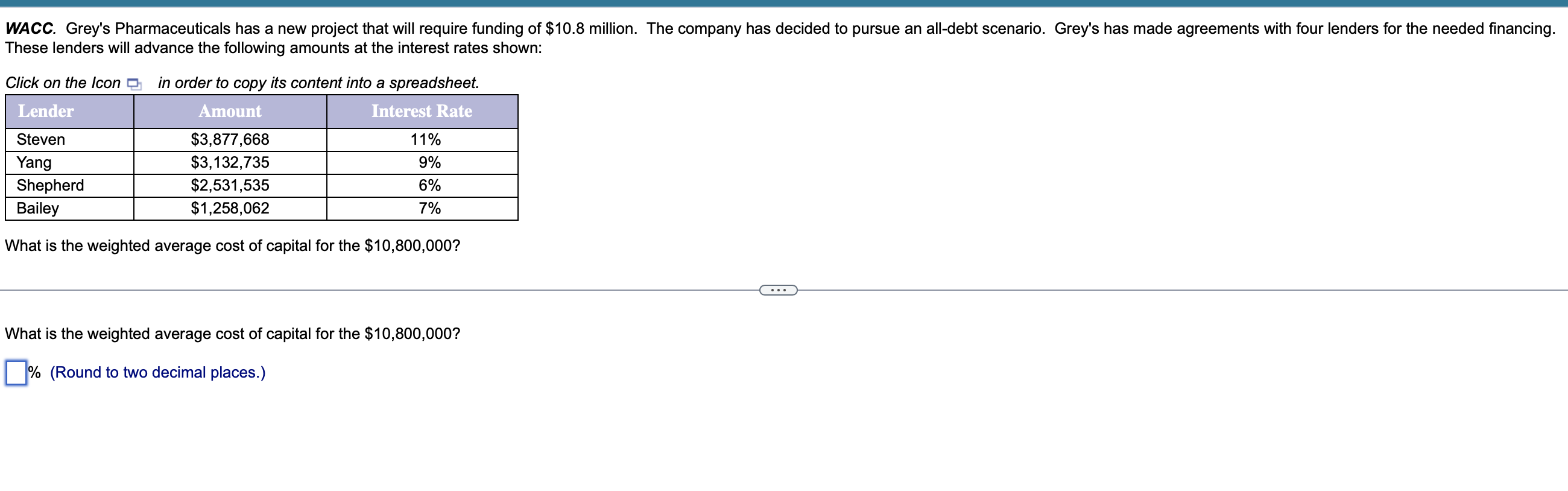

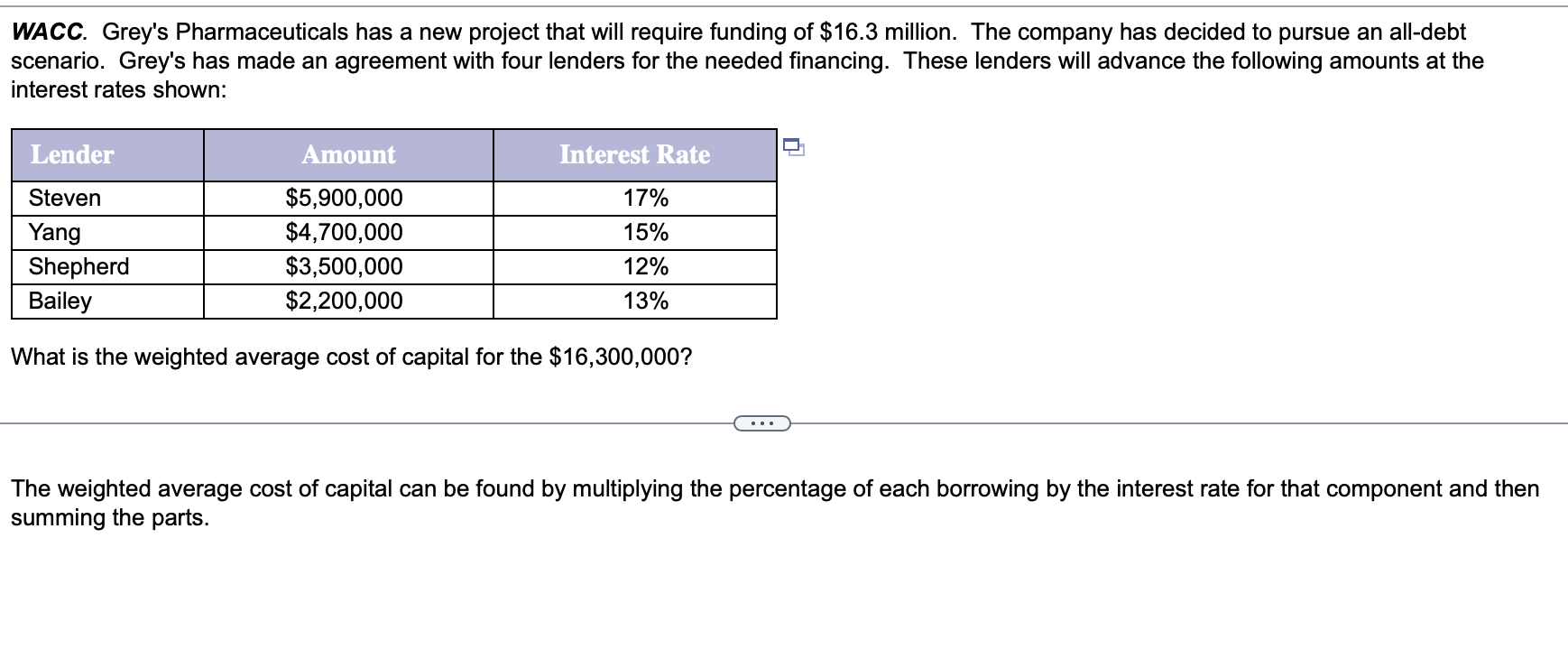

WACC. Grey's Pharmaceuticals has a new project that will require funding of $10.8 million. The company has decided to pursue an all-debt scenario. Grey's has made agreements with four lenders for the needed financing. These lenders will advance the following amounts at the interest rates shown: Click on the Icon Lender Steven in order to copy its content into a spreadsheet. Amount Interest Rate $3,877,668 11% $3,132,735 9% $2,531,535 6% $1,258,062 7% Yang Shepherd Bailey What is the weighted average cost of capital for the $10,800,000? What is the weighted average cost of capital for the $10,800,000? % (Round to two decimal places.) WACC. Grey's Pharmaceuticals has a new project that will require funding of $16.3 million. The company has decided to pursue an all-debt scenario. Grey's has made an agreement with four lenders for the needed financing. These lenders will advance the following amounts at the interest rates shown: Lender Amount Interest Rate Steven Yang Shepherd Bailey $5,900,000 $4,700,000 $3,500,000 $2,200,000 17% 15% 12% 13% What is the weighted average cost of capital for the $16,300,000? The weighted average cost of capital can be found by multiplying the percentage of each borrowing by the interest rate for that component and then summing the parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts