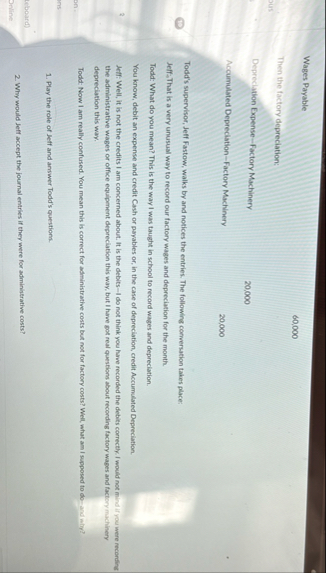

Question: Wages Payable 6 0 , 0 0 0 Then the factory depreciation: Deprecistion Expense - Factory Machinery 2 0 , 0 0 0 Accumulated Depreciation

Wages Payable

Then the factory depreciation:

Deprecistion ExpenseFactory Machinery

Accumulated DepreciationFactory Machinery

Todd's supervisor, Jeff Fastow, walks by and notices the entries. The following corrersation takes place:

JeffThat is a very unusual way to record our factory wages and depreciation for the month.

Todd: What do you mean? This is the way I was taught in school to record wages and depreciation.

You know, debit an expense and credit Cash or payables or in the case of depreciation, credit Accumulated Depreciation.

Jeff: Well, it is not the credits I am concerned about. It is the debitsI do not think you have recorded the debits correctly. I would not mind if rou were reconting the administrative wages or office equipment depreciation this way, but I have got real questions about reconding factory wages and factory machinery depreciation this way.

Todd Now I am really confused. You mean this is correct for administrative costs but not for factory costs? Well, what am I supposed to doand nin?

Play the role of Jeff and answer Todd's question.

Why would Jeff accept the journal entries if they were for administrative costs?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock