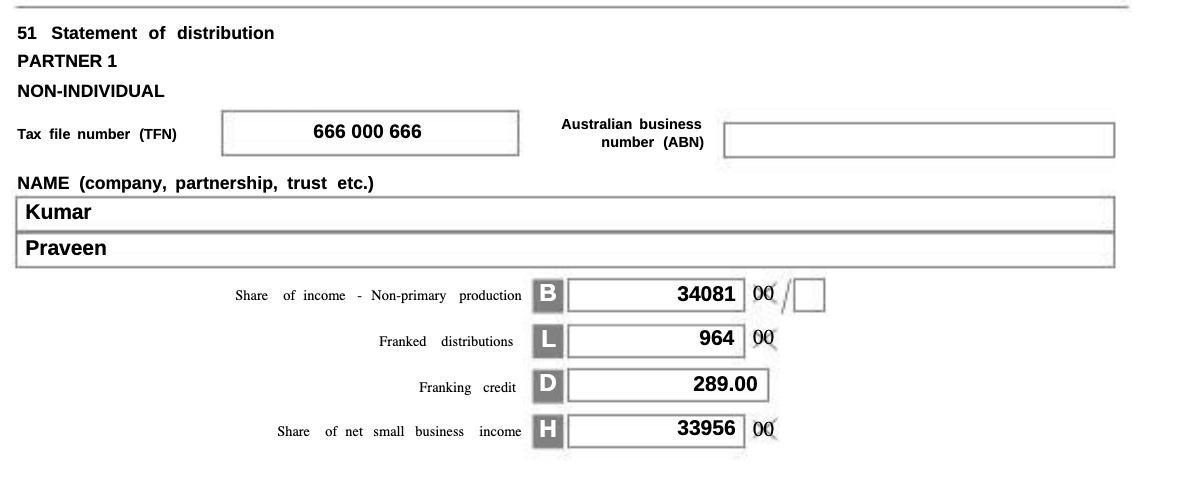

Question: What is franked distribution in partnership? How is it calculated? 51 Statement of distribution PARTNER 1 NON-INDIVIDUAL Tax file number (TFN) 666 000 666 NAME

What is franked distribution in partnership?

51 Statement of distribution PARTNER 1 NON-INDIVIDUAL Tax file number (TFN) 666 000 666 NAME (company, partnership, trust etc.) Kumar Praveen Share of income - Non-primary production B Franked distributions L D Share of net small business income H Franking credit Australian business number (ABN) 34081 00 964 00 289.00 33956 00

Step by Step Solution

★★★★★

3.48 Rating (171 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

In a partnership a franked distribution refers to the portion of the distribution made to partners t... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock