Question: Wallace sells a AAA rated 4% bond for $960 and buys another AAA rated 4% bond for $950. Both bonds mature in seven years. This

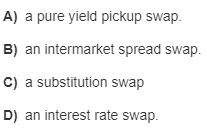

Wallace sells a AAA rated 4% bond for $960 and buys another AAA rated 4% bond for $950. Both bonds mature in seven years. This is an example of

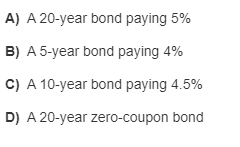

Q..An investor whose primary investment objective is capital appreciation is anticipating a decrease in interest rates. Which of the following bonds would she most likely purchase?

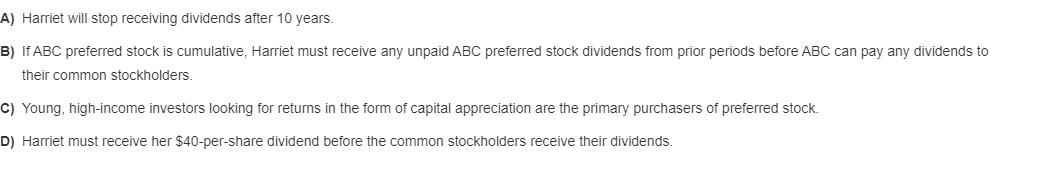

Q..Harriet recently purchased 100 shares of ABC preferred stock, paying a 4% dividend. Which of the following statements is CORRECT?

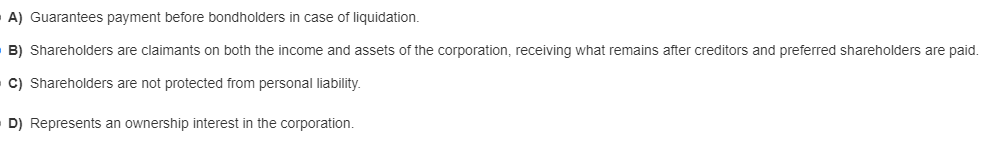

Q..Which of the following statements regarding common stock is correct?

Q..Which of the following statements regarding common stock is correct?

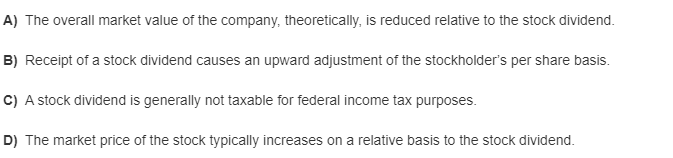

Q...Which of the following statements regarding dividends paid in stock, rather than cash, is correct?

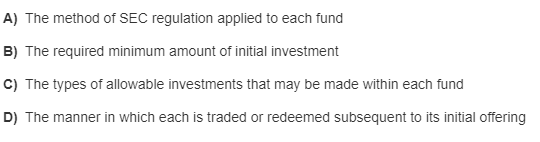

Q....Identify the primary difference between a closed-end fund and an open-end (mutual) fund.

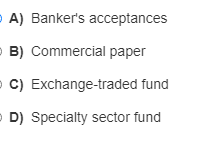

Q...Abigail wants to diversify her portfolio. She is looking for an investment that invests in a broad market index with low costs and tax efficiency, can be purchased and sold throughout the trading day, and can be purchased on margin and sold short. Choose the appropriate recommendation for Abigail.

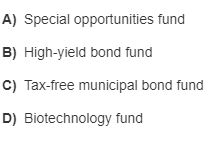

Q....Louis, 55, and Rita, 52, have a large investment portfolio concentrated in individual stocks and stock mutual funds. They maintain cash reserves in a money market deposit account. Louis is employed as a senior nuclear engineer and earns an annual salary of $350,000. He is expecting to retire in five years. Select the investment that would be most suitable for the couple if they are seeking capital preservation and diversification.

Q....Interest rates have been falling for the past several weeks. Describe what has happened to the price of bonds that were traded in the secondary market.

Q......Evergreen company has assets of $500 million and $125 million in liabilities. For the past year, Evergreen earned $150 million and paid out $20 million in dividends. What is the company's return on equity (ROE)?

Q......Eugene wants to purchase a growth stock for his portfolio and has been comparing a number of companies in the biotech industry. One company has a current market price per share of $25 and sales per share of $1.25. Calculate the company's price-to-sales (P/S) ratio.

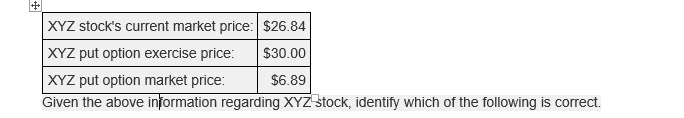

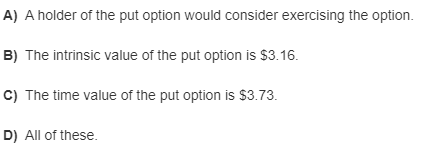

Q,,,,,,,,,,,,,,,,,

Q........

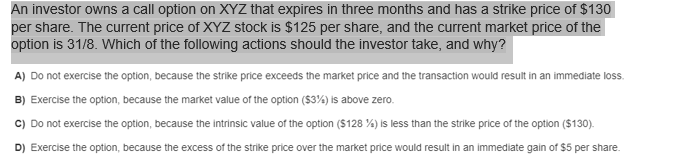

A) a pure yield pickup swap. B) an intermarket spread swap. C) a substitution swap D) an interest rate swap. A) A 20-year bond paying 5% B) A 5-year bond paying 4% C) A 10-year bond paying 4.5% D) A 20-year zero-coupon bond A) Harriet will stop receiving dividends after 10 years. B) IfABC preferred stock is cumulative, Harriet must receive any unpaid ABC preferred stock dividends from prior periods before ABC can pay any dividends to their common stockholders C) Young, high-income investors looking for returns in the form of capital appreciation are the primary purchasers of preferred stock. D) Harriet must receive her $40-per-share dividend before the common stockholders receive their dividends. A) Guarantees payment before bondholders in case of liquidation. B) Shareholders are claimants on both the income and assets of the corporation, receiving what remains after creditors and preferred shareholders are paid. C) Shareholders are not protected from personal liability D) Represents an ownership interest in the corporation. A) The overall market value of the company, theoretically, is reduced relative to the stock dividend. B) Receipt of a stock dividend causes an upward adjustment of the stockholder's per share basis. C) A stock dividend is generally not taxable for federal income tax purposes. D) The market price of the stock typically increases on a relative basis to the stock dividend. A) The method of SEC regulation applied to each fund B) The required minimum amount of initial investment C) The types of allowable investments that may be made within each fund D) The manner in which each is traded or redeemed subsequent to its initial offering A) Banker's acceptances B) Commercial paper C) Exchange-traded fund D) Specialty sector fund A) Special opportunities fund B) High-yield bond fund C) Tax-free municipal bond fund D) Biotechnology fund A) Not affected B) Decreased C) Increased D) Stayed the same A) 25% B) 40% C) 30% D) 10% A) 25 B) 40 C) 20 D) 32 # XYZ stock's current market price: $26.84 XYZ put option exercise price: $30.00 XYZ put option market price: $6.89 Given the above information regarding XYZ stock, identify which of the following is correct. A) A holder of the put option would consider exercising the option. B) The intrinsic value of the put option is $3.16. C) The time value of the put option is $3.73. D) All of these. An investor owns a call option on XYZ that expires in three months and has a strike price of $130 per share. The current price of XYZ stock is $125 per share, and the current market price of the option is 31/8. Which of the following actions should the investor take, and why? A) Do not exercise the option, because the strike price exceeds the market price and the transaction would result in an immediate loss B) Exercise the option, because the market value of the option (53%) is above zero. C) Do not exercise the option, because the intrinsic value of the option (5128 %) is less than the strike price of the option ($130). D) Exercise the option, because the excess of the strike price over the market price would result in an immediate gain of $5 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts