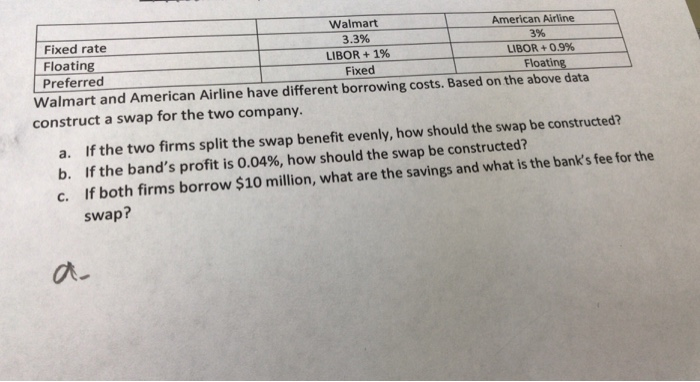

Question: Walmart American Airline Fixed rate 3.3% 3% Floating LIBOR + 1% LIBOR +0.9% Preferred Fixed Floating Walmart and American Airline have different borrowing costs. Based

Walmart American Airline Fixed rate 3.3% 3% Floating LIBOR + 1% LIBOR +0.9% Preferred Fixed Floating Walmart and American Airline have different borrowing costs. Based on the above data construct a swap for the two company. a. If the two firms split the swap benefit evenly, how should the swap be constructed? b. If the band's profit is 0.04%, how should the swap be constructed? c. If both firms borrow $10 million, what are the savings and what is the bank's fee for the swap? Walmart American Airline Fixed rate 3.3% 3% Floating LIBOR + 1% LIBOR +0.9% Preferred Fixed Floating Walmart and American Airline have different borrowing costs. Based on the above data construct a swap for the two company. a. If the two firms split the swap benefit evenly, how should the swap be constructed? b. If the band's profit is 0.04%, how should the swap be constructed? c. If both firms borrow $10 million, what are the savings and what is the bank's fee for the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts