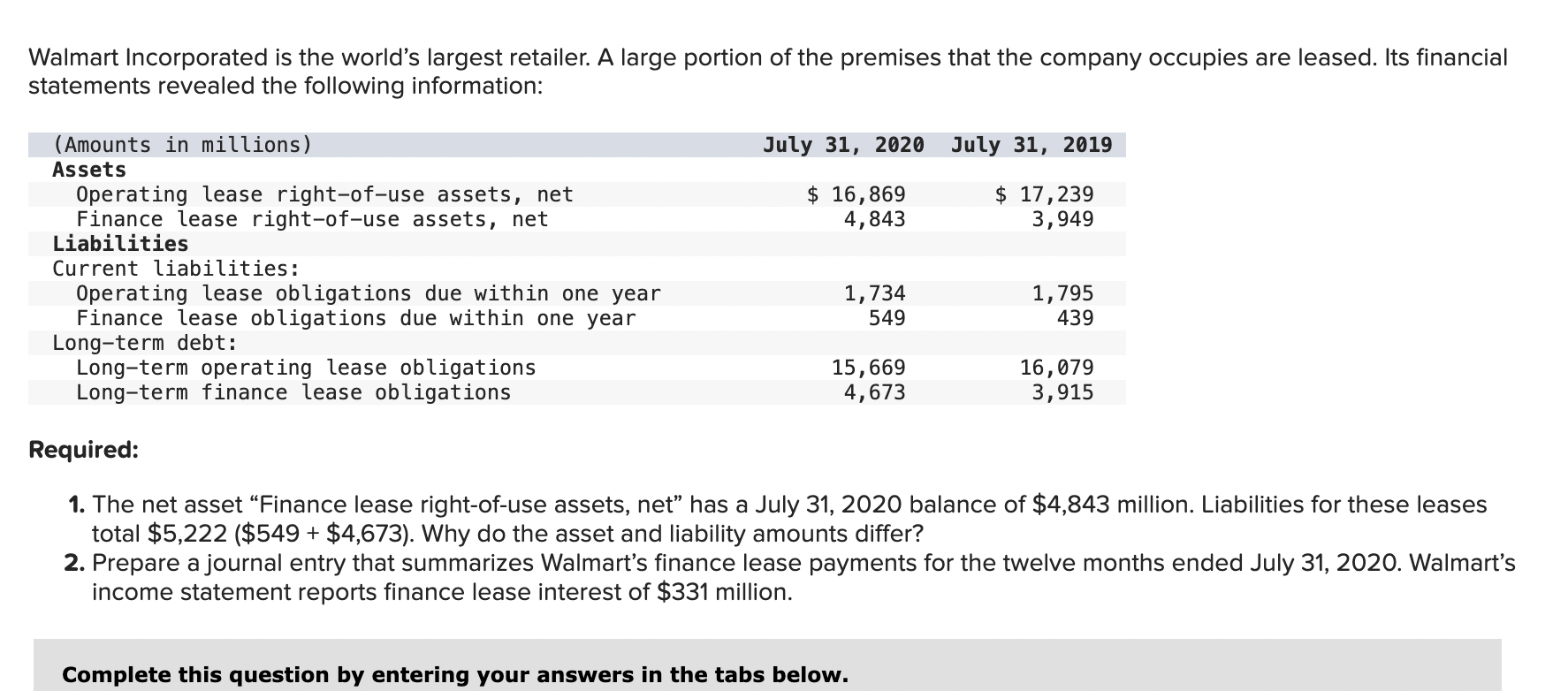

Question: Walmart Incorporated is the world's largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements revealed the

Walmart Incorporated is the world's largest retailer. A large portion of the premises that the company occupies are leased. Its financial statements revealed the following information: (Amounts in millions) Assets Operating lease right-of-use assets, net Finance lease right-of-use assets, net Liabilities Current liabilities: Operating lease obligations due within one year Finance lease obligations due within one year Long-term debt: Long-term operating lease obligations Long-term finance lease obligations July 31, 2020 July 31, 2019 $ 16,869 4,843 $ 17,239 3,949 1,734 549 1,795 439 15,669 4,673 16,079 3,915 Required: 1. The net asset "Finance lease right-of-use assets, net" has a July 31, 2020 balance of $4,843 million. Liabilities for these leases total $5,222 ($549 + $4,673). Why do the asset and liability amounts differ? 2. Prepare a journal entry that summarizes Walmart's finance lease payments for the twelve months ended July 31, 2020. Walmart's income statement reports finance lease interest of $331 million. Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

Answer 1 The difference between the net asset Finance lease rightofuse assets net and the total liab... View full answer

Get step-by-step solutions from verified subject matter experts