Question: Walton Ltd is thinking about replacing a current machine with a new and faster machine that will produce a more reliable product. This change that

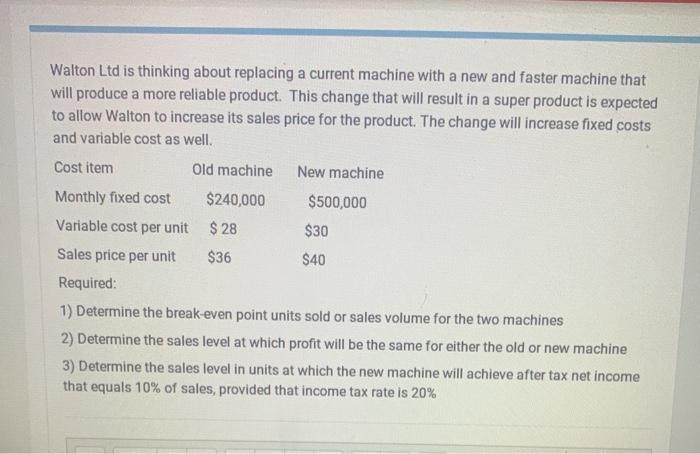

Walton Ltd is thinking about replacing a current machine with a new and faster machine that will produce a more reliable product. This change that will result in a super product is expected to allow Walton to increase its sales price for the product. The change will increase fixed costs and variable cost as well. Cost item Old machine New machine Monthly fixed cost $240,000 $500,000 Variable cost per unit $ 28 $30 Sales price per unit $36 $40 Required: 1) Determine the break-even point units sold or sales volume for the two machines 2) Determine the sales level at which profit will be the same for either the old or new machine 3) Determine the sales level in units at which the new machine will achieve after tax net income that equals 10% of sales, provided that income tax rate is 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts