Question: want pure answer nit copy paste ok thanks Question Description The expected total property return is (8!12)% per month for a $100K house. You make

want pure answer nit copy paste ok thanks

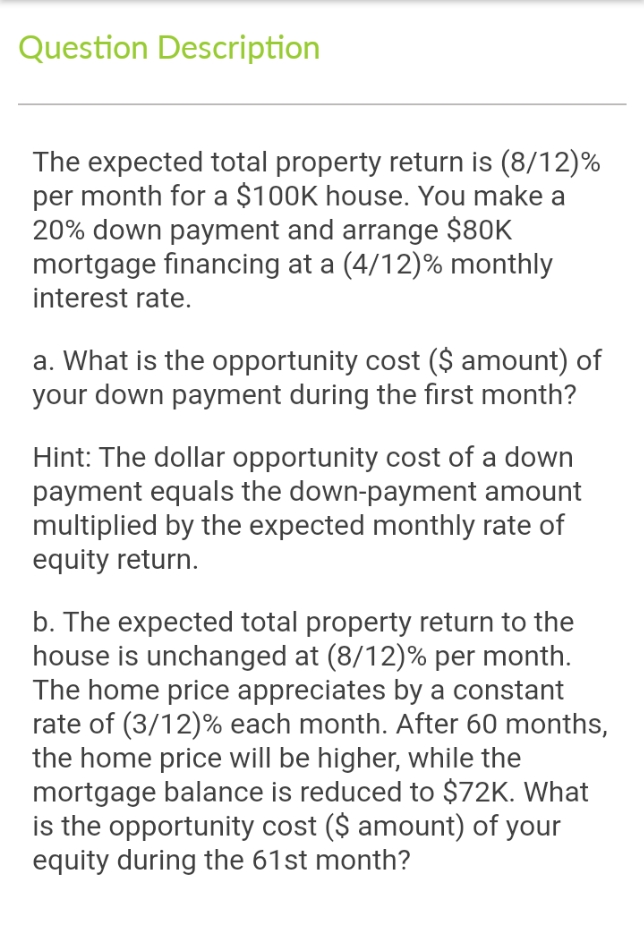

Question Description The expected total property return is (8!12)% per month for a $100K house. You make a 20% down payment and arrange $80K mortgage nancing at a (4/12)% monthly interest rate. a. What is the opportunity cost (S amount) of your down payment during the rst month? Hint: The dollar opportunity cost of a down payment equals the down-payment amount multiplied by the expected monthly rate of equity return. b. The expected total property return to the house is unchanged at (8X12)% per month. The home price appreciates by a constant rate of (3/12)% each month. After 60 months, the home price will be higher, while the mortgage balance is reduced to $72K. What is the opportunity cost (3 amount) of your equity during the 61st month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts