Question: wardacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 2 0 2 2 -

wardacademy.comlmsAFTRExam

CCHS Liv...

KDE Licensure

MyAccount Americ....

FastForwardAcademy

Expungement Certif...

You Will Love Histor.

History Grant Prof...

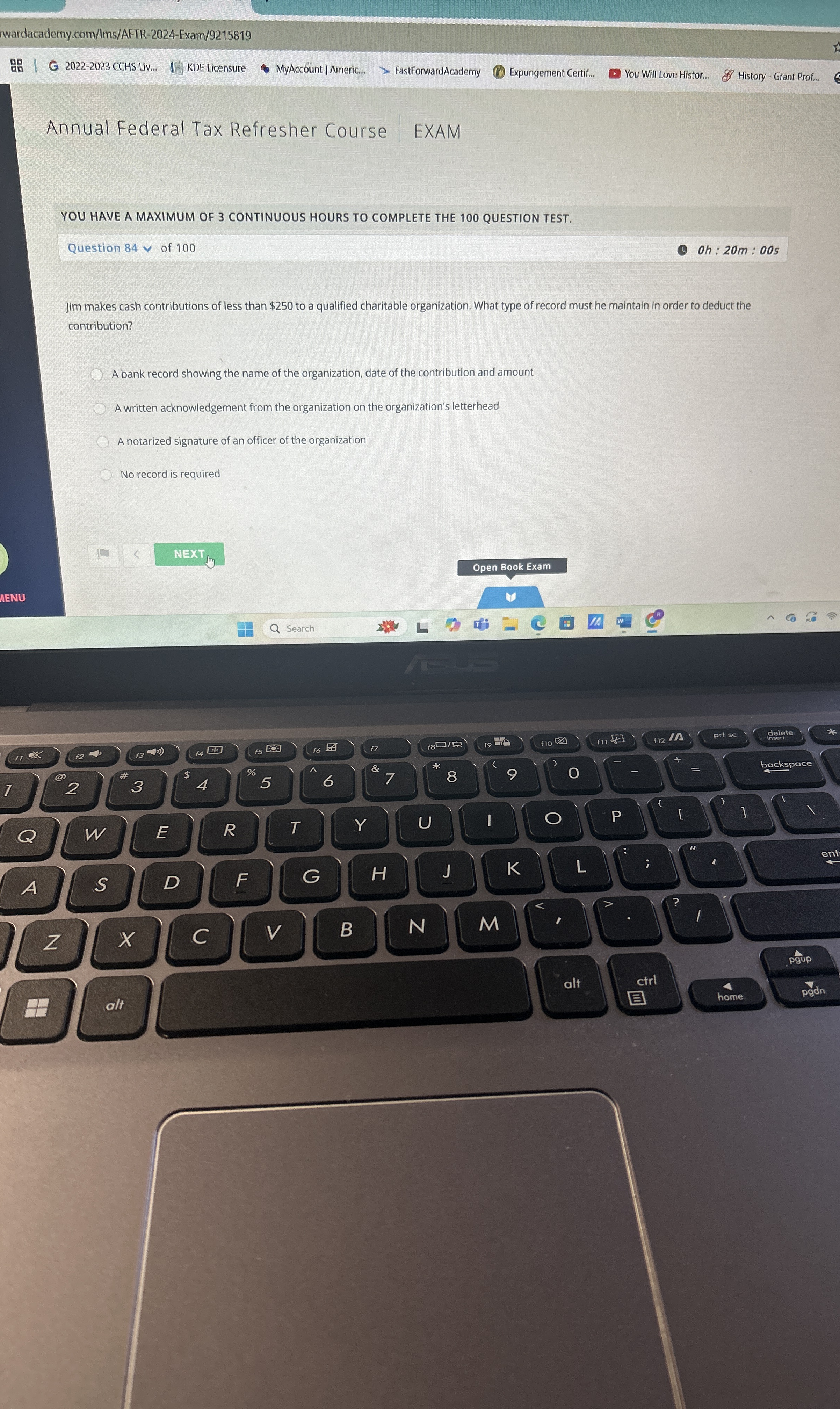

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

oh : :

Jim makes cash contributions of less than $ to a qualified charitable organization. What type of record must he maintain in order to deduct the contribution?

A bank record showing the name of the organization, date of the contribution and amount

A written acknowledgement from the organization on the organization's letterhead

A notarized signature of an officer of the organization

No record is required

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock