Question: Warner Corporation is considering two financing alternatives. Under the first alternative, interest expense would be $10,000 and there would be 3,000 common shares outstanding. Under

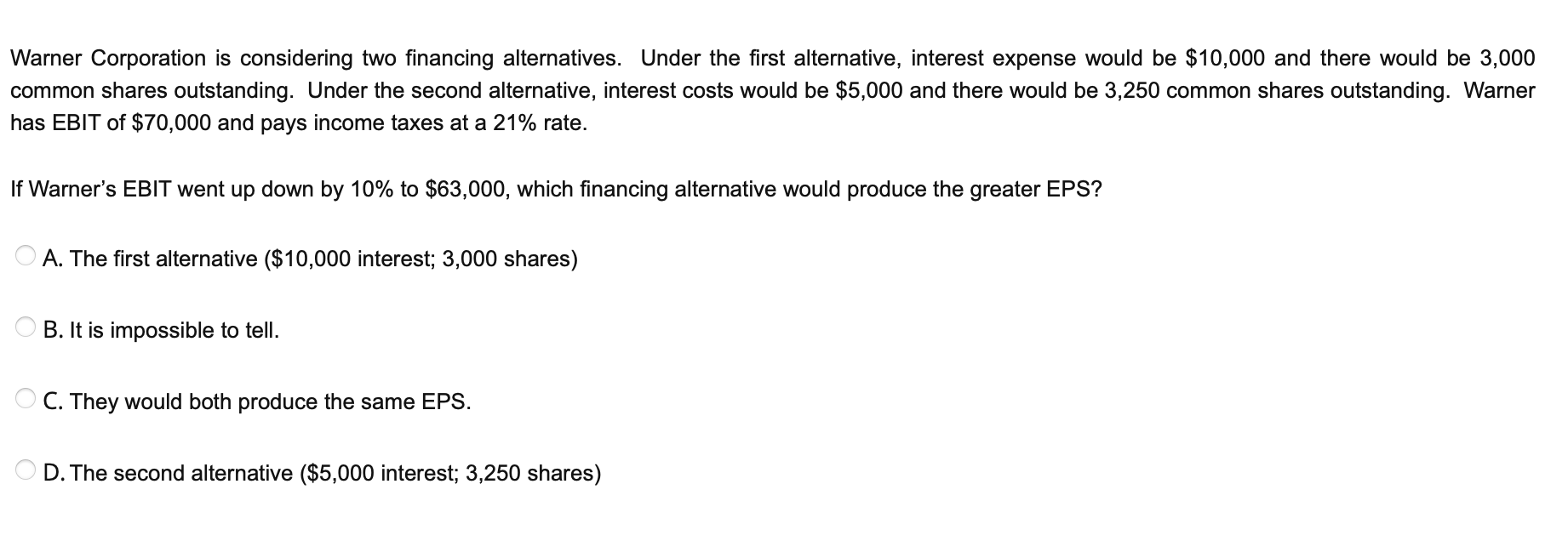

Warner Corporation is considering two financing alternatives. Under the first alternative, interest expense would be $10,000 and there would be 3,000 common shares outstanding. Under the second alternative, interest costs would be $5,000 and there would be 3,250 common shares outstanding. Warner has EBIT of $70,000 and pays income taxes at a 21% rate. If Warner's EBIT went up down by 10% to $63,000, which financing alternative would produce the greater EPS? A. The first alternative ($10,000 interest; 3,000 shares) B. It is impossible to tell. C. They would both produce the same EPS. D. The second alternative ($5,000 interest; 3,250 shares)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock