Question: Warning- i m posting it 4th time Do not give me wrong answer otherwise i will give 10 downvotes if u do not know then

Warning- i m posting it 4th time Do not give me wrong answer otherwise i will give 10 downvotes if u do not know then skip it

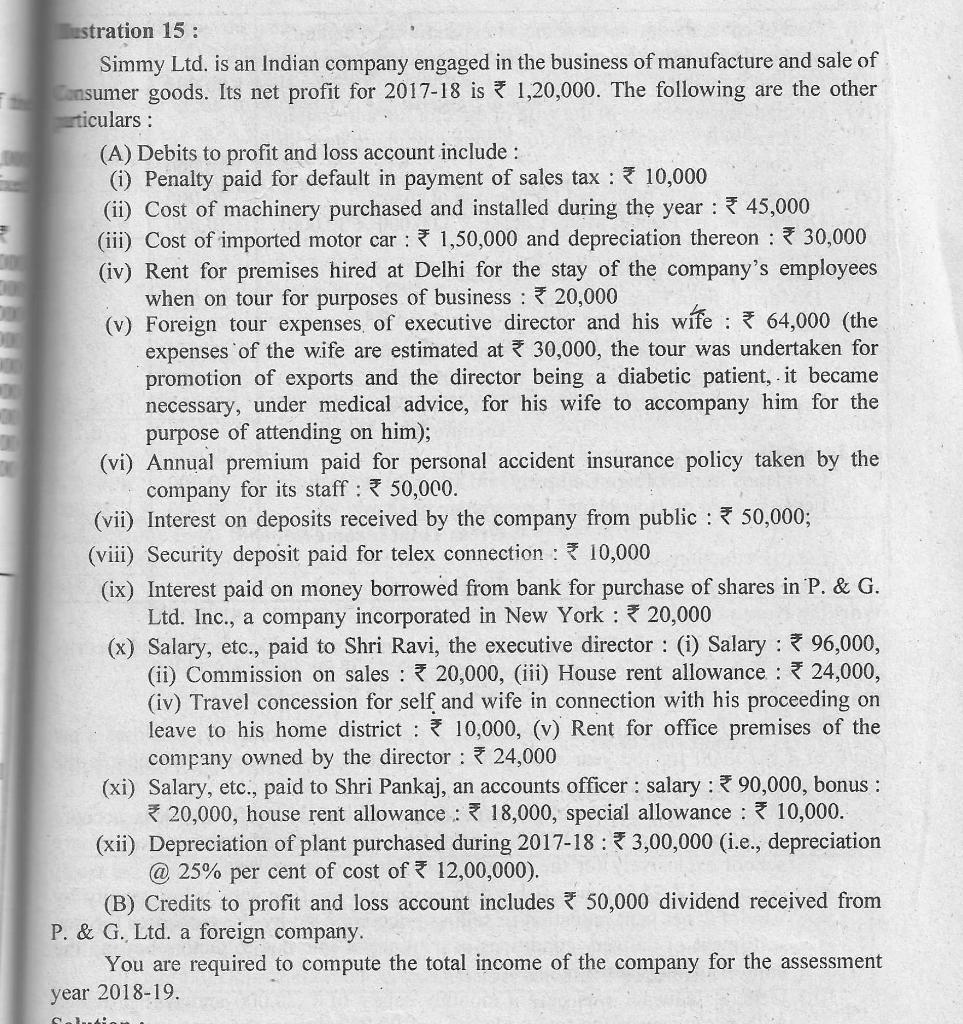

Sustration 15 : Simmy Ltd. is an Indian company engaged in the business of manufacture and sale of Consumer goods. Its net profit for 2017-18 is * 1,20,000. The following are the other articulars : (A) Debits to profit and loss account include: (i) Penalty paid for default in payment of sales tax : * 10,000 (ii) Cost of machinery purchased and installed during the year : * 45,000 (iii) Cost of imported motor car : * 1,50,000 and depreciation thereon : 30,000 (iv) Rent for premises hired at Delhi for the stay of the company's employees when on tour for purposes of business : 20,000 (v) Foreign tour expenses, of executive director and his wife : 64,000 (the expenses of the wife are estimated at 30,000, the tour was undertaken for promotion of exports and the director being a diabetic patient, it became necessary, under medical advice, for his wife to accompany him for the purpose of attending on him); (vi) Annual premium paid for personal accident insurance policy taken by the company for its staff : 50,000. (vii) Interest on deposits received by the company from public : * 50,000; (viii) Security deposit paid for telex connection : * 10,000 (ix) Interest paid on money borrowed from bank for purchase of shares in P. & G. Ltd. Inc., a company incorporated in New York : 20,000 (x) Salary, etc., paid to Shri Ravi, the executive director : (i) Salary: 96,000, (ii) Commission on sales : 20,000, (iii) House rent allowance : *24,000, (iv) Travel concession for self and wife in connection with his proceeding on leave to his home district : 10,000, (v) Rent for office premises of the company owned by the director : 24,000 (xi) Salary, etc., paid to Shri Pankaj, an accounts officer : salary : 90,000, bonus : 320,000, house rent allowance : 18,000, special allowance : 10,000. (xii) Depreciation of plant purchased during 2017-18 : 3,00,000 (i.e., depreciation @ 25% per cent of cost of 12,00,000). (B) Credits to profit and loss account includes 50,000 dividend received from P. & G. Ltd. a foreign company. You are required to compute the total income of the company for the assessment year 2018-19. Same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts