Question: Do not give me wrong answer otherwise i will personally report that answer and give downvote as well i am posting it 3rd time please

Do not give me wrong answer otherwise i will personally report that answer and give downvote as well i am posting it 3rd time please skip it if u r not sure

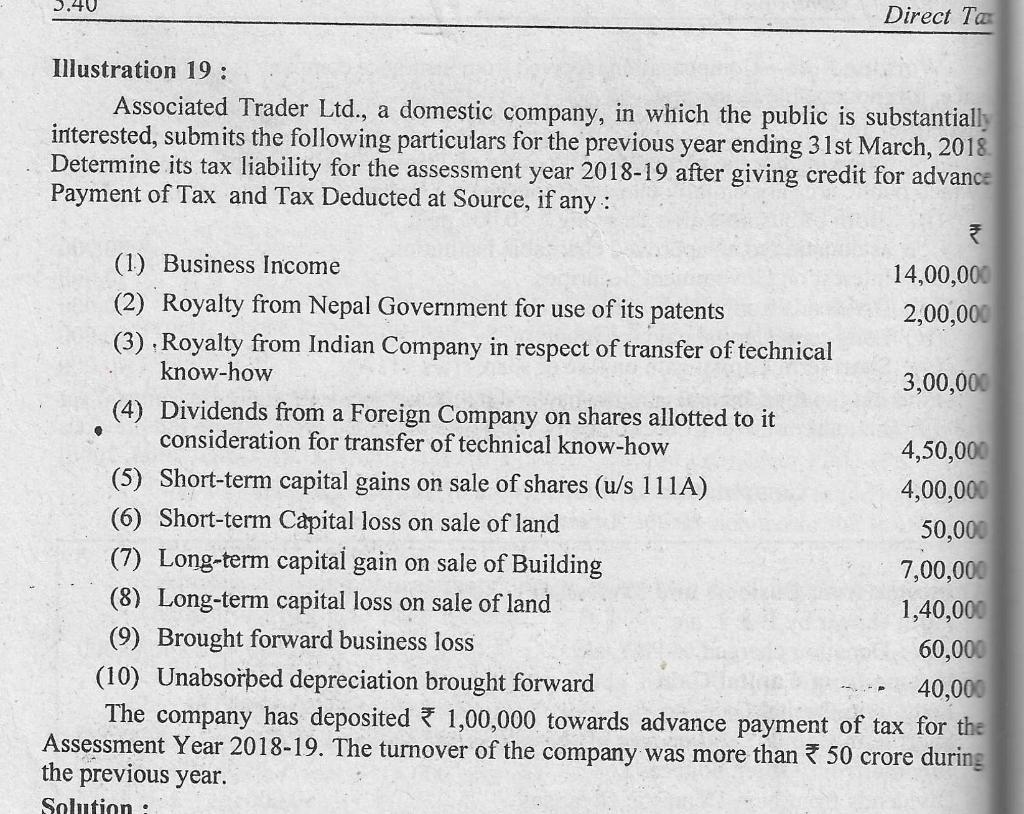

2.40 Direct Tax Illustration 19 : Associated Trader Ltd., a domestic company, in which the public is substantially interested, submits the following particulars for the previous year ending 31st March, 2018 Determine its tax liability for the assessment year 2018-19 after giving credit for advance Payment of Tax and Tax Deducted at Source, if any: (1) Business Income 14,00,000 (2) Royalty from Nepal Government for use of its patents 2,00,000 (3) . Royalty from Indian Company in respect of transfer of technical know-how 3,00,000 (4) Dividends from a Foreign Company on shares allotted to it consideration for transfer of technical know-how 4,50,000 (5) Short-term capital gains on sale of shares (u/s 111A) 4,00,000 (6) Short-term Capital loss on sale of land 50,000 (7) Long-term capital gain on sale of Building 7,00,000 (8) Long-term capital loss on sale of land 1,40,000 (9) Brought forward business loss 60,000 (10) Unabsorbed depreciation brought forward 40,000 The company has deposited 1,00,000 towards advance payment of tax for the Assessment Year 2018-19. The turnover of the company was more than 50 crore during the previous year. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts