Question: we can solve it with excel Given LBO Parameters and Assumptions O . . Abraaj Capital purchases Hepsiburada (HB) for 7.0x Forward 12 months (FTM)

we can solve it with excel

we can solve it with excel

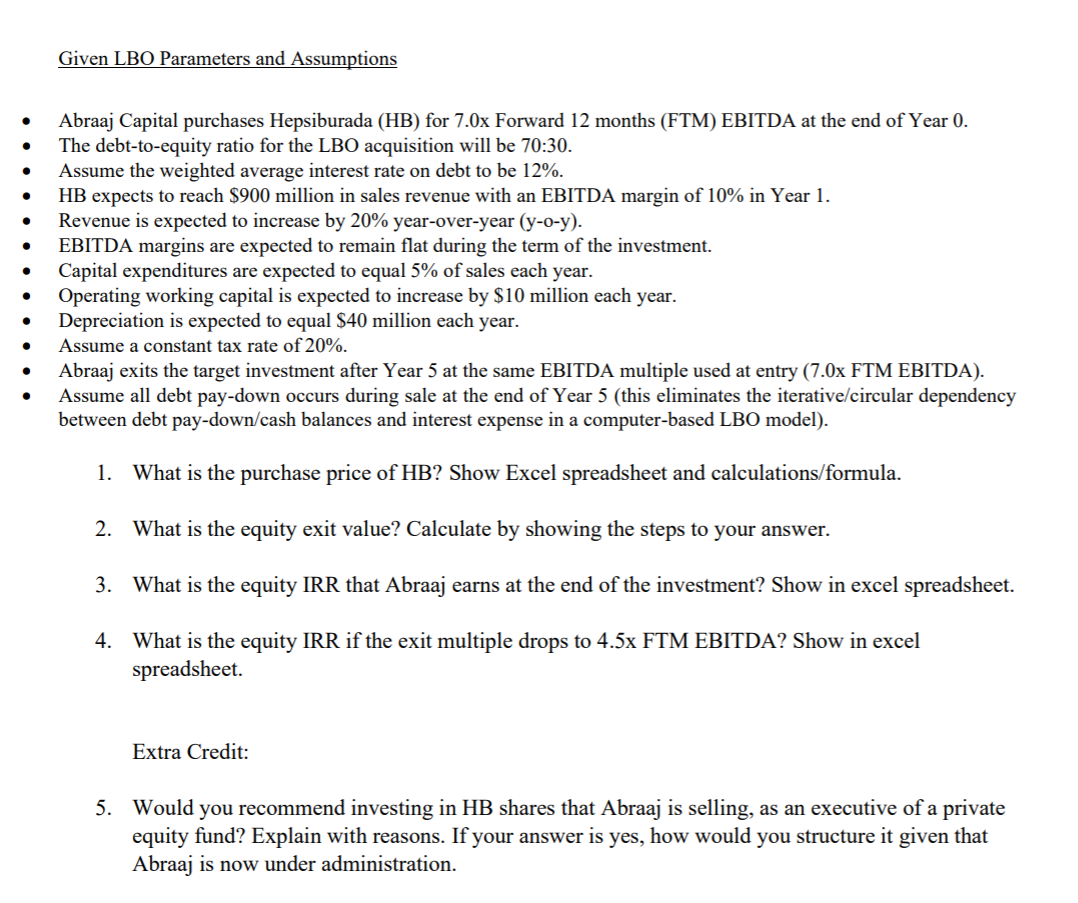

Given LBO Parameters and Assumptions O . . Abraaj Capital purchases Hepsiburada (HB) for 7.0x Forward 12 months (FTM) EBITDA at the end of Year 0. The debt-to-equity ratio for the LBO acquisition will be 70:30. Assume the weighted average interest rate on debt to be 12%. HB expects to reach $900 million in sales revenue with an EBITDA margin of 10% in Year 1. Revenue is expected to increase by 20% year-over-year (y-o-y). EBITDA margins are expected to remain flat during the term of the investment. Capital expenditures are expected to equal 5% of sales each year. Operating working capital is expected to increase by $10 million each year. Depreciation is expected to equal $40 million each year. Assume a constant tax rate of 20%. Abraaj exits the target investment after Year 5 at the same EBITDA multiple used at entry (7.0x FTM EBITDA). Assume all debt pay-down occurs during sale at the end of Year 5 (this eliminates the iterative/circular dependency between debt pay-down/cash balances and interest expense in a computer-based LBO model). . 1. What is the purchase price of HB? Show Excel spreadsheet and calculations/formula. 2. What is the equity exit value? Calculate by showing the steps to your answer. 3. What is the equity IRR that Abraaj earns at the end of the investment? Show in excel spreadsheet. 4. What is the equity IRR if the exit multiple drops to 4.5x FTM EBITDA? Show in excel spreadsheet. Extra Credit: 5. Would you recommend investing in HB shares that Abraaj is selling, as an executive of a private equity fund? Explain with reasons. If your answer is yes, how would you structure it given that Abraaj is now under administration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts