Question: We consider a MBS issue constructed from a 30 -year, $100 million mortgage pool with the following features: Current balance =$100 million, WAC =8.4%, WAM

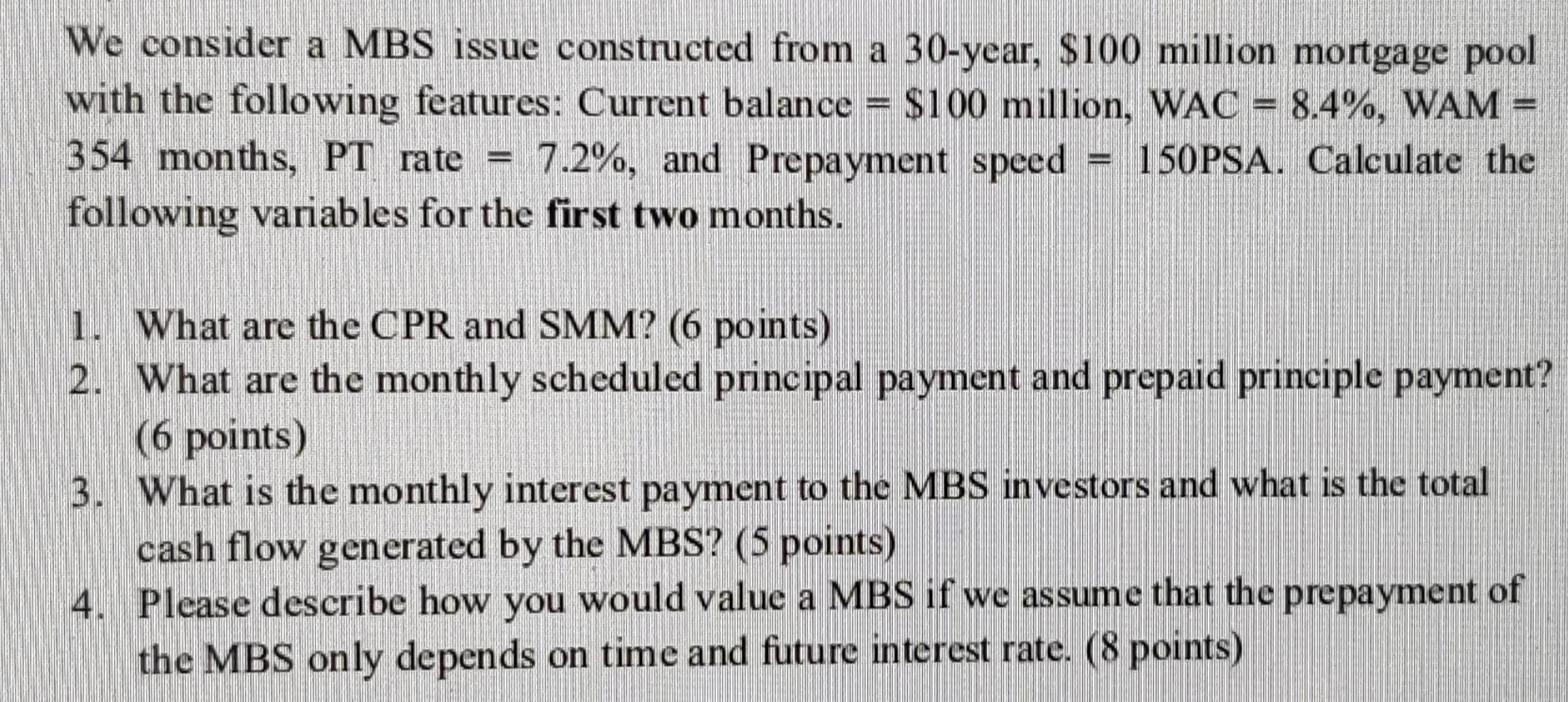

We consider a MBS issue constructed from a 30 -year, $100 million mortgage pool with the following features: Current balance =$100 million, WAC =8.4%, WAM = 354 months, PT rate =7.2%, and Prepayment speed =150PSA. Calculate the following variables for the first two months. 1. What are the CPR and SMM? (6 points) 2. What are the monthly scheduled principal payment and prepaid principle payment? ( 6 points) 3. What is the monthly interest payment to the MBS investors and what is the total cash flow generated by the MBS? (5 points) 4. Please describe how you would value a MBS if we assume that the prepayment of the MBS only depends on time and future interest rate. ( 8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts