Question: We consider a two-period binomial tree to model interest rates. The time step dt is 1 year. We know that ro 1%, t-1.1 and

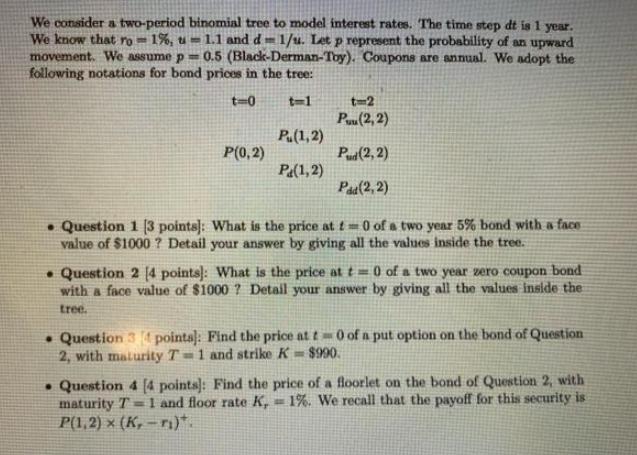

We consider a two-period binomial tree to model interest rates. The time step dt is 1 year. We know that ro 1%, t-1.1 and dm1/u. Let p represent the probability of an upward movement. We assume p= 0.5 (Black-Derman-Toy). Coupons are annual. We adopt the following notations for bond prices in the tree: t=0 t=1 t=2 Puu (2, 2) Pud(2, 2) Pad(2, 2) Question 1 (3 points]: What is the price at t= 0 of a two year 5% bond with a face value of $1000? Detail your answer by giving all the values inside the tree. P(0,2) P.(1,2) P(1,2) Question 2 [4 points]: What is the price at t=0 of a two year zero coupon bond with a face value of $1000? Detail your answer by giving all the values inside the tree. Question 3 4 pointa]: Find the price at t=0 of a put option on the bond of Question 2, with maturity T1 and strike K= $990. Question 4 (4 points]: Find the price of a floorlet on the bond of Question 2, with maturity T= 1 and floor rate K, 1%. We recall that the payoff for this security is P(1,2) x (K,-ri)*. a

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Question 1 To find the price at f0 of a twoyear 5 bond with a face value of 1000 we need to calculat... View full answer

Get step-by-step solutions from verified subject matter experts