Question: We consider an accounting problem for a bank that acts as a financial intermediary between savers and borrowers. In the first month of the bank's

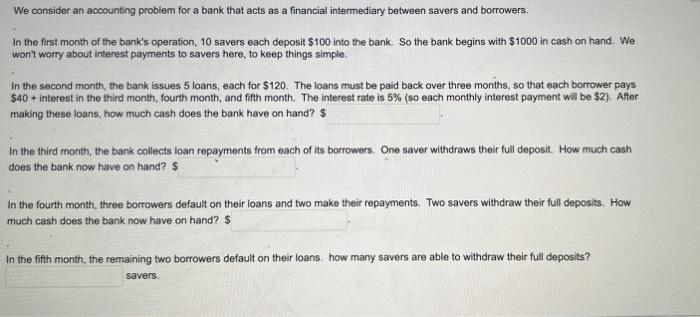

We consider an accounting problem for a bank that acts as a financial intermediary between savers and borrowers. In the first month of the bank's operation, 10 savers each deposit $100 into the bank. So the bank begins with $1000 in cash on hand. We won't worry about interest payments to savers here, to keep things simple. In the second month, the bank issues 5 loans, each for $120. The loans must be paid back over three months, so that each borrower pays $40+ interest in the third month, fourth month, and fift month. The interest rate is 5% (so each monthly interest payment will be $2 ). After making these loans, how much cash does the bank have on hand? $ In the third month, the bank collects loan repayments from each of its borrowers. One saver withdraws their full deposit. How much cash does the bank now have on hand? $ In the fourth month, three borrowers default on their loans and two make their repayments. Two savers withdraw their full deposits. How much cash does the bank now have on hand? \$ In the fifth month, the remaining two borrowers default on their loans. how many savers are able to withdraw their full deposits? savers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts