Question: We consider an accounting problem for a bank that acts as a financial intermediary between savers and borrowers. Make sure you have paper and pen

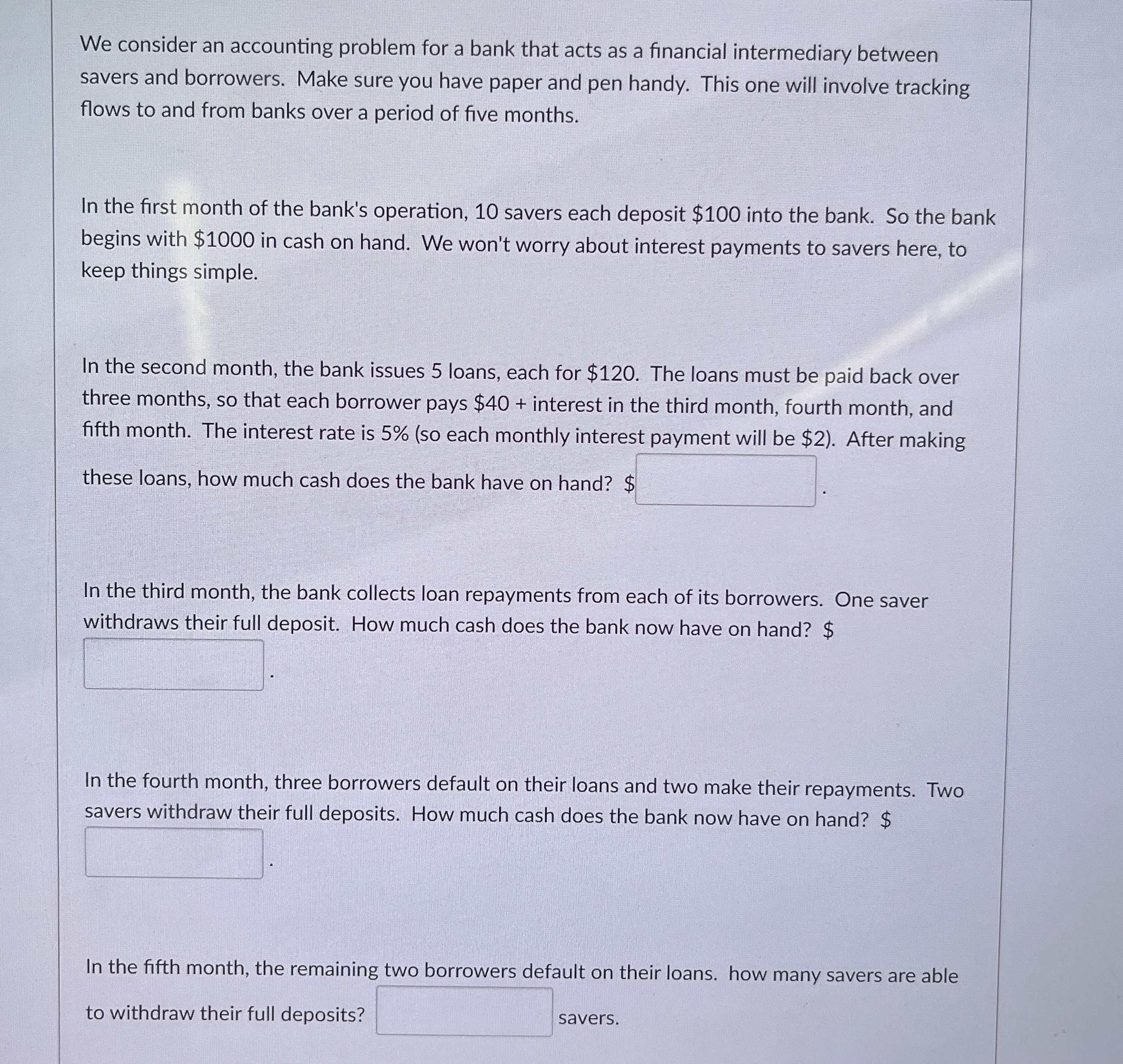

We consider an accounting problem for a bank that acts as a financial intermediary between savers and borrowers. Make sure you have paper and pen handy. This one will involve tracking flows to and from banks over a period of five months.

In the first month of the bank's operation, savers each deposit $ into the bank. So the bank begins with $ in cash on hand. We won't worry about interest payments to savers here, to keep things simple.

In the second month, the bank issues loans, each for $ The loans must be paid back over three months, so that each borrower pays $ interest in the third month, fourth month, and fifth month. The interest rate is so each monthly interest payment will be $ After making these loans, how much cash does the bank have on hand?

In the third month, the bank collects loan repayments from each of its borrowers. One saver withdraws their full deposit. How much cash does the bank now have on hand? $

In the fourth month, three borrowers default on their loans and two make their repayments. Two savers withdraw their full deposits. How much cash does the bank now have on hand? $

In the fifth month, the remaining two borrowers default on their loans. how many savers are able to withdraw their full deposits? savers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock