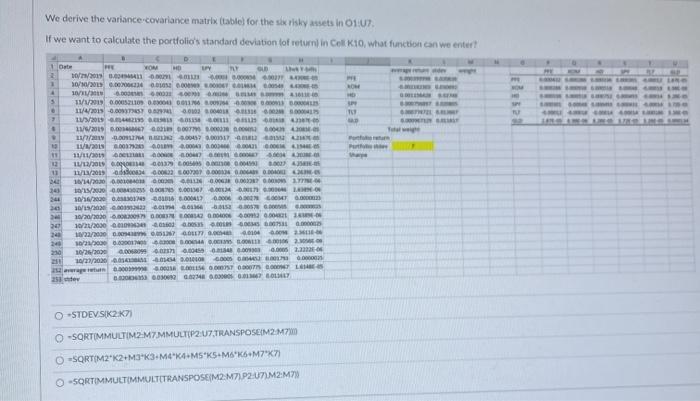

Question: We derive the variance covariance matrix table for the six risky assets in 01:07 If we want to calculate the portfolio's standard deviation for return

We derive the variance covariance matrix table for the six risky assets in 01:07 If we want to calculate the portfolio's standard deviation for return in Cell to, what function can we enter! www -- OR // Date WON URY 10/8/2019 114mm 1 30/0/00.00 0.00 0.00 0 4 6.000 BMS 5 11/1/2019 0.19 0.00011 11/4/2013 -0.00 0.00 0000 0000 7 1200225 600 . 11/9/2010. 000 000 13/19 -5.00 4.00457 0.00TL 11/1/2018 00 0.00 0.00 0.00 GS 11 11/11/2011 1/1/0001 603 0019 11 11/13/2013 0 0 .000 0.00 0.00 14 10/14/200 000 000 000 0.00 0.0 100 0.00 0.00 0.00 0.00 340 Wh i H L 091 44 H l 4 0904 6 5 4 | HUHUHU 30/15/300.000 10/20/230.000 0.00 0.00 0.00 - 30 10/21/2000 0100 0100 0.00 0.00 0.00 22/2000 17001 - 0 0.0 C 02 10/26/2090.00 0.00 0.00 2.2 10/21/2001 - G300 C napewa 001 SEST ONT LES 25 6.000 0.000000 OSTDEVSK2K -SORTIMMULTIM2 M7 MMULTIP2:U7 TRANSPOSEM2.70 O SORTIM2K2+M3K3+ MKUMSK5+M6 KM7*X71 SQRTIMMULTIMMULT TRANSPOSEM2M71P2 U7M2:M78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts