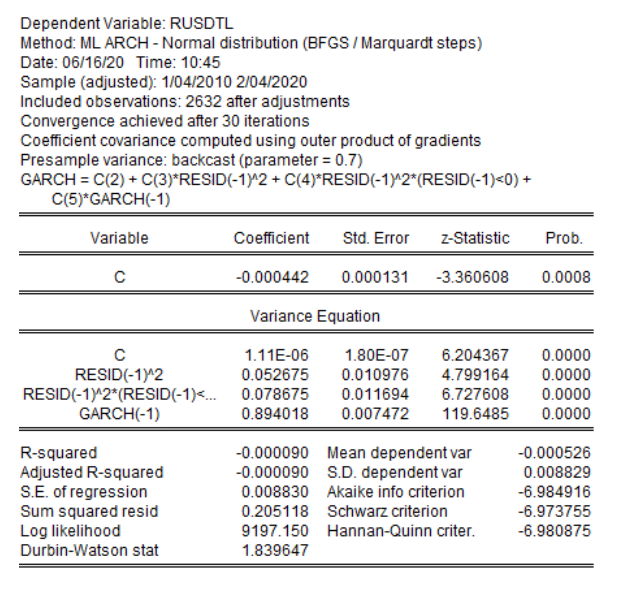

Question: We estimated a conditional volatility model for a return series. Estimation results are provided. Based on this output, try to discuss (a) volatility model estimated,

We estimated a conditional volatility model for a return series. Estimation results are provided. Based on this output, try to discuss (a) volatility model estimated, and (b) findings.

We estimated a conditional volatility model for a return series. Estimation results are provided. Based on this output, try to discuss (a) volatility model estimated, and (b) findings.

Note Resid means residuals and (RESID Dependent Variable: RUSDTL Method: ML ARCH - Normal distribution (BFGS / Marquardt steps) Date: 06/16/20 Time: 10:45 Sample (adjusted): 1/04/2010 2/04/2020 Included observations: 2632 after adjustments Convergence achieved after 30 iterations Coefficient covariance computed using outer product of gradients Presample variance: backcast (parameter = 0.7) GARCH = C(2) + C(3)*RESID(-1)^2 + C(4)*RESID(-1)^2*(RESID(-1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts