Question: We expect a project to pay $40,000 at the end of each year for 10 years. The project requires that we purchase an asset that

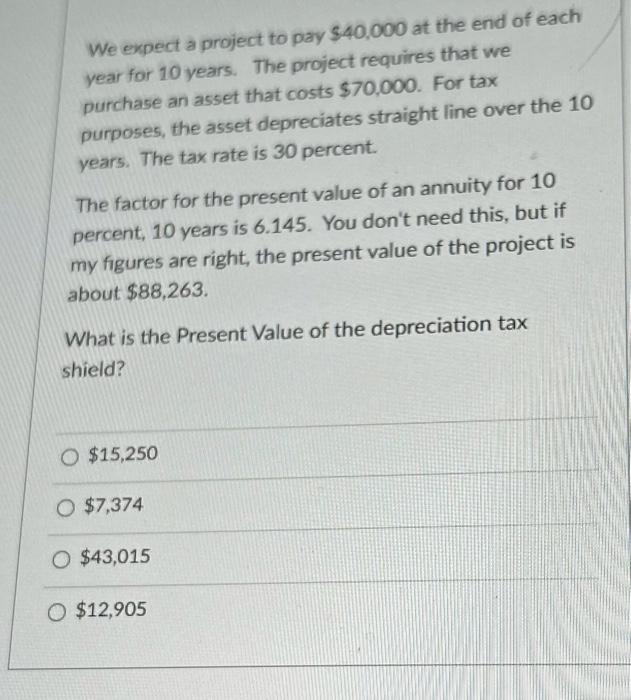

We expect a project to pay $40,000 at the end of each year for 10 years. The project requires that we purchase an asset that costs $70,000. For tax purposes, the asset depreciates straight line over the 10 years. The tax rate is 30 percent. The factor for the present value of an annuity for 10 percent, 10 years is 6.145. You don't need this, but if my figures are right, the present value of the project is about $88,263 What is the Present Value of the depreciation tax shield? O $15,250 O $7,374 O $43,015 O $12,905

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock