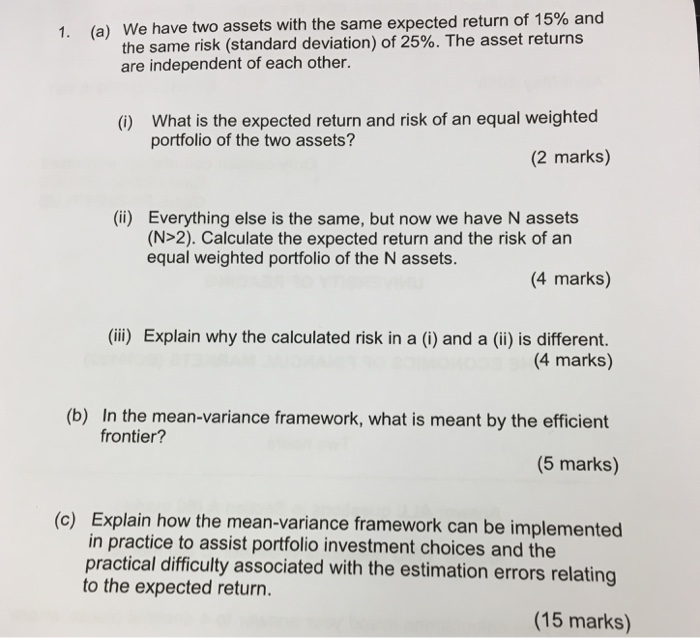

Question: We have two assets with the same expected return of 15% and the same risk (standard deviation) of 25%. The asset returns are independent of

We have two assets with the same expected return of 15% and the same risk (standard deviation) of 25%. The asset returns are independent of each other. I. (a) What is the expected return and risk of an equal weighted portfolio of the two assets? (0) (2 marks) (ii) Everything else is the same, but now we have N assets (N>2). Calculate the expected return and the risk of an equal weighted portfolio of the N assets. (4 marks) (ii) Explain why the calculated risk in a (i) and a (ii) is different. (4 marks) (b) In the mean-variance framework, what is meant by the efficient frontier? (5 marks) (c) Explain how the mean-variance framework can be implemented in practice to assist portfolio investment choices and the practical difficulty associated with the estimation errors relating to the expected return. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts