Question: we need an explanation on this question Downstream and Upstream Effects on Income Computations Assume that the separate incomes of a parent and its 80

we need an explanation on this question

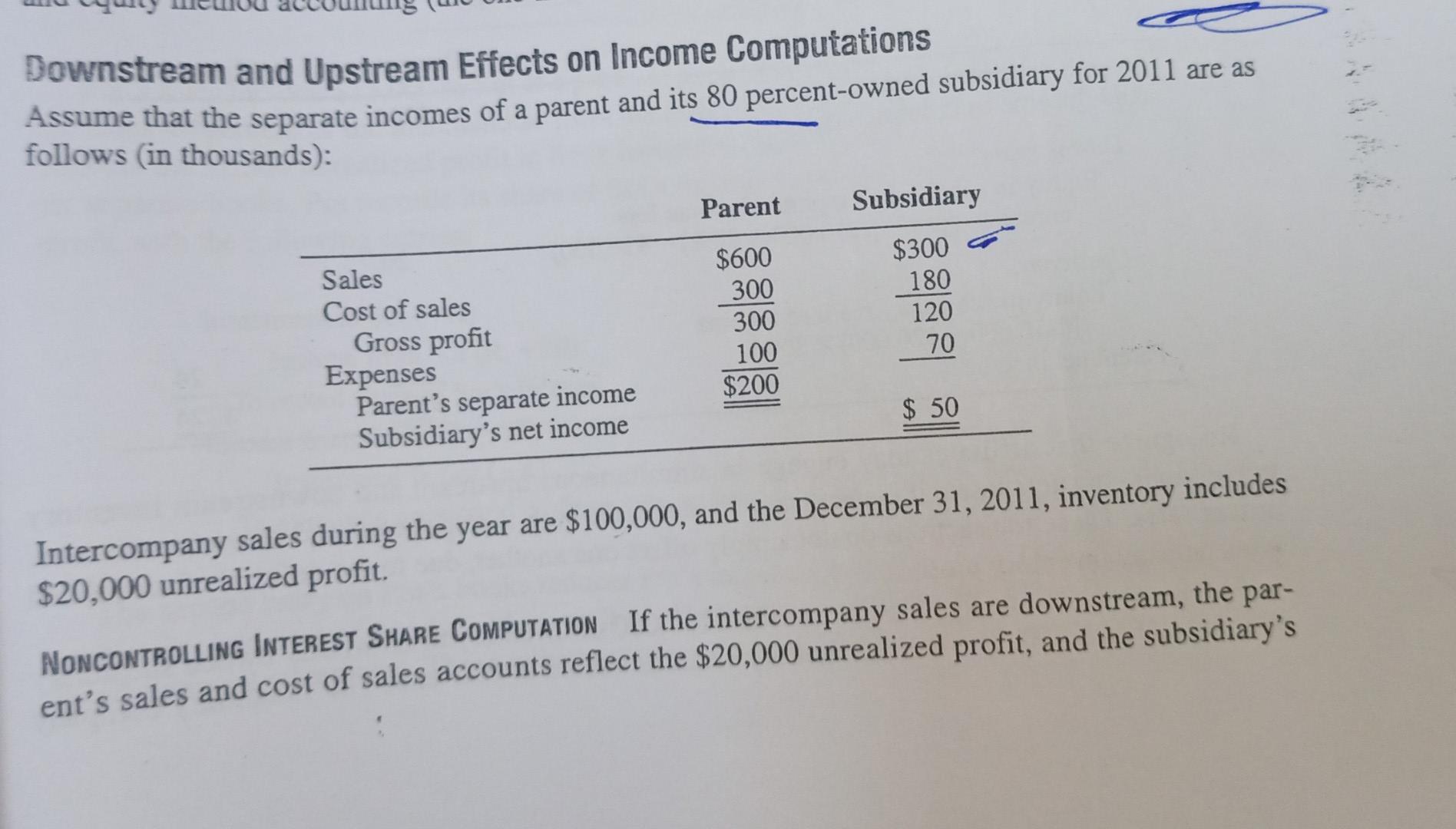

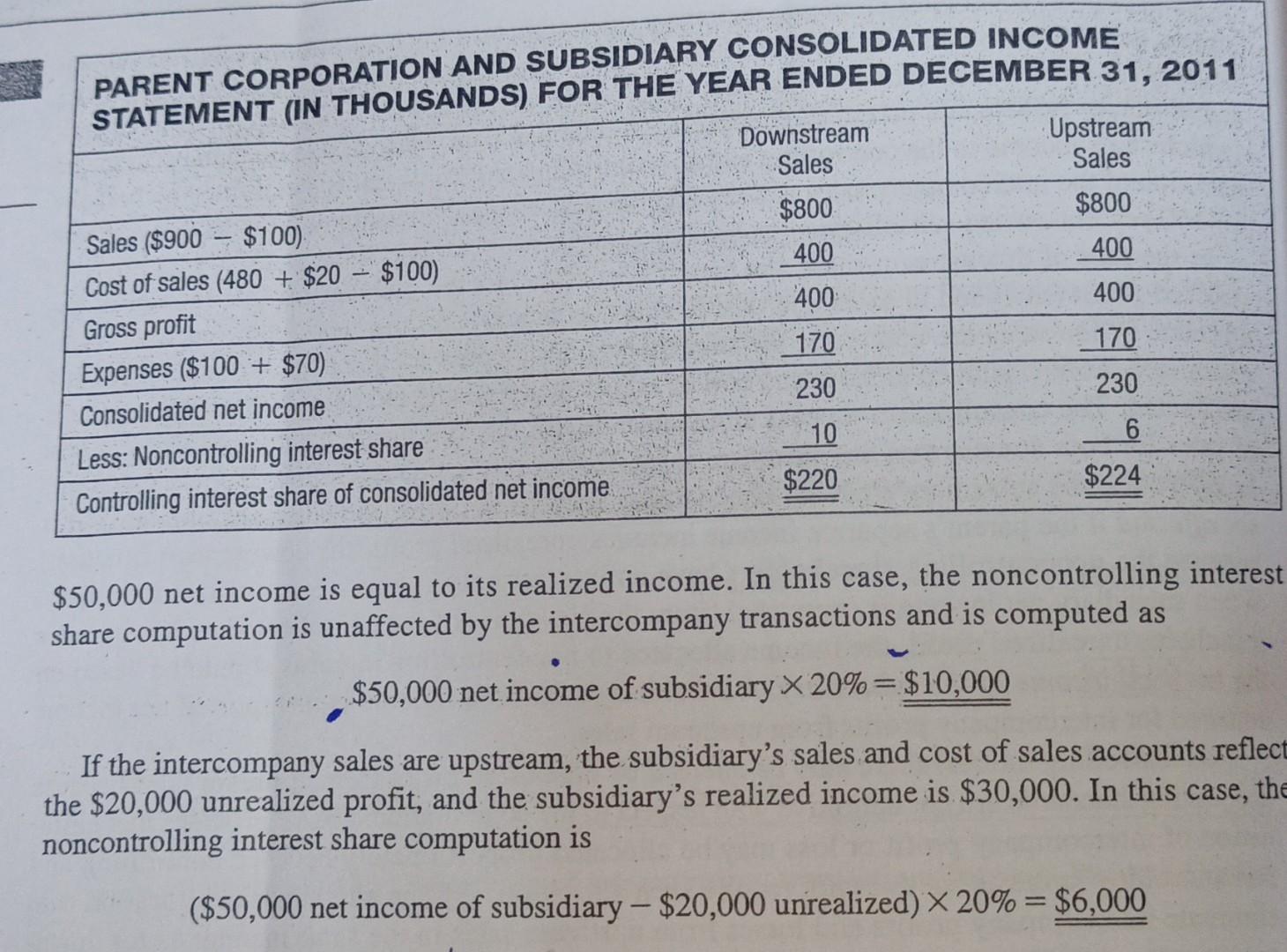

Downstream and Upstream Effects on Income Computations Assume that the separate incomes of a parent and its 80 percent-owned subsidiary for 2011 are as follows (in thousands): Intercompany sales during the year are $100,000, and the December 31,2011 , inventory includes $20,000 unrealized profit. NONCONTROLLING INTEREST SHARE COMPUTATION If the intercompany sales are downstream, the parent's sales and cost of sales accounts reflect the $20,000 unrealized profit, and the subsidiary's share computation is unaffected by the intercompany transactions and is computed as $50,000 net income of subsidiary 20%=$10,000 If the intercompany sales are upstream, the subsidiary's sales and cost of sales accounts reflect the $20,000 unrealized profit; and the subsidiary's realized income is $30,000. In this case, the noncontrolling interest share computation is ($50,000 net income of subsidiary $20,000 unrealized )20%=$6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts