Question: we need formal case analysis for this case study In January 2018, Alex Hall, packaging buyer for Markvale Inc. in Markham, Ontario, was working on

we need formal case analysis for this case study

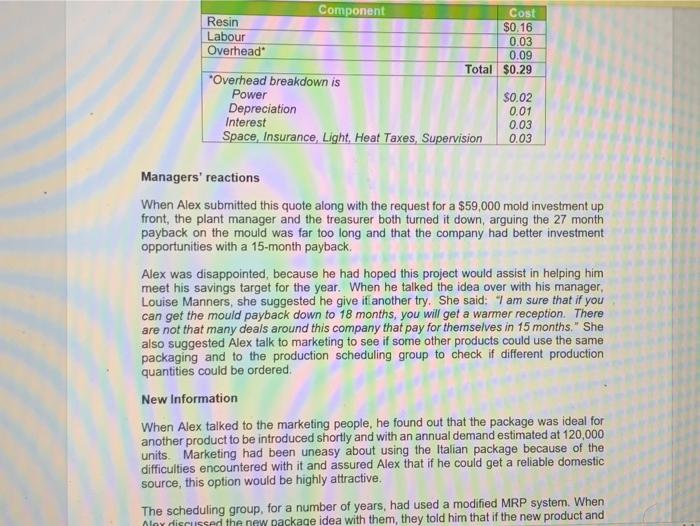

In January 2018, Alex Hall, packaging buyer for Markvale Inc. in Markham, Ontario, was working on an import substitution project involving a local minority supplier. He was concerned however, that his efforts would be fruitless since his original proposal had been flatly rejected by the plant manager as too expensive. Current Situation Markvale Inc., a medium-sized company, had over the year specialized in prescription skin care products, a market niche in which it had developed an excellent reputation. In March 2019, after extensive testing, Markvale had introduced a new facial cream in a special package that allowed for precise measurement of the quantity dispensed. The container, manufactured by an Italian firm for a different application was fairly expensive at an FOB Markvale's factory cost of $0.39. What concerned Alex Hall even more, however, were the quality and delivery problems encountered. Communications with the manufacturer were difficult and Alex had the impression the manufacturer did not seem to care much about Markvale's business, which as Alex knew, was only a small portion of their total volume produced. An Alternate Source With the cooperation of Markvale's engineering, production, and quality control personnel, Alex had found a local minority supplier who appeared capable of meeting Markvale's requirements. This custom moulding firm, Thorndike Inc., was owned by John Angus, an engineer who had purchased the firm several years earlier when the previous owner wished to retire. Thorndike Inc. had its own tool and die manufacturing operations as well as its own moulding shop. It depended heavily on automotive contracts, a situation John wished to correct by acquiring more non-automotive business. In conjunction with Markvale's engineers, Angus had worked out a mould design for the cream dispenser and included several suggestions for minor improvements. The cost of the mould was $59,000, an investment John was in no position to make and that Markvale would have to absorb upfront. John quoted a unit price of $0.29 based on purchased quantities of 40,000 units at a time and an annual volume estimated at 400,000 units. He had submitted a cost breakdown of this quote as follows: Component Cost Resin $0.16 Labour 0.03 Overhead 0.09 Total $0.29 "Overhead breakdown is Power $0.02 Depreciation 0.01 Interest 0.03 Space, Insurance, Light, Heat Taxes, Supervision 0.03 Managers' reactions When Alex submitted this quote along with the request for a $59,000 mold investment up front, the plant manager and the treasurer both turned it down, arguing the 27 month payback on the mould was far too long and that the company had better investment opportunities with a 15-month payback Alex was disappointed, because he had hoped this project would assist in helping him meet his savings target for the year. When he talked the idea over with his manager, Louise Manners, she suggested he give it another try. She said: "I am sure that if you can get the mould payback down to 18 months, you will get a warmer reception. There are not that many deals around this company that pay for themselves in 15 months." She also suggested Alex talk to marketing to see if some other products could use the same packaging and to the production scheduling group to check if different production quantities could be ordered. New Information When Alex talked to the marketing people, he found out that the package was ideal for another product to be introduced shortly and with an annual demand estimated at 120,000 units. Marketing had been uneasy about using the Italian package because of the difficulties encountered with it and assured Alex that if he could get a reliable domestic source, this option would be highly attractive. The scheduling group, for a number of years, had used a modified MRP system. When Olny discussed the new package idea with them, they told him that if the new product and When Alex talked to the marketing people, he found out that the package was ideal for another product to be introduced shortly and with an annual demand estimated at 120,000 units. Marketing had been uneasy about using the Italian package because of the difficulties encountered with it and assured Alex that if he could get a reliable domestic source, this option would be highly attractive, The scheduling group, for a number of years, had used a modified MRP system. When Alex discussed the new package idea with them, they told him that if the new product and the older one were to be packaged in the same package, a total package requirement of about 50,000 units would make sense and that the master production schedule could easily be adjusted to run the two products in conjunction ten times a year. MGMT-6082 DOMESTIC INTERNATIONAL SOURCING Alex also discussed the situation with the resin supplier, who indicated that his quote to John Angus had been based on the lot size of 40,000 packages, but that a 50,000 unit lot would fall into a new price bracket 6 percent lower than the original quoted price. Alex wondered what effect all of this new information would have on his original proposal. He knew that Angus had been adamant about his $0.29 quote. John had said: "I know / am classified as a minority supplier, but I don't want to hide behind that fact. I want no special favours from any of my customers. I am in not position to make special gifts to anyone. I have had to borrow a large amount to buy this company. Now I have to make it pay off. My $0.29 price is as low as I can go, as low as I can see