Question: we need to review a 10k form and then input it into this, the company i chose is Jet Blue it must be from 2021

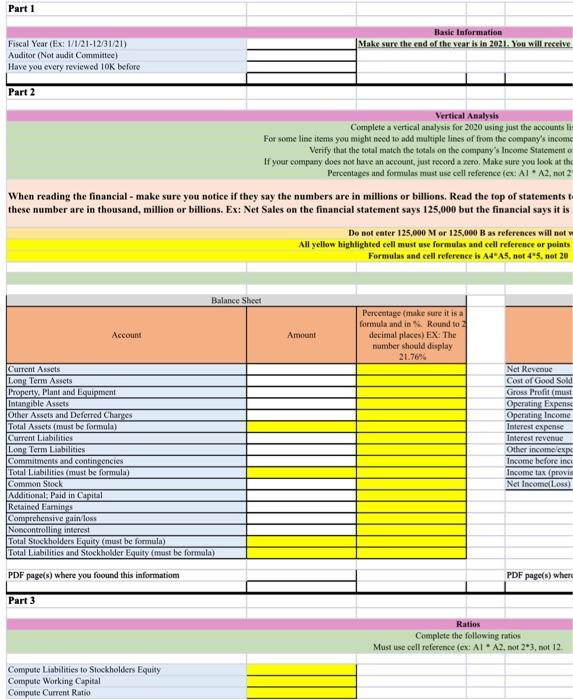

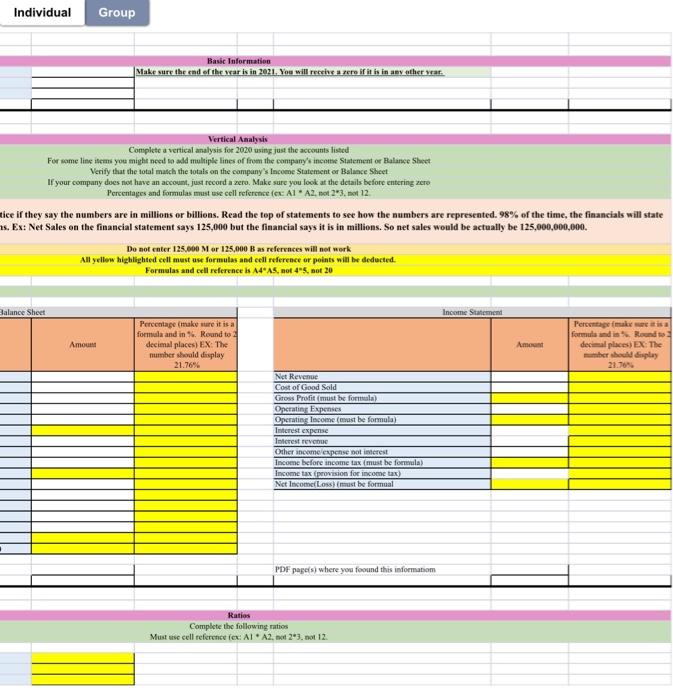

Part 1 Basic Information Make sure the end of the year is in 2021. You will receive Fiscal Year (Ex: 1/1/21-12/31/21) Auditor (Not audit Committee) Have you every reviewed 10K before Part 2 Vertical Analysis Complete a vertical analysis for 2020 using just the accounts lis For some line items you might need to add multiple lines of from the company's income Verify that the total match the totals on the company's Income Statement of If your company does not have an account, just record a zero. Make sure you look at the Percentages and formulas must use cell reference (ex: A1 A2, not 2 When reading the financial - make sure you notice if they say the numbers are in millions or billions. Read the top of statements to these number are in thousand, million or billions. Ex: Net Sales on the financial statement says 125,000 but the financial says it is Do not enter 125,000 M or 125,000 B as references will not w All yellow highlighted cell must use formulas and cell reference or points Formulas and cell reference is A4 A5, not 45, not 20 Balance Sheet Account Amount Percentage (make sure it is a formula and in %. Round to 2 decimal places) EX: The number should display 21.76% Current Assets Long Term Assets Property, Plant and Equipment Intangible Assets Other Assets and Deferred Charges Total Assets (must be formula) Net Revenue Cost of Good Sold Gross Profit (must Operating Expense Operating Income Interest expense Interest revenue Other income expe Income before inco Income tax (provis Net Income(Loss) Current Liabilities Long Term Liabilities Commitments and contingencies Total Liabilities (must be formula) Common Stock Additional; Paid in Capital Retained Earnings Comprehensive gain/loss Noncontrolling interest Total Stockholders Equity (must be formula) Total Liabilities and Stockholder Equity (must be formula) PDF page(s) where you found this information PDF page(s) where Part 3 Ratios Complete the following ratios Must use cell reference (ex: A1 A2, not 23, not 12. Compute Liabilities to Stockholders Equity Compute Working Capital Compute Current Ratio Individual Group Basic Information Make sure the end of the year is in 2021. You will receive a zero if it is in any other year. Vertical Analysis Complete a vertical analysis for 2020 using just the accounts listed For some line items you might need to add multiple lines of from the company's income Statement or Balance Sheet Verify that the total match the totals on the company's Income Statement or Balance Sheet If your company does not have an account, just record a zero. Make sure you look at the details before entering zero Percentages and formulas must use cell reference (ex: A1 A2, not 2*3, not 12. tice if they say the numbers are in millions or billions. Read the top of statements to see how the numbers are represented. 98% of the time, the financials will state 1s. Ex: Net Sales on the financial statement says 125,000 but the financial says it is in millions. So net sales would be actually be 125,000,000,000. Do not enter 125,000 M or 125,000 B as references will not work All yellow highlighted cell must use formulas and cell reference or points will be deducted. Formulas and cell reference is A4 A5, not 45, not 20 Balance Sheet Income Statement Percentage (make sure it is a formula and in %. Round to 2 Amount decimal places) EX: The number should display Percentage (make sure it is a formula and in %. Round to 1 decimal places) EX: The number should display 21.76% 21.76% Net Revenue Cost of Good Sold Gross Profit (must be formula) Operating Expenses Operating Income (must be formula) Interest expense Interest revenue Other income expense not interest Income before income tax (must be formula) Income tax (provision for income tax) Net Income(Loss) (must be formual PDF page(s) where you foound this information Ratios Complete the following ratios Must use cell reference (ex: A1 A2, not 2*3. not 12. Amount Part 1 Basic Information Make sure the end of the year is in 2021. You will receive Fiscal Year (Ex: 1/1/21-12/31/21) Auditor (Not audit Committee) Have you every reviewed 10K before Part 2 Vertical Analysis Complete a vertical analysis for 2020 using just the accounts lis For some line items you might need to add multiple lines of from the company's income Verify that the total match the totals on the company's Income Statement of If your company does not have an account, just record a zero. Make sure you look at the Percentages and formulas must use cell reference (ex: A1 A2, not 2 When reading the financial - make sure you notice if they say the numbers are in millions or billions. Read the top of statements to these number are in thousand, million or billions. Ex: Net Sales on the financial statement says 125,000 but the financial says it is Do not enter 125,000 M or 125,000 B as references will not w All yellow highlighted cell must use formulas and cell reference or points Formulas and cell reference is A4 A5, not 45, not 20 Balance Sheet Account Amount Percentage (make sure it is a formula and in %. Round to 2 decimal places) EX: The number should display 21.76% Current Assets Long Term Assets Property, Plant and Equipment Intangible Assets Other Assets and Deferred Charges Total Assets (must be formula) Net Revenue Cost of Good Sold Gross Profit (must Operating Expense Operating Income Interest expense Interest revenue Other income expe Income before inco Income tax (provis Net Income(Loss) Current Liabilities Long Term Liabilities Commitments and contingencies Total Liabilities (must be formula) Common Stock Additional; Paid in Capital Retained Earnings Comprehensive gain/loss Noncontrolling interest Total Stockholders Equity (must be formula) Total Liabilities and Stockholder Equity (must be formula) PDF page(s) where you found this information PDF page(s) where Part 3 Ratios Complete the following ratios Must use cell reference (ex: A1 A2, not 23, not 12. Compute Liabilities to Stockholders Equity Compute Working Capital Compute Current Ratio Individual Group Basic Information Make sure the end of the year is in 2021. You will receive a zero if it is in any other year. Vertical Analysis Complete a vertical analysis for 2020 using just the accounts listed For some line items you might need to add multiple lines of from the company's income Statement or Balance Sheet Verify that the total match the totals on the company's Income Statement or Balance Sheet If your company does not have an account, just record a zero. Make sure you look at the details before entering zero Percentages and formulas must use cell reference (ex: A1 A2, not 2*3, not 12. tice if they say the numbers are in millions or billions. Read the top of statements to see how the numbers are represented. 98% of the time, the financials will state 1s. Ex: Net Sales on the financial statement says 125,000 but the financial says it is in millions. So net sales would be actually be 125,000,000,000. Do not enter 125,000 M or 125,000 B as references will not work All yellow highlighted cell must use formulas and cell reference or points will be deducted. Formulas and cell reference is A4 A5, not 45, not 20 Balance Sheet Income Statement Percentage (make sure it is a formula and in %. Round to 2 Amount decimal places) EX: The number should display Percentage (make sure it is a formula and in %. Round to 1 decimal places) EX: The number should display 21.76% 21.76% Net Revenue Cost of Good Sold Gross Profit (must be formula) Operating Expenses Operating Income (must be formula) Interest expense Interest revenue Other income expense not interest Income before income tax (must be formula) Income tax (provision for income tax) Net Income(Loss) (must be formual PDF page(s) where you foound this information Ratios Complete the following ratios Must use cell reference (ex: A1 A2, not 2*3. not 12. Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts