Question: We talked about several valuation models during the semester. Which of the formulas below is consistent with a two-stage dividend discount model where the the

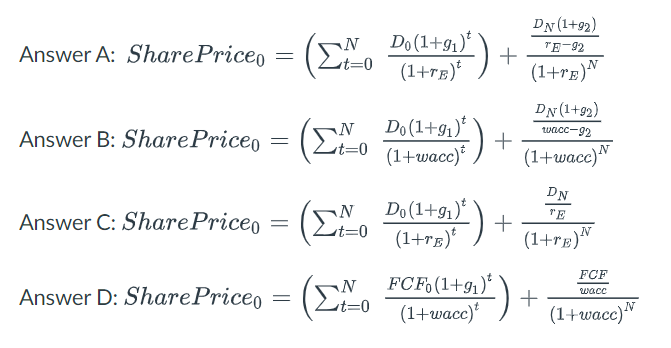

We talked about several valuation models during the semester. Which of the formulas below is consistent with a two-stage dividend discount model where the the first stage assumes an initial annual growth rate for N years and the second stage assumes no growth in the subsequent dividends after the Nth year? In the formulas shown below for this question assume that g1 and g2 are both positive. Assume the references to rE, wacc, D, g1, g2, and FCF are consistent with the notation used in the lectures when talking about DCF models.

IswerA:SharePrice0=(t=0N(1+rE)tD0(1+g1)t)+(1+rE)NrEg2DN(1+g2)swerB:SharePriceSh0=(t=0N(1+wacc)tD0(1+g1)t)+(1+wacc)Nwaccg2DN(1+g2)swerC:SharePrice0=(t=0N(1+rE)tD0(1+g1)t)+(1+rE)NrEDNswerD:SharePrice0=(t=0N(1+wacc)tFCF0(1+g1)t)+(1+wacc)NwaccFCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts