Question: WebWork 6: Problem 10 Previous Problem Problem List Next Problem (1 point) A stock currently trades at $43, and the volatility of its return is

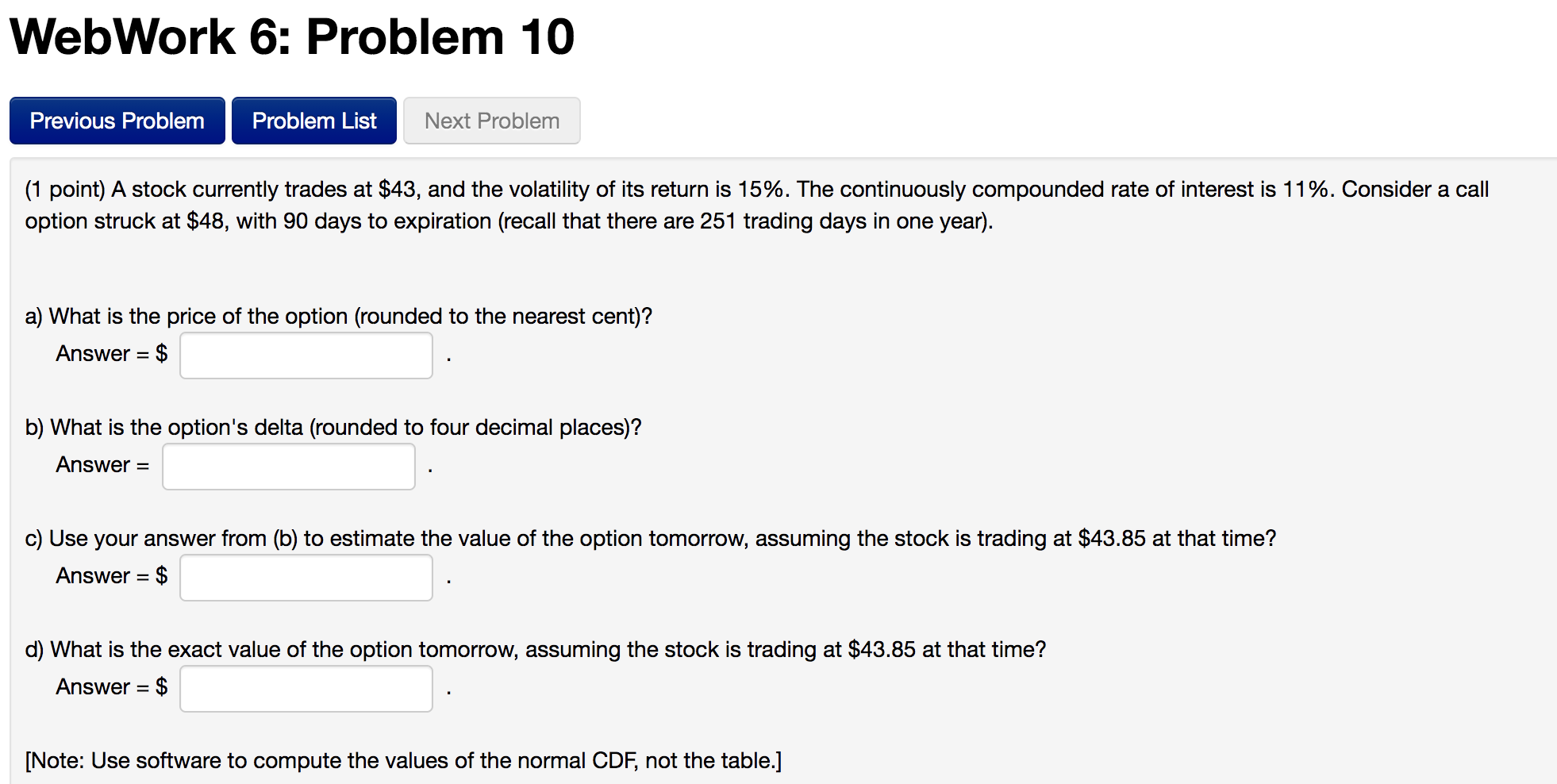

WebWork 6: Problem 10 Previous Problem Problem List Next Problem (1 point) A stock currently trades at $43, and the volatility of its return is 15%. The continuously compounded rate of interest is 11%. Consider a call option struck at $48, with 90 days to expiration (recall that there are 251 trading days in one year). a) What is the price of the option (rounded to the nearest cent)? Answer = $ b) What is the option's delta (rounded to four decimal places)? Answer = c) Use your answer from (b) to estimate the value of the option tomorrow, assuming the stock is trading at $43.85 at that time? Answer = $ d) What is the exact value of the option tomorrow, assuming the stock is trading at $43.85 at that time? Answer = $ [Note: Use software to compute the values of the normal CDF, not the table.] WebWork 6: Problem 10 Previous Problem Problem List Next Problem (1 point) A stock currently trades at $43, and the volatility of its return is 15%. The continuously compounded rate of interest is 11%. Consider a call option struck at $48, with 90 days to expiration (recall that there are 251 trading days in one year). a) What is the price of the option (rounded to the nearest cent)? Answer = $ b) What is the option's delta (rounded to four decimal places)? Answer = c) Use your answer from (b) to estimate the value of the option tomorrow, assuming the stock is trading at $43.85 at that time? Answer = $ d) What is the exact value of the option tomorrow, assuming the stock is trading at $43.85 at that time? Answer = $ [Note: Use software to compute the values of the normal CDF, not the table.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts