Question: Week 1 2 3 4 5 6 Forecast 25 45 25 20 25 30 Customer orders (committed) 30 20 18 15 20 15 Projected On

| Week | 1 | 2 | 3 | 4 | 5 | 6 |

| Forecast | 25 | 45 | 25 | 20 | 25 | 30 |

| Customer orders (committed) | 30 | 20 | 18 | 15 | 20 | 15 |

| Projected On Hand Inventory | 20 | 0 | 0 | 0 | 0 | 0 |

| Net Inventory before MPS | 20 | 0 | 0 | 0 | 0 | 0 |

| MPS Receipts | 0 | 25 | 25 | 20 | 25 | 30 |

| MPS Start | 25 | 25 | 20 | 25 | 30 | 0 |

| Available-to-promise inventory (uncommitted) | 20 | 5 | 7 | 5 | 5 | 15 |

Please answer all the sub-questions, this is all one question.

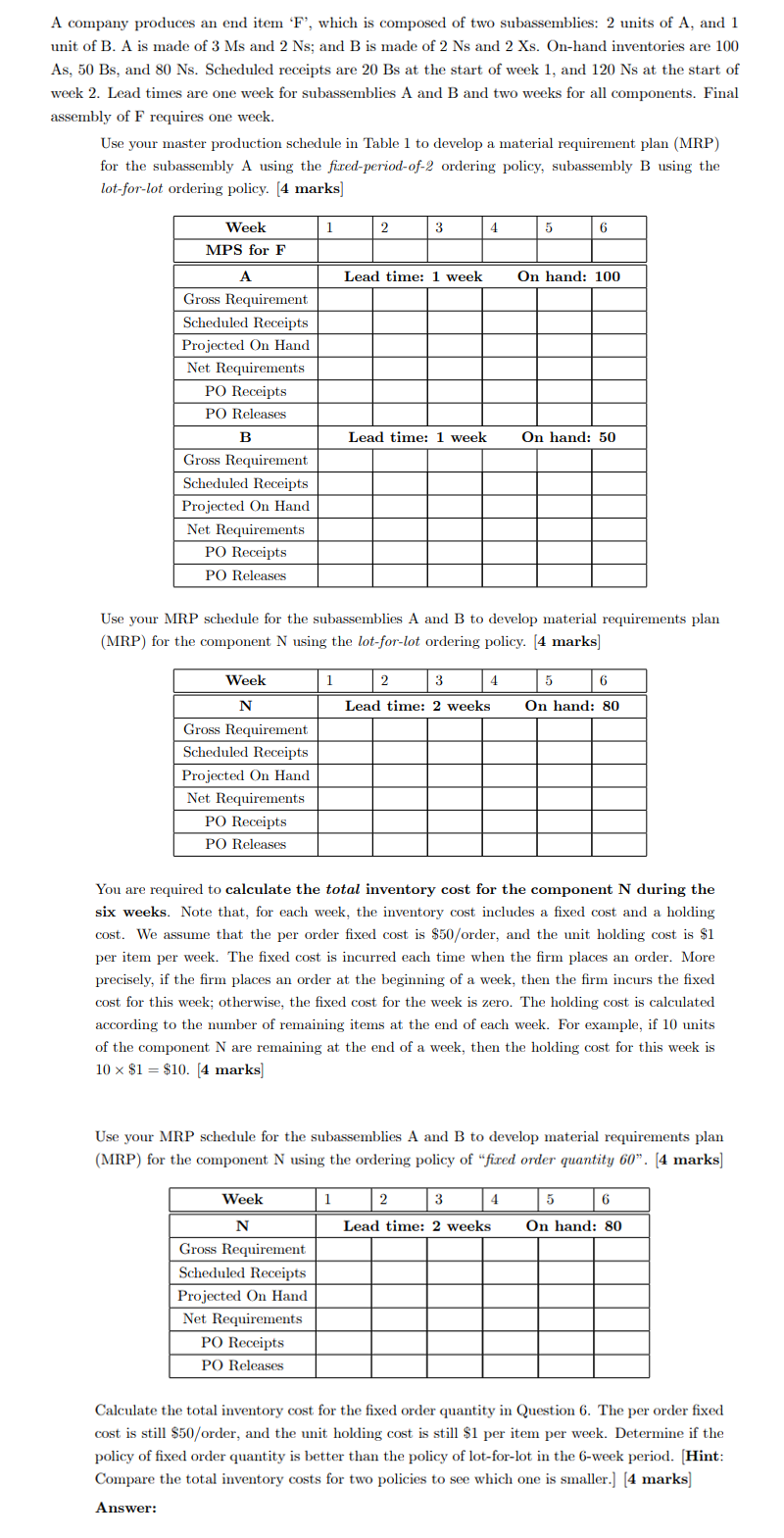

A company produces an end item 'F', which is composed of two subassemblies: 2 units of A, and 1 unit of B. A is made of 3 Ms and 2 Ns; and B is made of 2 Ns and 2 Xs. On-hand inventories are 100 As, 50 Bs, and 80 Ns. Scheduled receipts are 20 Bs at the start of week 1, and 120 Ns at the start of week 2. Lead times are one week for subassemblies A and B and two weeks for all components. Final assembly of F requires one week. Use your master production schedule in Table 1 to develop a material requirement plan (MRP) for the subassembly A using the fixed-period-of-2 ordering policy, subassembly B using the lot-for-lot ordering policy. (4 marks) 1 2 3 4 4 5 6 Week MPS for F Lead time: 1 week On hand: 100 A A Gross Requirement Scheduled Receipts Projected On Hand Net Requirements PO Receipts PO Releases B Gross Requirement Scheduled Receipts Projected On Hand Net Requirements PO Receipts PO Releases Lead time: 1 week On hand: 50 Use your MRP schedule for the subassemblies A and B to develop material requirements plan (MRP) for the component N using the lot-for-lot ordering policy. (4 marks) Week 1 5 6 2 3 4 Lead time: 2 weeks On hand: 80 N Gross Requirement Scheduled Receipts Projected On Hand Net Requirements PO Receipts PO Releases You are required to calculate the total inventory cost for the component N during the six weeks. Note that, for each week, the inventory cost includes a fixed cost and a holding cost. We assume that the per order fixed cost is $50/order, and the unit holding cost is $1 per item per week. The fixed cost is incurred each time when the firm places an order. More precisely, if the firm places an order at the beginning of a week, then the firm incurs the fixed cost for this week; otherwise, the fixed cost for the week is zero. The holding cost is calculated according to the number of remaining items at the end of each week. For example, if 10 units of the component N are remaining at the end of a week, then the holding cost for this week is 10 x $1 = $10. (4 marks) Use your MRP schedule for the subassemblies A and B to develop material requirements plan (MRP) for the component N using the ordering policy of "fixed order quantity 60. (4 marks) Week 1 2 3 4 5 6 Lead time: 2 weeks On hand: 80 N Gross Requirement Scheduled Receipts Projected On Hand Net Requirements PO Receipts PO Releases Calculate the total inventory cost for the fixed order quantity in Question 6. The per order fixed cost is still $50/order, and the unit holding cost is still $1 per item per week. Determine if the policy of fixed order quantity is better than the policy of lot-for-lot in the 6-week period. (Hint: Compare the total inventory costs for two policies to see which one is smaller.) (4 marks)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock