Question: Week 2 - Practice Set Name Please type a numerical solution to the problems below: 1. Malden Corporation has annual fixed costs of $2,000,000, variable

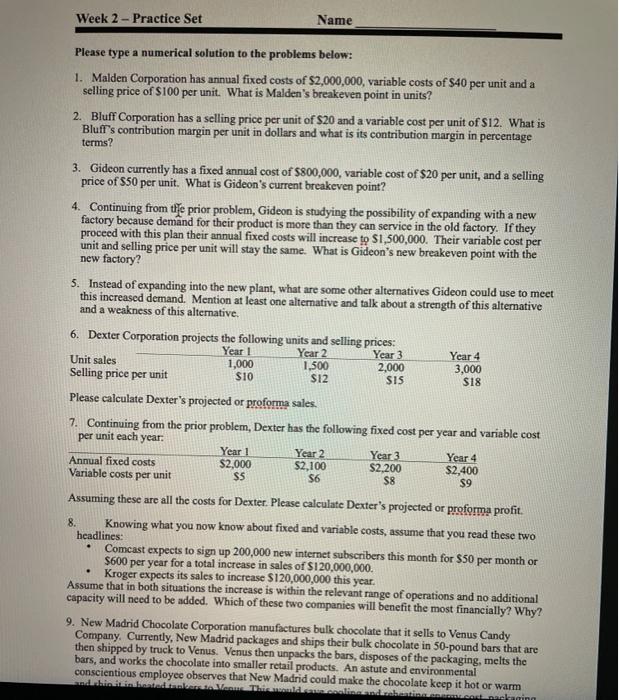

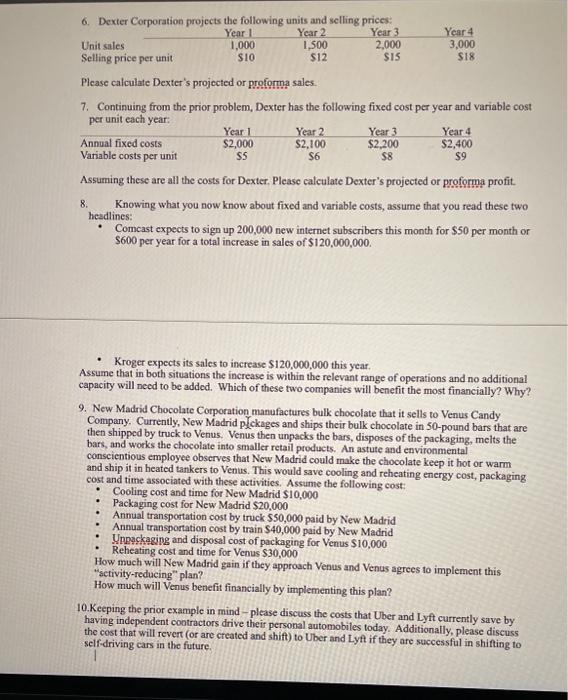

Week 2 - Practice Set Name Please type a numerical solution to the problems below: 1. Malden Corporation has annual fixed costs of $2,000,000, variable costs of $40 per unit and a selling price of $100 per unit. What is Malden's breakeven point in units? 2. Bluff Corporation has a selling price per unit of $20 and a variable cost per unit of $12. What is Bluff's contribution margin per unit in dollars and what is its contribution margin in percentage terms? 3. Gideon currently has a fixed annual cost of $800,000, variable cost of $20 per unit, and a selling price of $50 per unit. What is Gideon's current breakeven point? 4. Continuing from the prior problem, Gideon is studying the possibility of expanding with a new factory because demand for their product is more than they can service in the old factory. If they proceed with this plan their annual fixed costs will increase to $1,500,000. Their variable cost per unit and selling price per unit will stay the same. What is Gideon's new breakeven point with the new factory? 5. Instead of expanding into the new plant, what are some other alternatives Gideon could use to meet this increased demand. Mention at least one alternative and talk about a strength of this alternative and a weakness of this alternative. 6. Dexter Corporation projects the following units and selling prices: Year 1 Year 2 Year 3 Unit sales 1,000 1,500 2,000 Selling price per unit $10 $12 SIS Year 4 3,000 $18 Please calculate Dexter's projected or proforma sales. 7. Continuing from the prior problem, Dexter has the following fixed cost per year and variable cost per unit each year: Year! Year 2 Year 3 Year 4 Annual fixed costs $2,000 $2,100 $2,200 Variable costs per unit $2,400 SS S6 $8 $9 8. . . Assuming these are all the costs for Dexter. Please calculate Dexter's projected or proforma profit. Knowing what you now know about fixed and variable costs, assume that you read these two headlines: Comcast expects to sign up 200,000 new internet subscribers this month for $50 per month or $600 per year for a total increase in sales of $120,000,000. Kroger expects its sales to increase $120,000,000 this year. Assume that in both situations the increase is within the relevant range of operations and no additional capacity will need to be added. Which of these two companies will benefit the most financially? Why? 9. New Madrid Chocolate Corporation manufactures bulk chocolate that it sells to Venus Candy Company. Currently, New Madrid packages and ships their bulk chocolate in 50-pound bars that are then shipped by truck to Venus. Venus then unpacks the bars, disposes of the packaging, melts the bars, and works the chocolate into smaller retail products. An astute and environmental conscientious employee observes that New Madrid could make the chocolate keep it hot or warm dibin bestedenomThird.co.licendiente encaming 6. Dexter Corporation projects the following units and selling prices: Year 1 Year 2 Year 3 Unit sales 1,000 1,500 2,000 Selling price per unit SIO $12 $15 Year 4 3,000 S18 Please calculate Dexter's projected or proforma sales. 7. Continuing from the prior problem, Dexter has the following fixed cost per year and variable cost per unit each year Year 1 Year 2 Year 3 Year 4 Annual fixed costs $2,000 $2,100 $2,200 $2,400 Variable costs per unit S6 $8 $9 SS Assuming these are all the costs for Dexter. Please calculate Dexter's projected or proforma profit. Knowing what you now know about fixed and variable costs, assume that you read these two headlines: Comcast expects to sign up 200.000 new internet subscribers this month for $50 per month or $600 per year for a total increase in sales of $120,000,000. Kroger expects its sales to increase $120,000,000 this year. Assume that in both situations the increase is within the relevant range of operations and no additional capacity will need to be added. Which of these two companies will benefit the most financially? Why? 9. New Madrid Chocolate Corporation manufactures bulk chocolate that it sells to Venus Candy Company. Currently, New Madrid pIckages and ships their bulk chocolate in 50-pound bars that are then shipped by truck to Venus Venus then unpacks the bars, disposes of the packaging, melts the bars, and works the chocolate into smaller retail products. An astute and environmental conscientious employee observes that New Madrid could make the chocolate keep it hot or warm and ship it in heated tankers to Venus. This would save cooling and reheating energy cost, packaging cost and time associated with these activities. Assume the following cost: Cooling cost and time for New Madrid $10,000 Packaging cost for New Madrid $20,000 Annual transportation cost by truck 550,000 paid by New Madrid Annual transportation cost by train S40,000 paid by New Madrid : Unpackaging and disposal cost of packaging for Venus $10,000 Reheating cost and time for Venus S30,000 How much will New Madrid gain if they approach Venus and Venus agrees to implement this How much will Venus benefit financially by implementing this plan? 10. Keeping the prior example in mind - please discuss the costs that Uber and Lyft currently save by having independent contractors drive their personal automobiles today. Additionally, please discuss the cost that will revert (or are created and shift) to Uber and Lyf if they are successful in shifting to self-driving cars in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts