Question: week 4 hcs385 financial performance worksheet. please also provide the step by step work instructions on how you came up with each answer. I am

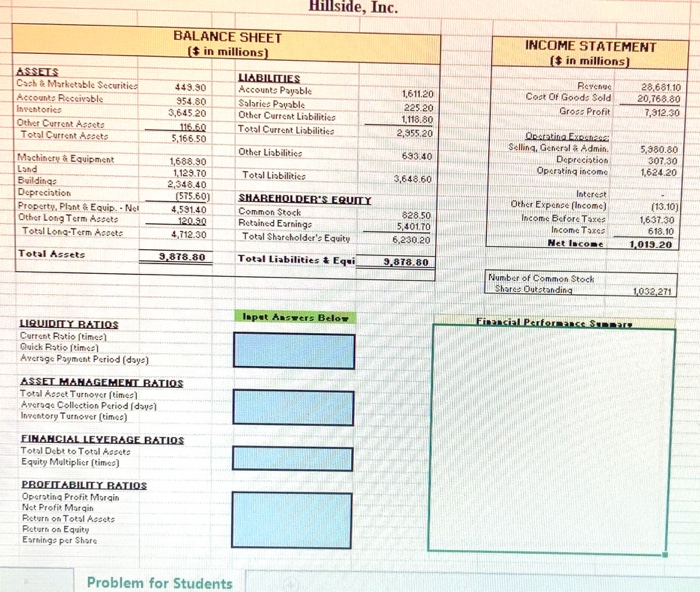

AutoSave OM 8 hes385_24_wk4_financial performance_worksheet - Protected View - E File Home Insert Draw Page Layout Formulas Data Review View Help Search PROTECTED VIEW Be careful-Files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing G28 D 1 H K L M N 0 Hillside, Inc. BALANCE SHEET ($ in millions) 3 4 5 8 7 8 9 10 11 12 1 INCOME STATEMENT ($ in millions) Rece 28.66110 Cost Of Godo Sold 20.160.00 Gross Pro 7.912.30 9540 3,645.20 161120 225 20 (118.80 2.955.20 5,166 50 ASSLTS Cal Market Securities Account Receivable loties Our Current Tots CAN Machinery Equip Building Depreciation Property. Plot top.Net Other Long Term Auto Tots Long-Tern Aus Total Assets 693 40 LIABILITIES Accounts Publi Sai Pablo Our Current Tots Currenties Other abiti Totsibile SHAREHOLDER'S LQUILY Concs Stock Rused wings Tot Shabaldur's Equity Total Liabilities & Eyni Selling Gul Ades Depre Operation 5.380.00 307.30 162420 3,648 60 1688.30 1,129.70 2.540.40 1515.60 4,59140 15 11 18 Our Eiends flacon Incom. Before The Incontre Net face 82850 5.4010 6,230 20 20 (13.10) 163130 63.10 1.013.20 4,722.30 22 23 24 2010.30 Number of Connon toch Ispet Anwer Below 20 23 Licial Putra LIQUIDITY RATIOS Creston Ouick Rution AvongPot Puriod (de) ASSET MANAGEMENT RATIOS Tol [id] Art Collection Pied wil Ivetry Tusor) FINANCIAL LEYLRAGE BATIOS Totslitte Total Equity Multiple times) PROEIT ABILITY RATIOS Operating Pront Mon Net Pro Mergin Parros Total Rus Equity Eigepers II 41 44 5 47 43 Problem for Students Hillside, Inc. BALANCE SHEET ($ in millions) INCOME STATEMENT ($ in millions) ASSETS Cash & Marketable Securities Accounts Receivable Inventorisa Other Current Assets Total Current Assets 449.90 954.80 3,645.20 116.50 5,166.50 LIABILITIES Accounts Payable Salaries Payable Other Current Liabilities Total Current Liabilities 1,611.20 225.20 1.118.80 2,955,20 Revenec Cost Of Goods Sold Gross Profit 28,681.10 20.768.80 7,312.30 Other Liabilities 693.40 Oreating Expat Selling, General Admin Deprecistion Operating income 5,980.80 307.30 1.624.20 Total Liabilities 3,648,60 Machinery & Equipment Lund Buildings Depreciation Property. Plant & Equip. . Nel Other Long Term Assets Total Long-Term Assets 1,688.90 1,129.70 2,348.40 (575.60) 4,591.40 120.99 4,712.30 SHAREHOLDER'S EQUITY Common Stock Retained Earning Total Shareholder's Equity 828.50 5,401.70 6,230.20 Interest Other Expense (Income) Income Before Taxes Income Taxes Het lacone (13.10) 1,637.30 618.10 1,019.20 Total Assets 9,878.80 Total Liabilities & Equi 9,878.80 Number of Common Stock Share Outstanding 1032.271 lepet Answers Below Financial Performance Son LIQUIDITY RATIOS Current Ratio times Quick Ratio time Average Payment Period (days) ASSET MAHAGEMENT RATIOS Total Aspet Turnover times) Average Collection Period (days) Inventory Turnover (times) FINANCIAL LEYEBAGE BATIOS Total Debt to Total Assets Equity Multiplier (times) PROFITABILITY RATIOS Operating Profit Morgin Net Profit Margin Return on Total Assets Return on Equity Earnings per Shore HOT Problem for Students

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts