Question: Week 4 Work Problems Part 2 Answers Question 1 Suppose that you estimate the Market Risk Premium for the U.S. for the period 1928 to

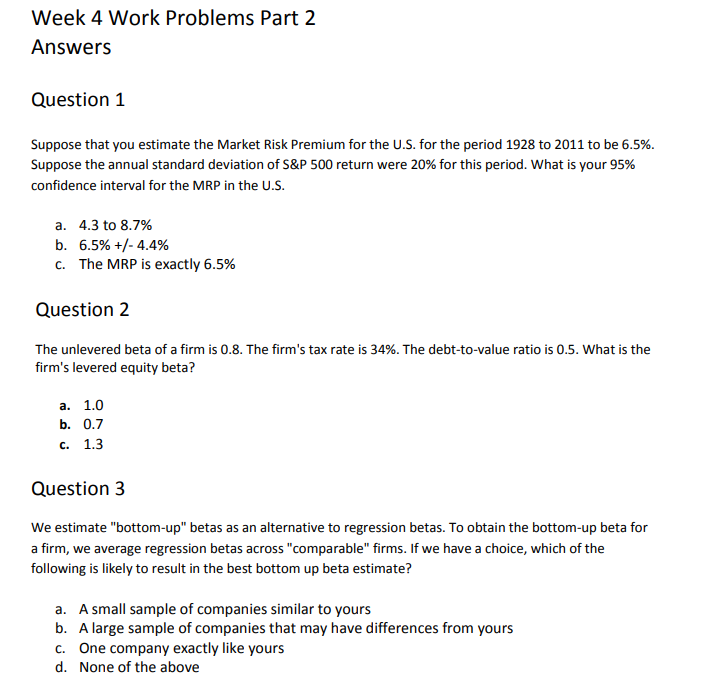

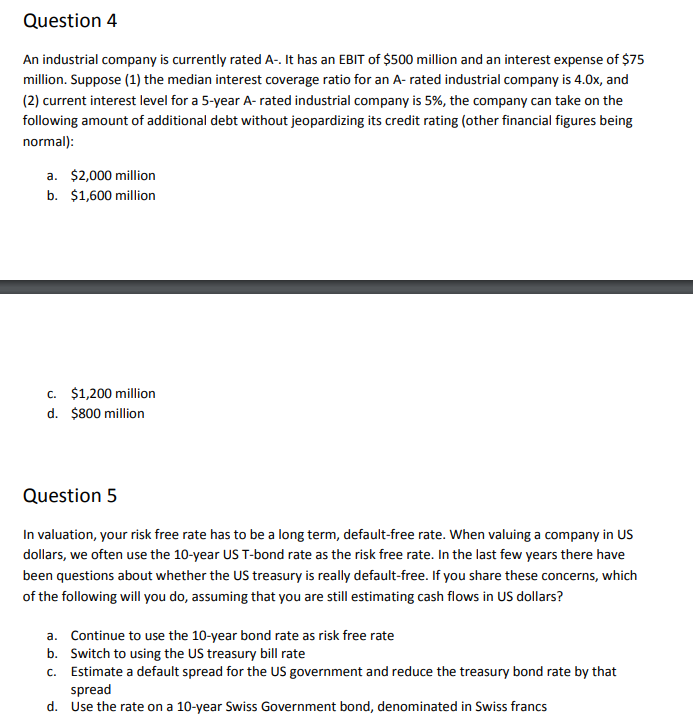

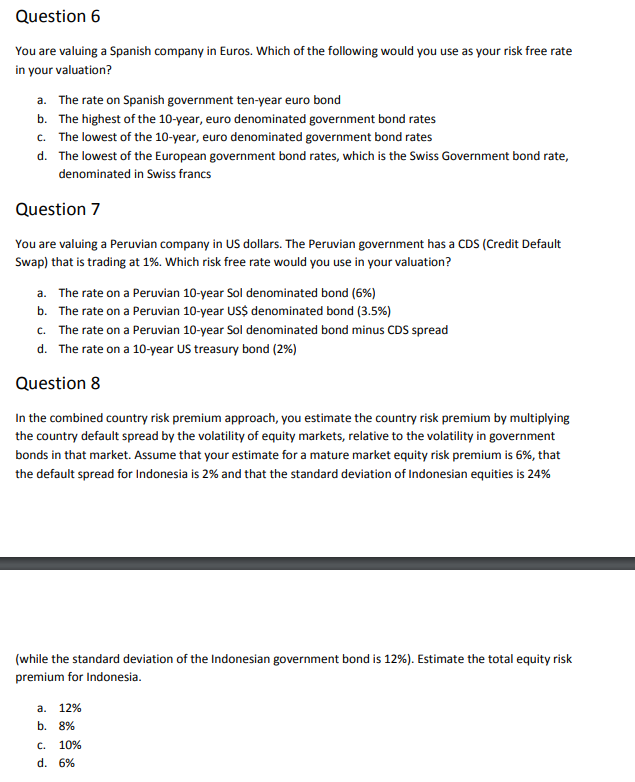

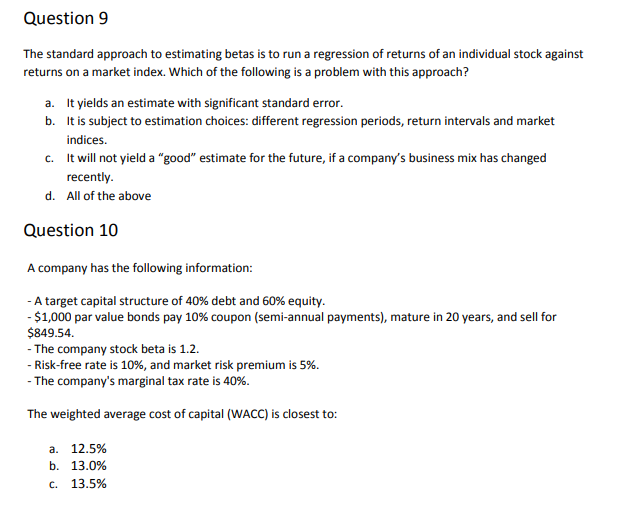

Week 4 Work Problems Part 2 Answers Question 1 Suppose that you estimate the Market Risk Premium for the U.S. for the period 1928 to 2011 to be 6.5%. Suppose the annual standard deviation of S&P 500 return were 20% for this period. What is your 95% confidence interval for the MRP in the U.S. a. 4.3 to 8.7% b. 6.5% +/- 4.4% C. The MRP is exactly 6.5% Question 2 The unlevered beta of a firm is 0.8. The firm's tax rate is 34%. The debt-to-value ratio is 0.5. What is the firm's levered equity beta? a. 1.0 b. 0.7 c. 1.3 Question 3 We estimate "bottom-up" betas as an alternative to regression betas. To obtain the bottom-up beta for a firm, we average regression betas across "comparable" firms. If we have a choice, which of the following is likely to result in the best bottom up beta estimate? a. A small sample of companies similar to yours b. A large sample of companies that may have differences from yours C. One company exactly like yours d. None of the above Question 4 An industrial company is currently rated A-. It has an EBIT of $500 million and an interest expense of $75 million. Suppose (1) the median interest coverage ratio for an A-rated industrial company is 4.0x, and (2) current interest level for a 5-year A-rated industrial company is 5%, the company can take on the following amount of additional debt without jeopardizing its credit rating (other financial figures being normal): a. $2,000 million b. $1,600 million C. $1,200 million d. $800 million Question 5 In valuation, your risk free rate has to be a long term, default-free rate. When valuing a company in US dollars, we often use the 10-year US T-bond rate as the risk free rate. In the last few years there have been questions about whether the US treasury is really default-free. If you share these concerns, which of the following will you do, assuming that you are still estimating cash flows in US dollars? a. Continue to use the 10-year bond rate as risk free rate b. Switch to using the US treasury bill rate C. Estimate a default spread for the US government and reduce the treasury bond rate by that spread d. Use the rate on a 10-year Swiss Government bond, denominated in Swiss francs Question 6 You are valuing a Spanish company in Euros. Which of the following would you use as your risk free rate in your valuation? a. The rate on Spanish government ten-year euro bond b. The highest of the 10-year, euro denominated government bond rates c. The lowest of the 10-year, euro denominated government bond rates d. The lowest of the European government bond rates, which is the Swiss Government bond rate, denominated in Swiss francs Question 7 You are valuing a Peruvian company in US dollars. The Peruvian government has a CDS (Credit Default Swap) that is trading at 1%. Which risk free rate would you use in your valuation? a. The rate on a Peruvian 10-year Sol denominated bond (6%) b. The rate on a Peruvian 10-year US$ denominated bond (3.5%) C. The rate on a Peruvian 10-year Sol denominated bond minus CDS spread d. The rate on a 10-year US treasury bond (2%) Question 8 In the combined country risk premium approach, you estimate the country risk premium by multiplying the country default spread by the volatility of equity markets, relative to the volatility in government bonds in that market. Assume that your estimate for a mature market equity risk premium is 6%, that the default spread for Indonesia is 2% and that the standard deviation of Indonesian equities is 24% (while the standard deviation of the Indonesian government bond is 12%). Estimate the total equity risk premium for Indonesia. a. 12% b. 8% C. 10% d. 6% Question 9 The standard approach to estimating betas is to run a regression of returns of an individual stock against returns on a market index. Which of the following is a problem with this approach? a. It yields an estimate with significant standard error. b. It is subject to estimation choices: different regression periods, return intervals and market indices. C. It will not yield a "good" estimate for the future, if a company's business mix has changed recently. d. All of the above Question 10 A company has the following information: - A target capital structure of 40% debt and 60% equity. - $1,000 par value bonds pay 10% coupon (semi-annual payments), mature in 20 years, and sell for $849.54. - The company stock beta is 1.2. - Risk-free rate is 10%, and market risk premium is 5%. - The company's marginal tax rate is 40%. The weighted average cost of capital (WACC) is closest to: a. 12.5% b. 13.0% 13.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts