Question: 1. 2. 3. 4. 5. ANY HELP WOULD BE GREATLY APPRECIATED, I WILL GIVE THUMBS UP FOR YOU NPV Calculate the net present value (NPV)

1. 2.

2. 3.

3. 4.

4. 5.

5.

ANY HELP WOULD BE GREATLY APPRECIATED, I WILL GIVE THUMBS UP FOR YOU

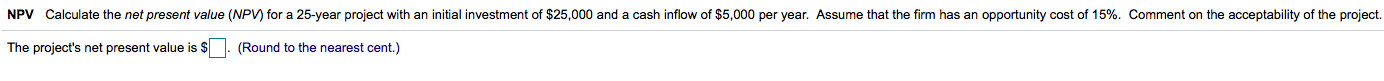

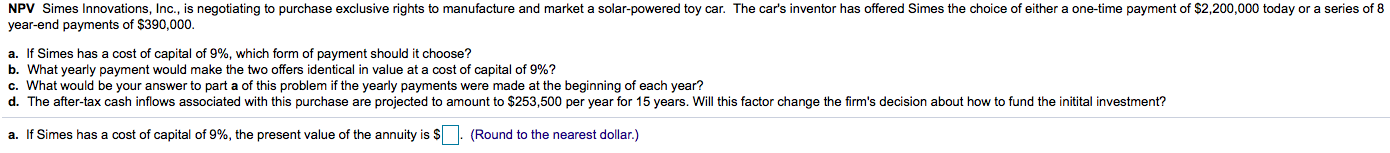

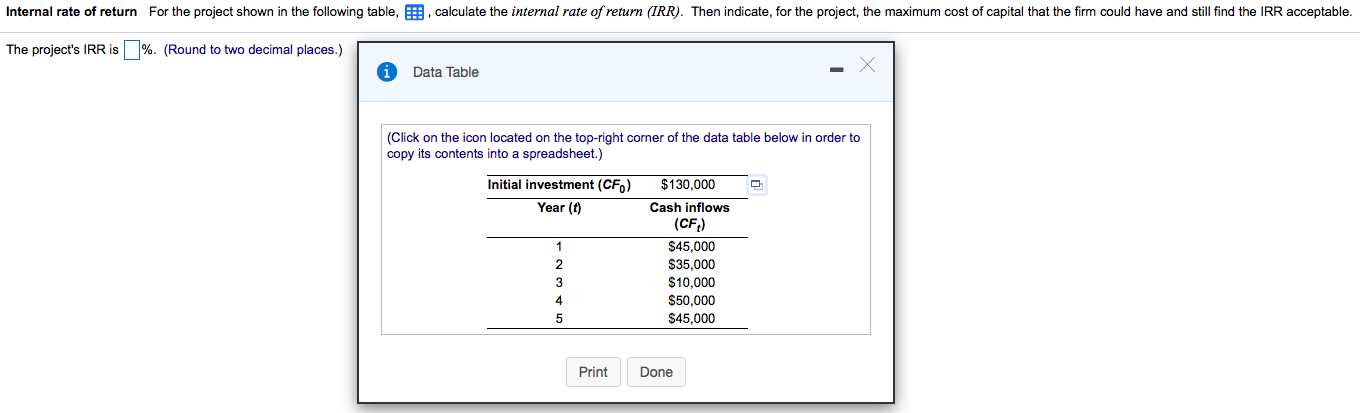

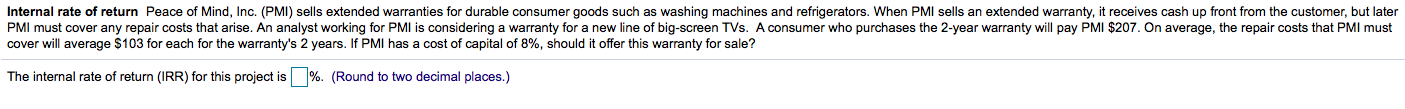

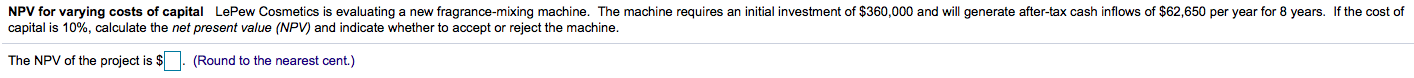

NPV Calculate the net present value (NPV) for a 25-year project with an initial investment of $25,000 and a cash inflow of $5,000 per year. Assume that the firm has an opportunity cost of 15%. Comment on the acceptability of the project. The project's net present value is $ . (Round to the nearest cent.) NPV Simes Innovations, Inc., is negotiating to purchase exclusive rights to manufacture and market a solar-powered toy car. The car's inventor has offered Simes the choice of either a one-time payment of $2,200,000 today or a series of 8 year-end payments of $390,000. a. If Simes has a cost of capital of 9%, which form of payment should it choose? b. What yearly payment would make the two offers identical in value at a cost of capital of 9%? c. What would be your answer to part a of this problem if the yearly payments were made at the beginning of each year? d. The after-tax cash inflows associated with this purchase are projected to amount to $253,500 per year for 15 years. Will this factor change the firm's decision about how to fund the initital investment? a. If Simes has a cost of capital of 9%, the present value of the annuity is $ . (Round to the nearest dollar.) Internal rate of return For the project shown in the following table, . calculate the internal rate of return (IRR). Then indicate, for the project, the maximum cost of capital that the firm could have and still find the IRR acceptable. The project's IRR is %. (Round to two decimal places.) A Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Initial investment (CF) Year (0) $130,000 Cash inflows (CF) $45,000 $35,000 $10,000 $50,000 $45,000 Print Done Internal rate of return Peace of Mind, Inc. (PMI) sells extended warranties for durable consumer goods such as washing machines and refrigerators. When PMI sells an extended warranty, it receives cash up front from the customer, but later PMI must cover any repair costs that arise. An analyst working for PMI is considering a warranty for a new line of big-screen TVs. A consumer who purchases the 2-year warranty will pay PMI $207. On average, the repair costs that PMI must cover will average $103 for each for the warranty's 2 years. If PMI has a cost of capital of 8%, should it offer this warranty for sale? The internal rate of return (IRR) for this project is %. (Round to two decimal places.) NPV for varying costs of capital LePew Cosmetics is evaluating a new fragrance-mixing machine. The machine requires an initial investment of $360,000 and will generate after-tax cash inflows of $62,650 per year for 8 years. If the cost of capital is 10%, calculate the net present value (NPV) and indicate whether to accept or reject the machine. The NPV of the project is $ . (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts