Question: Week 8 - Project Justification It is now time to prepare a capital budget. The idea is to prepare a list of acceptable projects in

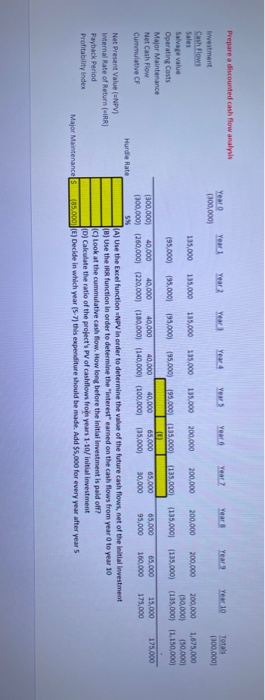

Week 8 - Project Justification It is now time to prepare a capital budget. The idea is to prepare a list of acceptable projects in which to spend in the first quarter in order to increase the value of operations. Recall that the cash budget included funds for plant expansion The estimated future cash flows arising from sales, net of operating costs are given. The hurdle rate represents the interest rate to borrow these funds plus a 2% risk factor. Use this percent in order to discount the cash flows The project cost and the salvage value, as well, have already been input into the worksheets. Input these cash flows: Sales revenues: Years 1-5 $135,000 per year, Years 6-10 $200,000 per year Operating costs: Years 1-5 $ 95,000 per year, Years 6-10 $ 135,000 per year Decide in which year (5-7) to spend the $85.000 of major maintenance Complete the five (5) measures at the bottom of the worksheet. Provide a recommendation as to whether this project is acceptable. Prepare a discounted cash flow analysis Year Yew Yews Year Year Yew 19 Year (300,000 Total 1300,000) Investment Cash Flows Sales Salvage value Operating costs Major Maintenance Net Cash Flow Cumulative CF Hurdle Rate Net Present Value (NPV) Internal Rate of Return (IRR) Payback Period Profitability Index Major Maintenance 135,000 135.000 135.000 135.000 135.000 200,000 200,000 200,000 200.000 200,000 1,675.000 (50,000) 150,0001 (95.000) 195,000) 195,0001 195.000) 195.000)135.000) (135,000) (135.000 (135.000) (135,000) 11,150,000 U (300,000) 40,000 40.000 40,000 40,000 40.000 65.000 65.000 65,000 65.000 15,000 175.000 (300,000) (260,000) (220,000) (180,000) (140,000) (100,000) (35,000 30,000 95,000 100,000 175,000 5% (A) Use the Excel function NPV in order to determine the value of the future cash flows, net of the initial investment (B) Use the IRR function in order to determine the interest earned on the cash flows from year to year 10 IC) Look at the cummulative cash flow. How long before the initial Investment is paid off? Dj Calculate the ratio of the project's PV of cashflows from years 1-10/initial investment (85,000E) Decide in which year (5-7) this expenditure should be made. Add $5,000 for every year after years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts