Question: Weighted Average Cost Method with Perpetual Inventory The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are as

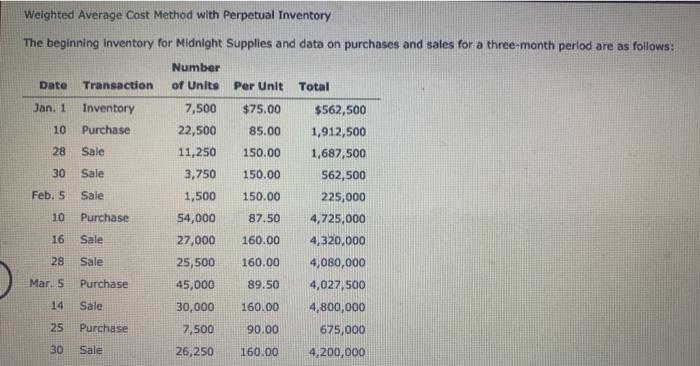

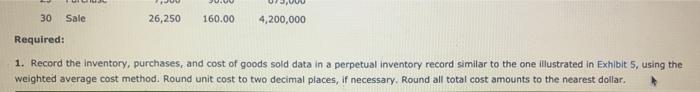

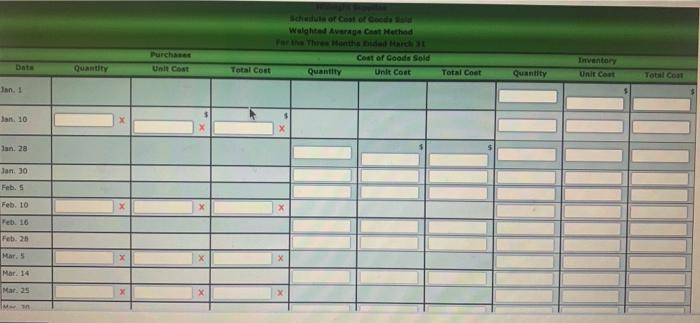

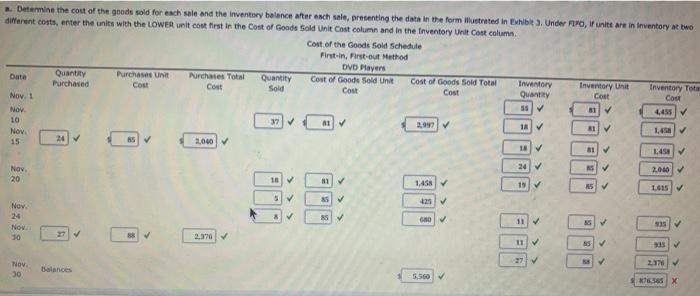

Weighted Average Cost Method with Perpetual Inventory The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are as follows: Number Date Transaction of Units Per Unit Total Jan. 1 Inventory 7,500 $75.00 $562,500 10 Purchase 22,500 85.00 1,912,500 28 Sale 11,250 150.00 1,687,500 30 Sale 3,750 150.00 562,500 Feb. 5 Sale 1,500 150.00 225,000 10 Purchase 54,000 87.50 4,725,000 16 Sale 27,000 160.00 4,320,000 28 Sale 25,500 160.00 4,080,000 Mars Purchase 45,000 89.50 4,027,500 14 Sale 30,000 160.00 4,800,000 25 Purchase 7,500 90.00 675,000 30 Sale 26,250 160.00 4,200,000 30 Sale 160.00 26,250 4,200,000 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 5, using the weighted average cost method. Round unit cost to two decimal places, if necessary. Round all total cost amounts to the nearest dollar, Schwior Color Code Walehted Ava Cat Method the Theth bar Con of Goods Sold Quantity Unit Cost Purchase Unit Cont Quantity Total Cost Inventory Unit Cout Total Coet Quantity Total Coat Inn. Jan 10 Ian, 28 Jan. 30 Febs Feb. 10 Feb. 16 Feb. 25 Mar. Mar. 14 Mar 25 Tun Jan 30 Pub. Feb. 10 Feb. 16 Feb. 28 Mar. 5 Mar. 14 Mar. 25 Mar. 30 Mar. 31 Balances 2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period Total sales Total cost of goods sold Gross pront 3. Determine the ending inventory cost as of March 3L Determine the cost of the goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Ehibit 3. Under Firo, if units are in Inventory at two different costs, enter the units with the LOWER unit cost first in the cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column Cost of the Goods Sold Schedule Fistin, First-out Method DVD Players Date Quantity Purchases Unit Purchases Total Quantity Cost of Goods Sold Unit Cost of Goods Sold Total Purchased Cost Cost Inventory Sold Inventory Unit Cost Inventory Tota Cost Quantity Nov. 1 Cos 55 81 Nov 10 37 A1 2.997 1 81 Nov 24 2040 18 14 Com NOW 24 2007 20 18 1,458 19 1.615 5 Nov. 24 Nov 30 XS NO 27 2.370 SS 27 28 NOV 30 Balances 5,560 76.365 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts