Question: Weir Enterprises Balance Sheet is listed in the table below. The preferred stock currently sells for $30 per share and it pays a $2 dividend.

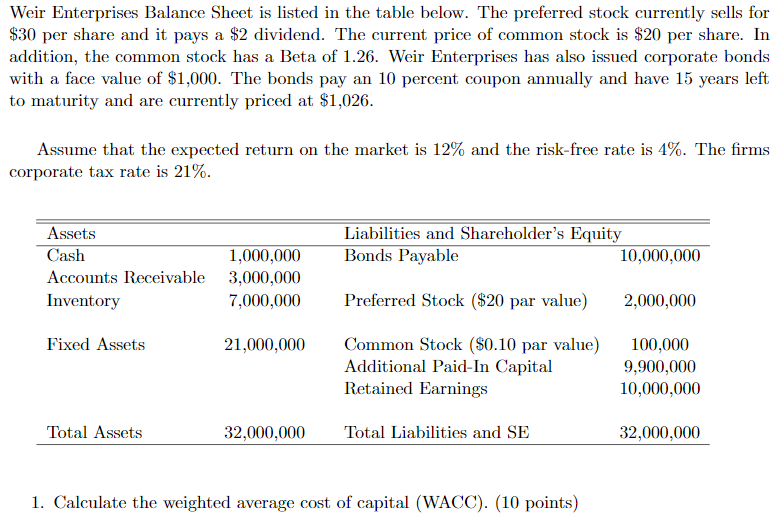

Weir Enterprises Balance Sheet is listed in the table below. The preferred stock currently sells for $30 per share and it pays a $2 dividend. The current price of common stock is $20 per share. In addition, the common stock has a Beta of 1.26. Weir Enterprises has also issued corporate bonds with a face value of $1,000. The bonds pay an 10 percent coupon annually and have 15 years left to maturity and are currently priced at $1,026 Assume that the expected return on the market is 12% and the risk-free rate is 4%. The firms corporate tax rate is 21% Assets Liabilities and Shareholder's Equity Bonds Payable 1,000,000 10,000,000 as Accounts Receivable 3,000,000 Inventory 7,000,000Preferred Stock ($20 par value) 2,000,000 Common Stock (S0.10 par value) Additional Paid-In Capital Retained Earnings Fixed Assets 21,000,000 100,000 9,900,000 10,000,000 Total Assets 32,000,000 Total Liabilities and SE 32,000,000 1. Calculate the weighted average cost of capital (WACC). (10 points) Weir Enterprises Balance Sheet is listed in the table below. The preferred stock currently sells for $30 per share and it pays a $2 dividend. The current price of common stock is $20 per share. In addition, the common stock has a Beta of 1.26. Weir Enterprises has also issued corporate bonds with a face value of $1,000. The bonds pay an 10 percent coupon annually and have 15 years left to maturity and are currently priced at $1,026 Assume that the expected return on the market is 12% and the risk-free rate is 4%. The firms corporate tax rate is 21% Assets Liabilities and Shareholder's Equity Bonds Payable 1,000,000 10,000,000 as Accounts Receivable 3,000,000 Inventory 7,000,000Preferred Stock ($20 par value) 2,000,000 Common Stock (S0.10 par value) Additional Paid-In Capital Retained Earnings Fixed Assets 21,000,000 100,000 9,900,000 10,000,000 Total Assets 32,000,000 Total Liabilities and SE 32,000,000 1. Calculate the weighted average cost of capital (WACC). (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts