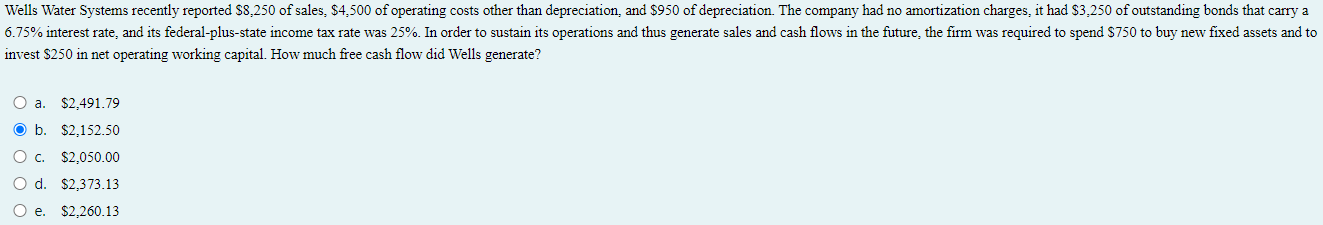

Question: Wells Water Systems recently reported $ 8 , 2 5 0 of sales, $ 4 , 5 0 0 of operating costs other than depreciation,

Wells Water Systems recently reported $ of sales, $ of operating costs other than depreciation, and $ of depreciation. The company had no amortization charges, it had $ of outstanding bonds that carry a interest rate, and its federalplusstate income tax rate was In order to sustain its operations and thus generate sales and cash flows in the future, the firm was required to spend $ to buy new fixed assets and to invest $ in net operating working capital. How much free cash flow did Wells generate?

Question Answer

a

$

b

$

c

$

d

$

e

$invest $ in net operating working capital. How much free cash flow did Wells generate?

a $

b $

c $

d $

e $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock