Question: were supposed to do each question then compare them (why theyre alike and similar) tysm! Use the Dividend Growth Model to compute the expected price

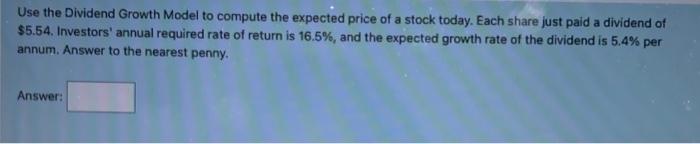

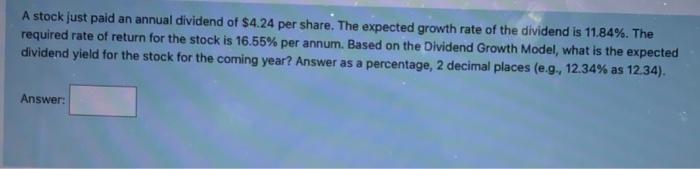

Use the Dividend Growth Model to compute the expected price of a stock today. Each share just paid a dividend of $5.54. Investors' annual required rate of return is 16.5%, and the expected growth rate of the dividend is 5.4% per annum. Answer to the nearest penny. Answer: A stock just paid an annual dividend of $4.24 per share. The expected growth rate of the dividend is 11.84%. The required rate of return for the stock is 16.55% per annum. Based on the Dividend Growth Model, what is the expected dividend yield for the stock for the coming year? Answer as a percentage, 2 decimal places (e.g., 12.34% as 12.34)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts