Question: Werqo Corp is considering two mutually exclusive projects, Projects A and B, and has determined that the crossover rate for these projects is 13.0 percent

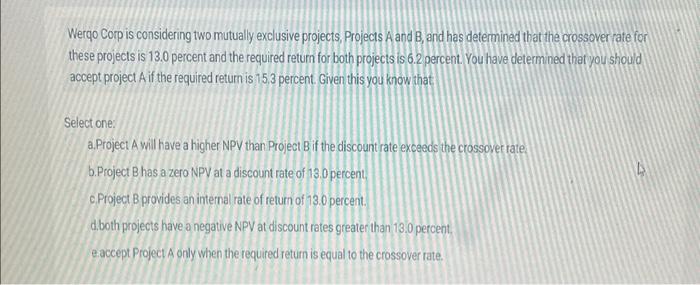

Werqo Corp is considering two mutually exclusive projects, Projects A and B, and has determined that the crossover rate for these projects is 13.0 percent and the required return for both projects is 6.2 percent You have determ ned that you should accept project A if the required return is 15,3 percent Given this you know that Select one: a. Project A will have a higher NPV than Project B if the discountrate exceeds the crossover rate. b.Project B has a zero NPV at a discount rate of 13.0 percent c. Project B provides an internal rate of return of 13.0 percent. d. both projects have a negative NPV at discount rates greater than 13.0 percent. eaccept Project A only when the required return is equal to the crossover rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts