Question: What am I doing incorrectly > C o ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ftamusa.blackboard.com%252Fwebapps%252Fportal%252... : Apps M Gmail (!) YouTube ) Maps Grades for Diana... :Texas A&M Univer... JagWire Mid-Term

What am I doing incorrectly

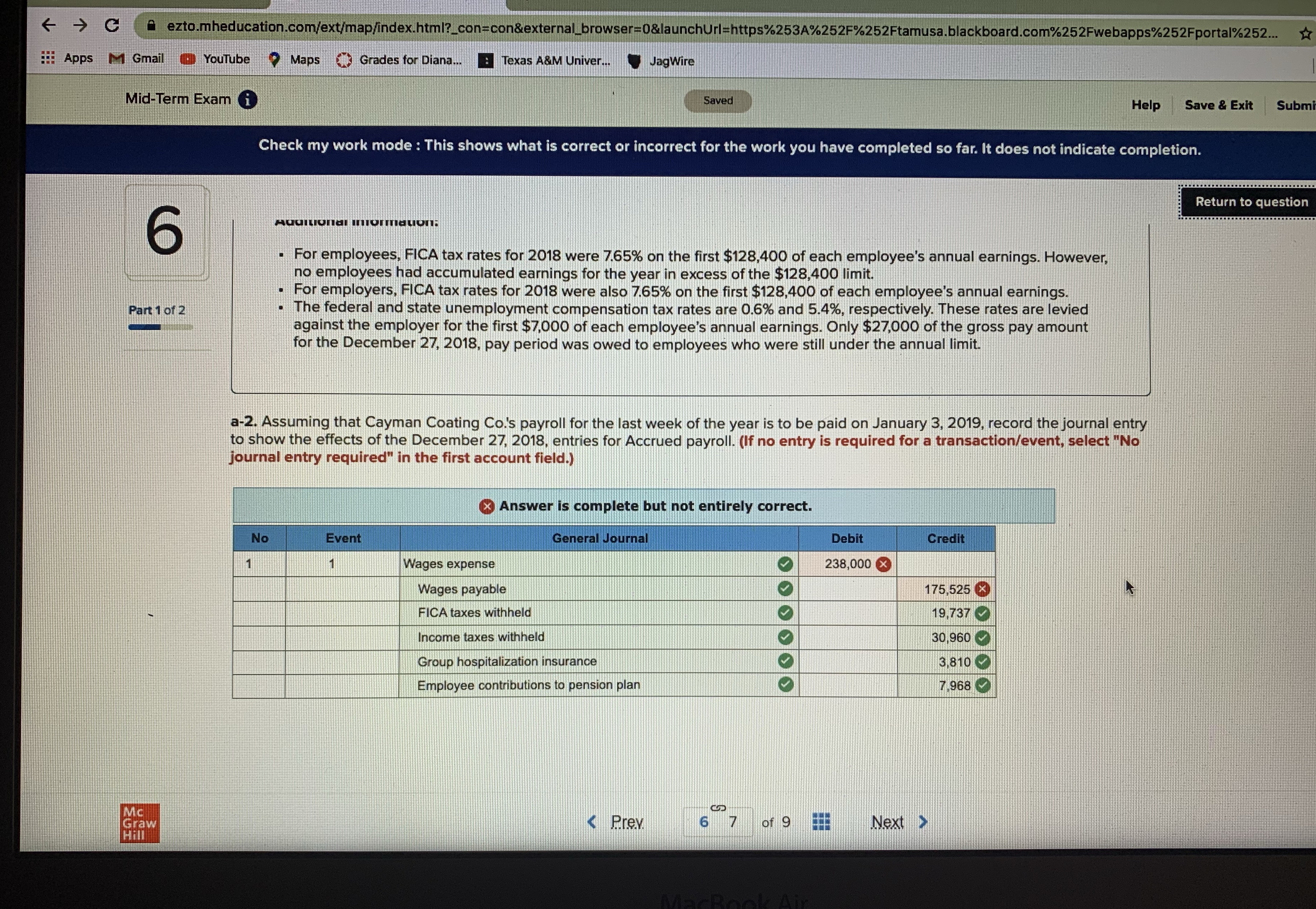

> C o ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ftamusa.blackboard.com%252Fwebapps%252Fportal%252... : Apps M Gmail (!) YouTube ) Maps Grades for Diana... :Texas A&M Univer... JagWire Mid-Term Exam i Saved Help Save & Exit Subm Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 6 For employees, FICA tax rates for 2018 were 7.65% on the first $128,400 of each employee's annual earnings. However, no employees had accumulated earnings for the year in excess of the $128,400 limit. . For employers, FICA tax rates for 2018 were also 7.65% on the first $128,400 of each employee's annual earnings. Part 1 of 2 . The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employee's annual earnings. Only $27,000 of the gross pay amount for the December 27, 2018, pay period was owed to employees who were still under the annual limit. a-2. Assuming that Cayman Coating Co.'s payroll for the last week of the year is to be paid on January 3, 2019, record the journal entry to show the effects of the December 27, 2018, entries for Accrued payroll. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Event General Journal Debit Credit 1 1 Wages expense 238,000 X Wages payable O 175,525 (X FICA taxes withheld 19,737 Income taxes withheld 30,960 Group hospitalization insurance 3,810 Employee contributions to pension plan 7,968

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts