Question: what am i doing wrong Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It

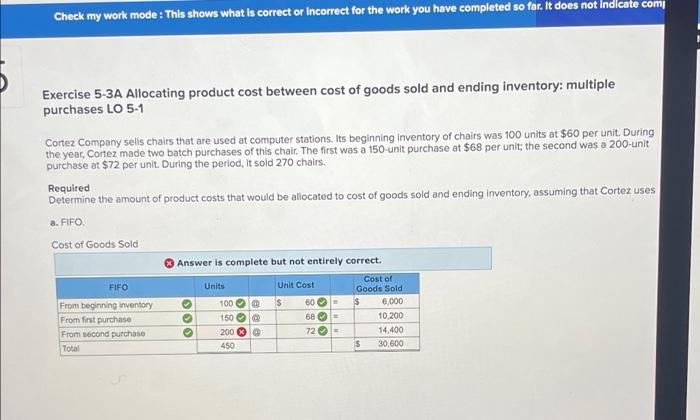

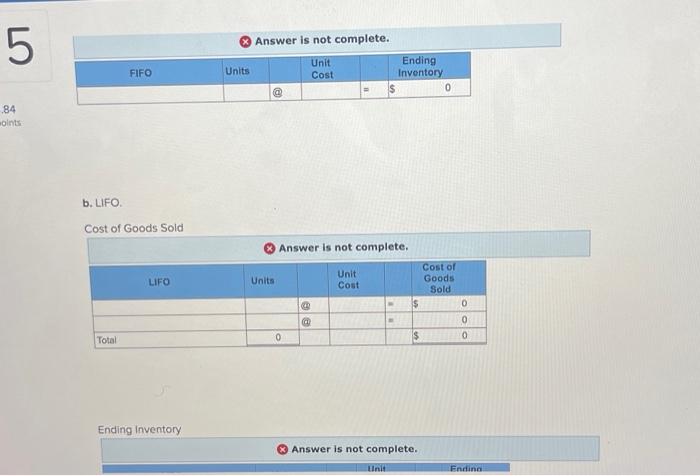

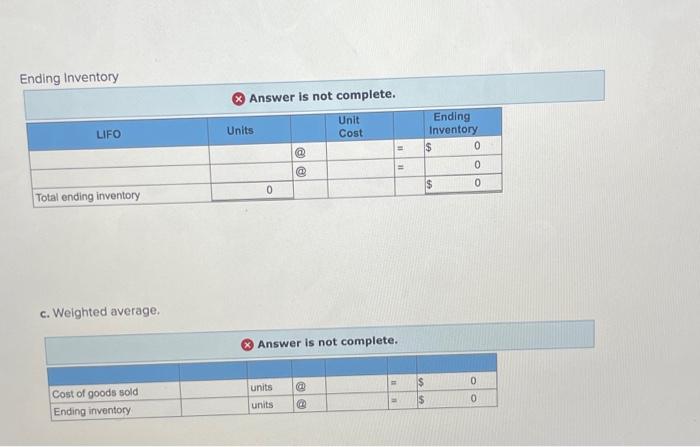

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not Indicate com Exercise 5-3A Allocating product cost between cost of goods sold and ending inventory: multiple purchases LO 5-1 Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 100 units at $60 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 150-unit purchase at $68 per unit; the second was a 200-unit purchase at $72 per unit. During the period, it sold 270 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO. Cost of Goods Sold Answer is complete but not entirely correct. FIFO Units Unit Cost Cost of Goods Sold From beginning inventory $ $ 6,000 From first purchase 10,200 From second purchase 14,400 Total 30,600 000 100 150@ 200 450 60- 68 = 72 - $ 5 84 oints FIFO b. LIFO. Cost of Goods Sold LIFO Total Ending Inventory Units Answer is not complete. Unit Cost @ $ Answer is not complete. Unit Cost @ Units 0 Ending Inventory $ $ Answer is not complete. Unit M 0 Cost of Goods Sold 0 0 0 Ending Ending Inventory LIFO Total ending inventory c. Weighted average. Cost of goods sold Ending inventory Answer is not complete. Unit Cost @ = @ = Units 0 Answer is not complete. units units @@ $ $ Ending Inventory 0 69 $ 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts