Question: What answer is wrong and why ? The current prices of three U.S. treasury bonds are as follows: Maturity Coupon Rate 1 0% 2 5%

What answer is wrong and why ?

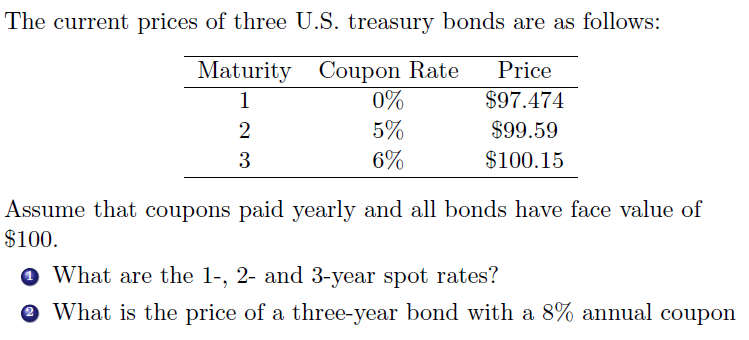

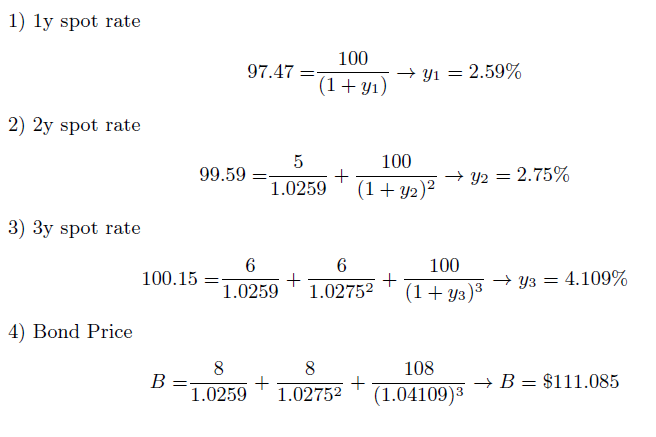

The current prices of three U.S. treasury bonds are as follows: Maturity Coupon Rate 1 0% 2 5% 3 6% Price $97.474 $99.59 $100.15 Assume that coupons paid yearly and all bonds have face value of $100. What are the 1-, 2- and 3-year spot rates? @ What is the price of a three-year bond with a 8% annual coupon 1) ly spot rate 97.47 = 100 (1+y) + Y1 = 2.59% 2) 2y spot rate 99.59 5 100 + 1.0259 Y2 = = 2.75% (1 + y2)2 3) 3y spot rate 6 6 100 100.15 = + + + Y3 1.0259 1.02752 (1 + Y3)3 = 4.109% 4) Bond Price B = 8 1.0259 + 8 108 + 1.02752 (1.04109) +B= $111.085

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts