Question: WHAT IS THE PROBLEM WITH THE SOLUTION GIVEN? WHAT IS THE PROBLEM WITH THE SOLUTION GIVEN? The current prices of three U.S. treasury bonds are

WHAT IS THE PROBLEM WITH THE SOLUTION GIVEN?

WHAT IS THE PROBLEM WITH THE SOLUTION GIVEN?

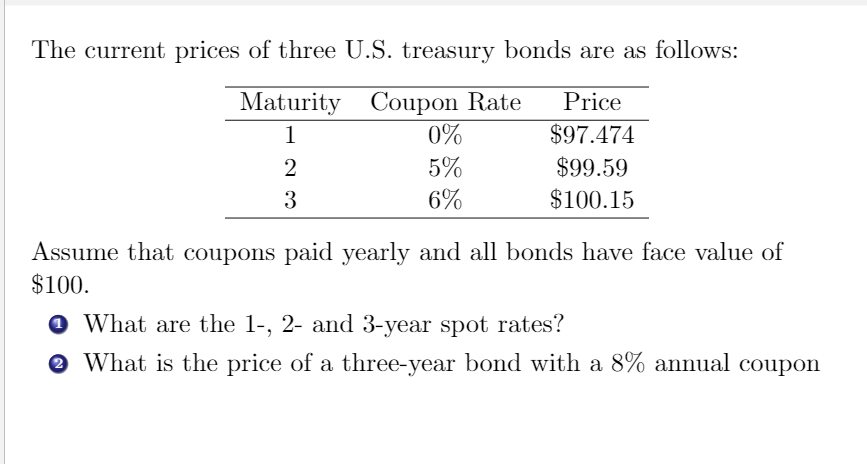

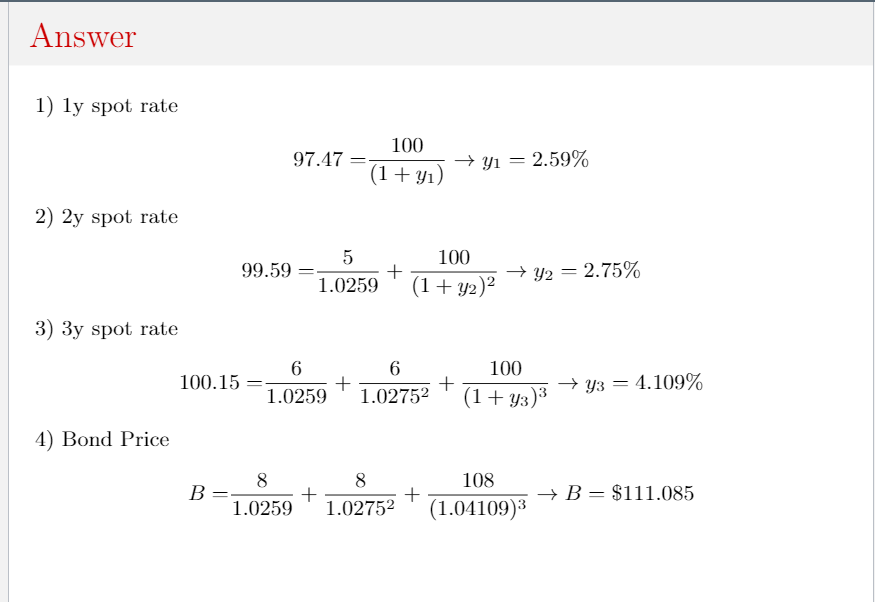

The current prices of three U.S. treasury bonds are as follows: Maturity Coupon Rate 1 0% 2 5% 3 6% Price $97.474 $99.59 $100.15 Assume that coupons paid yearly and all bonds have face value of $100. 0 What are the 1-, 2- and 3-year spot rates? @ What is the price of a three-year bond with a 8% annual coupon Answer 1) ly spot rate 97.47 100 (1 + y) +yi = 2.59% 2) 2y spot rate 99.59 5 1.0259 + 100 (1 + y2)2 + y2 = 2.75% 3) 3y spot rate 100.15 6 6 + 1.0259 1.02752 + 100 +y3 = 4.109% (1 + y3)3 4) Bond Price 8 8 108 B- + + 1.0259 1.02752 (1.04109) +B= $111.085

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts