Question: What are CSL's material risks and how do companies manage those risks and their negative impacts? Give at least four recommendations by clearly giving your

What are CSL's material risks and how do companies manage those risks and their negative impacts?

Give at least four recommendations by clearly giving your reasoning as to why or (why not) this should be an ideal company for them to invest in. (You may include both financial and non-financial criteria of the company)

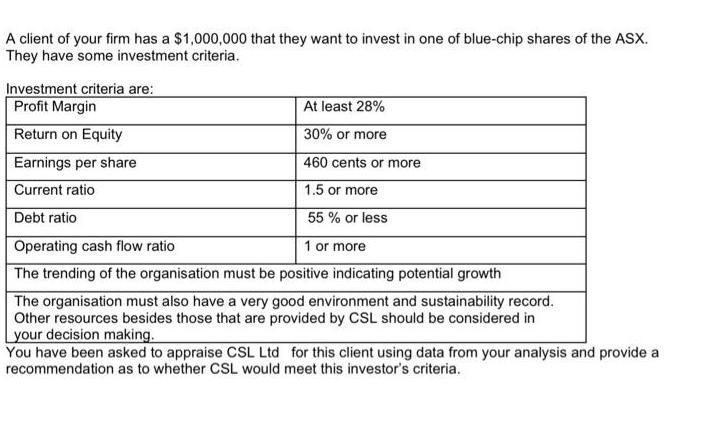

A client of your firm has a $1,000,000 that they want to invest in one of blue-chip shares of the ASX. They have some investment criteria. Investment criteria are: Profit Margin Return on Equity At least 28% 30% or more Earnings per share 460 cents or more Current ratio 1.5 or more Debt ratio 55 % or less Operating cash flow ratio 1 or more The trending of the organisation must be positive indicating potential growth The organisation must also have a very good environment and sustainability record. Other resources besides those that are provided by CSL should be considered in your decision making. You have been asked to appraise CSL Ltd for this client using data from your analysis and provide a recommendation as to whether CSL would meet this investor's criteria.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below What are C SL s material risks and how do companies manage those risks and their negative ... View full answer

Get step-by-step solutions from verified subject matter experts