Question: What are the differences between cash flows from operating activities and the elements of an income statement? (3 marks) Why is the gain not reported

- What are the differences between cash flows from operating activities and the elements of an income statement? (3 marks)

- Why is the gain not reported as a cash inflow from operating activities when an asset is sold at the gain? (3 marks)

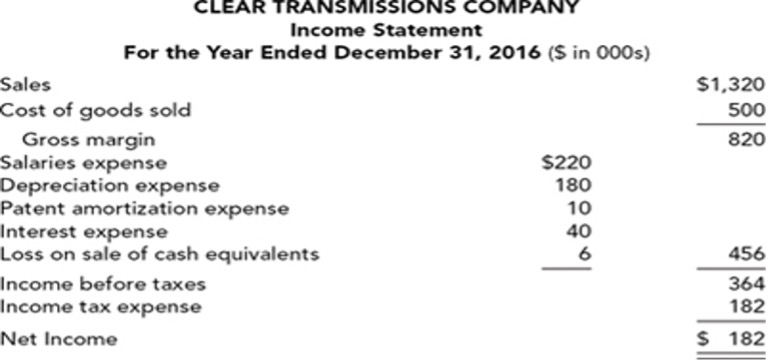

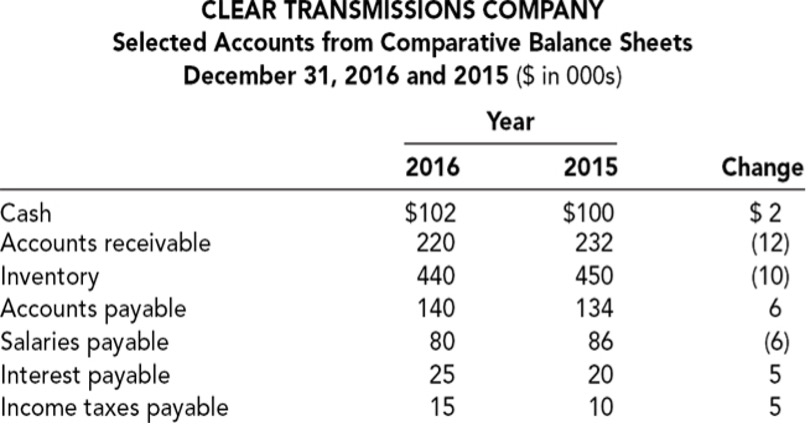

- Portions of the financial statements for Clear Transmissions Company are provided below

Required:

Prepare the cash flows from the operating activities section of the statement of cash flows for Clear Transmissions Company using theindirect method. (5 marks)

CLEAR TRANSMISSIONS COMPANY Income Statement For the Year Ended December 31, 2016 ($ in 000s) Sales $1,320 Cost of goods sold 500 Gross margin 820 Salaries expense $220 Depreciation expense 180 Patent amortization expense 10 Interest expense 40 Loss on sale of cash equivalents 6 456 Income before taxes 364 Income tax expense 182 Net Income 182CLEAR TRANSMISSIONS COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2016 and 2015 (5 in 0005} Year 2016 2015 Change Cash $102 $100 $ 2 Accounts receivable 220 232 (12) Inventory 440 450 (10) Accounts payable 140 134 6 Salaries payable 80 86 [6) Interest payable 25 20 5 Income taxes payable 15 10 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts