Question: What are the important external and internal environmental variables affecting compensation plans? Which are most important? Why? into consideration the external environment in which they

What are the important external and internal environmental variables affecting compensation plans? Which are most important? Why?

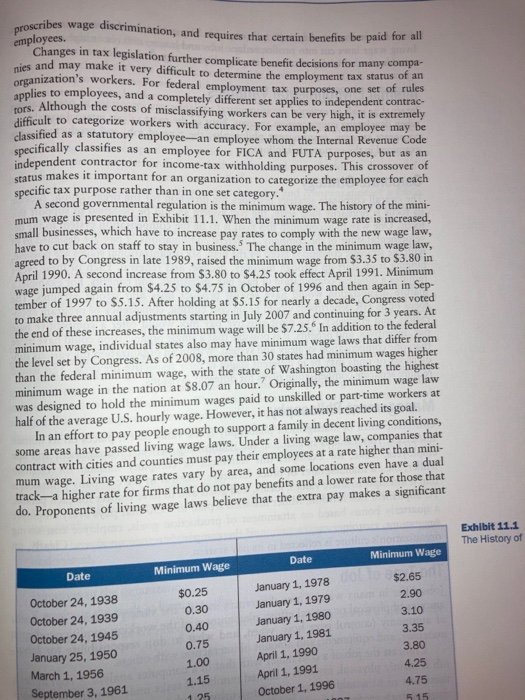

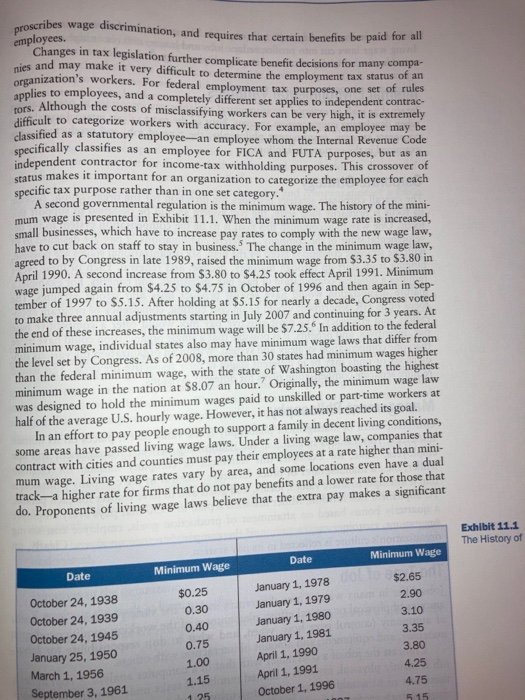

into consideration the external environment in which they do business. Many exter nal environmental factors affect an organization, but only a few have a direct effect on an organization's reward system. Three of these the nature of the competition, the nature of the labor market, and governmental regulations are discussed in the ees. Managers can make the stra are available to workers. nies External Environmental Variables When developing and designing a compensation system, organizations must take orgar appli tors. diffic class spec inde statt spec following sections. sma have agre Apr wag tem ton the min the tha: mir was hal Nature of the Competition The level of competition that a firm faces in the product market is an important com. sideration when a compensation system is designed. When an organization has many product competitors, cost control assumes greater significance. Price pressures gener ally are downward, and rising costs from salary increases cannot be passed on to cus tomers without risking loss of market share. In this situation, noneconomic rewards (such as promotions, job enrichment, and training and development programs) may assume greater importance in the pay scheme. On the other hand, when the firm faces only a few competitors, its flexibility the design of the compensation system is greater because wage increases are absorbed into the cost of the product or service. Nature of the Labor Market A discussion of the impact of the nature of the labor market on designing reward sys- tems focuses on two issues: labor supply and demand, and the wage levels that com- petitors are paying to their employees. When demand for labor is greater than the supply, competition for labor increases, bidding up its cost. Applicants can afford to "shop around" for a company that pays a higher salary when labor is in demand. When the supply of labor is greater than the demand, the competition among job applicants for a limited number of positions permits companies to pay lower salaries. This type of labor market exists in the cruise line industry. Most cruise line employ- ces are from Third World countries. Even though the hours are long and the wages are low, the jobs are in great demand. Applicants flood cruise-line hiring agencies around the world. This is because cruise wages compare very favorably with salaries available in workers' native lands. In addition, cruise ship jobs offer some added benefits not available in the workers' homeland: the opportunity to earn tips and room and board. Cruise ship workers are monitored closely. After two infractions such as tardiness, dirty quarters, or mingling with customers, the worker can be fired and the coveted position can be offered to someone else. This is not the only way that wages paid by competitors in the labor market can influence a company's wages. Some industries or individual organizations pay higher salaries than others as a policy. Certainly, high-tech and research and development industries must attract highly qualified employees. One way to do this is to pay more than other employers in the area. SOI COT mu tra do Government Regulations Specific employment legislation affecting compensation decisions is addressed in Chapter 4, and it is included here again because of its significant organizational impact. Federal legislation affects almost every aspect of the compensation plan. I places a lower limit on wages that can be paid, affects raise and incentive decisions employees. proscribes wage discrimination, and requires that certain benefits be paid for all Changes in tax legislation further complicate benefit decisions for many compa- nies and may make it very difficult to determine the employment tax status of an organization's workers. For federal employment tax purposes, one set of rules applies to employees, and a completely different set applies to independent contrac- tors. Although the costs of misclassifying workers can be very high, it is extremely difficult to categorize workers with accuracy. For example, an employee may be classified as a statutory employee-an employee whom the Internal Revenue Code specifically classifies as an employee for FICA and FUTA purposes, but as an independent contractor for income tax withholding purposes. This crossover of status makes it important for an organization to categorize the employee for each specific tax purpose rather than in one set category." A second governmental regulation is the minimum wage. The history of the mini- mum wage is presented in Exhibit 11.1. When the minimum wage rate is increased, small businesses, which have to increase pay rates to comply with the new wage law, have to cut back on staff to stay in business. The change in the minimum wage law, agreed to by Congress in late 1989, raised the minimum wage from $3.35 to $3.80 in April 1990. A second increase from $3.80 to $4.25 took effect April 1991. Minimum wage jumped again from $4.25 to $4.75 in October of 1996 and then again in Sep- tember of 1997 to $5.15. After holding at $5.15 for nearly a decade, Congress voted to make three annual adjustments starting in July 2007 and continuing for 3 years. At the end of these increases, the minimum wage will be $7.25. In addition to the federal minimum wage, individual states also may have minimum wage laws that differ from the level set by Congress. As of 2008, more than 30 states had minimum wages higher than the federal minimum wage, with the state of Washington boasting the highest minimum wage in the nation at $8.07 an hour. Originally, the minimum wage law was designed to hold the minimum wages paid to unskilled or part-time workers at half of the average U.S. hourly wage. However, it has not always reached its goal. In an effort to pay people enough to support a family in decent living conditions, some areas have passed living wage laws. Under a living wage law, companies that contract with cities and counties must pay their employees at a rate higher than mini- mum wage. Living wage rates vary by area, and some locations even have a dual track-a higher rate for firms that do not pay benefits and a lower rate for those that do. Proponents of living wage laws believe that the extra pay makes a significant Exhibit 11.1 The History of Date Minimum Wage Date Minimum Wage $2.65 October 24, 1938 October 24, 1939 October 24, 1945 January 25, 1950 March 1, 1956 September 3, 1961 $0.25 0.30 0.40 0.75 1.00 1.15 January 1, 1978 January 1, 1979 January 1, 1980 January 1, 1981 April 1, 1990 April 1, 1991 October 1, 1996 2.90 3.10 3.35 3.80 4.25 4.75 1 25 001 5 15 stimulus many con Reinforcement theories explain an individual's behavior as a response to a temporary models of reinforcement and explains how a person's own actions in a situation interact with the environment to influence future reactions in that environ ment." In essence, this law maintains that behavior that is positively reinforced (rewarded) tends to be repeated in that situation; behavior that is punished tends tot the relationship between the situation and the behavior. They can be as subtle as a to be repeated in similar situations. Rewards are positive reinforcers that strengthen Effective reward systems include both intrinsic rewards (those that result from Reinforcement Theory in the environment. Edward Thorndike's law of effect is the basis for 58 pat on the back or a smile or as obvious as a bonus or company car. The important point, again, is that rewards that are connected to a behavior courage that behavior to be repeated. As in expectancy theory, the manager must make sure that rewards are applied in a timely fashion so that employees (1) make the connection between behavior and outcome and (2) repeat the desired behavior in the future. Whether the behavior is short term or long term in focus and whether quality or quantity issues are relevant, management should understand the relation- ship between outcomes, their value to employees, and the impact that they have on employee behavior. Management Guidelines 1. Designing a reward system that reinforces the organization's business strategy can make the organization more competitive, increase its effectiveness, and help management focus on both short-term and long-term goals. 2. The goals of the compensation system can include the following: a. Attraction and retention of employees b. Cost efficiency c. Legal compliance d. Equitable salaries for all employees e. Motivation of employee performance . An organization's external environment interacts with its internal environment to influence the choice of compensation systems. the job itself) and extrinsic rewards (those that are provided by others in the organization) to increase employee motivation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock