Question: what are the major problems existing or anticipated with Procter & Gamble? (dentification of major problem with Procter & Gamble PROCTER & GAMBLE Procter &

what are the major problems existing or anticipated with Procter & Gamble?

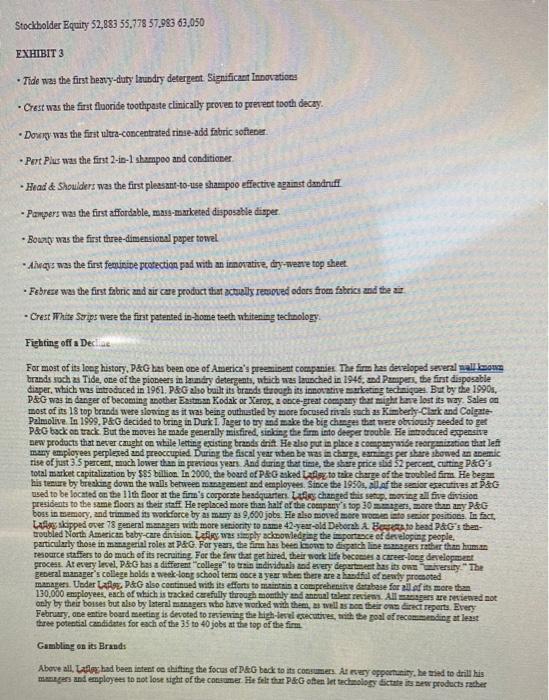

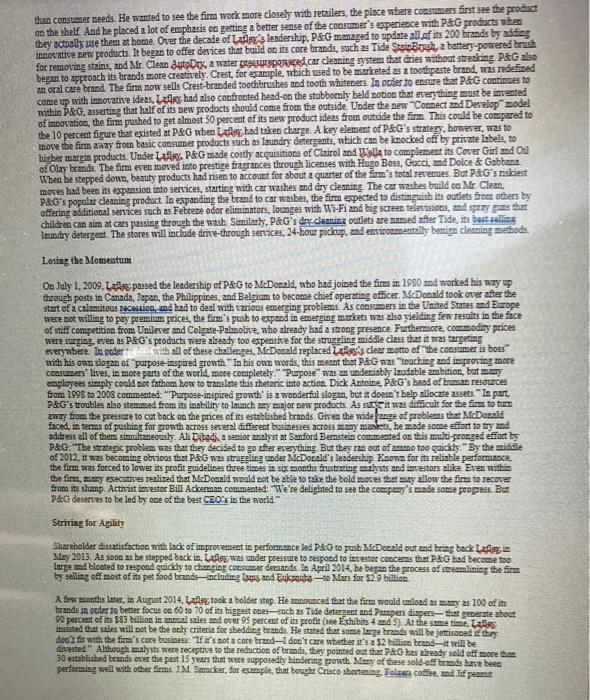

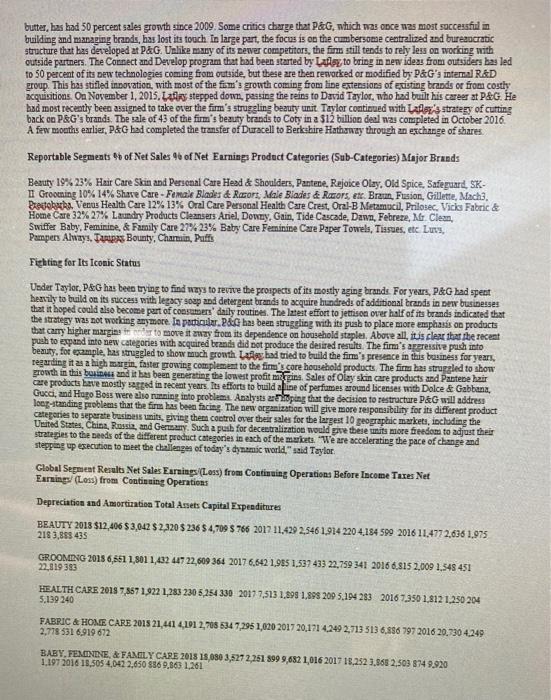

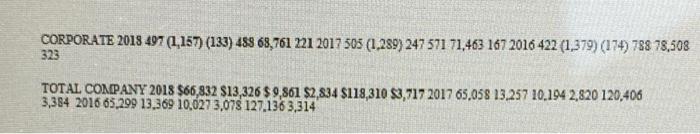

(dentification of major problem with Procter & Gamble PROCTER & GAMBLE Procter & Gamble, a leading global consumer products firm announced a revamping of its management structure in July 2019 part of an effort to streamline its operations. The firm had failed to show much prowth over the last five years, resulting in pressure from activist Trian Fund Management, which waped a proxy fight in 2017 and whose co-founder, Nelson Peltz, now sits on P&G's board (see Exhibit 1 and 2). The firm said it would shrink the member of its business units from ten to six and give the heads of each of these control over the management of different products as well as over their regional sales teams. P&G will also reduce its corporate functions, with about 60 percent of corporate work shifting to the new business units "There is a need for greater agility," said CEO David Taylor Since its founding 175 years ago, P&G has risen to the status of an American icon with well-known customer products such as Pampers, Tide, Downg, and Crest (see Exhibit 3). In fact, the firm bas long been admired for its superior products, marketing brilliance, and the intense loyalty of its employees who have come to be known respectfully as Reactoide In the 1990s, under Alan GL P&G spent $70 billion scooping up brands such as Gillette razors, Clairol cosmetics, and tans pet food. With 25 brands that generated more than $1 billion in sales, the firm claimed the status of the largest consumer products company in the world. However, under Lars's chosen successor, Bob McDonald, P&G's growth stalled as recession-battered consumers abandoned the firm's premium-priced products for cheaper alternatives. More significantly, the firm's vaunted innovation machine failed to achieve any major product success during his tenure. P&G's decline eroded morale among employees, with many managers taking early retirement or bolting to competitors Says Ed Arzt who was CEO from 1990 to 1995: "The most unfortunate aspect of this whole thing is the train drain. The loss of good people is almost irreparable when you depend on promotion from within to continue building the company" Pressure from the board forced LARRY to back come out of retirement in May 2013 to make another attempt to pull P&G out of its doldrums. Soon after he took back the helm of the form. Ludge announced that he would get rid of more than half of its brands. Over the next three years, the firm sold off many of the bands it had acquired, capped by the 311.6 billion sale of dozens of beauty brands to Coty He announced that the many would narrow its focus to 65 or 70 of its biggest brands such as Tide, Crest, and Pampers "Less will be more." La cold analysts. "The objective is growth and much more reliable generation of cash and profit." David S. Taylor, who had spent years managing P&G's businesses finally took over as chairman and CEO of the firm in November 2015 He has made moves to resurrect the firm but has opted against launching new brands or making new acquisitions. "I understand the desire for faster growth and for a single-minded short-term objective, but we've seen this movie before" he said at a meeting with analysts soon after he had taken over. Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 Revenue $66,832 $65.058 565,299 70,749 Operating Income 13,711 13,955 13,441 11,049 EBIT 13,326 13.237 13,369 11.012 Net Income 9.861 15,411 10,604 7.144 Source: P&G Annual Report 2018 EXHIBIT 1 Income Statement (in millions of 5) EXHIBIT 2 Balance Sheet (in millions of 5) Source: P&G Annual Report 2015 and 2017) Year Ending June 30, 2018 June 30, 2017 June 30, 2016 June 30, 2015 Current Assets 5 23,320 26.494 533,782 5 29,646 Total Assets 118,310 120,406 127,136 129,495 Current Liabilities 28.237 30.210 30,770 29,790 Total Liabilities 65,427 64,625 69.153 66,445 Stockholder Equity 52,883 55,778 57.083 63,050 EXHIBIT 3 Tide was the first heavy-duty Irundry detergent Significant Innovations Crest was the first flooride toothpaste clinically proven to prevent tooth decay. Dowry was the first ultra-concentrated rinse-add fabric soften Pet Plus was the first 2-in-1 shampoo and conditioner Head & Shoulders was the first pleasant-to-use shampoo effective against dandruff Pampers was the first affordable, mass-marketed disposable disper. Bounty was the first three-dimensional paper towel Always was the first feminine protection pad with an innovative, dry-weate top sheet Febreze was the first fabric and air care product that actually removed odors from fabrics and the siz Crest White Strips were the first patented in-home teeth whitening technology Fighting off a Decline For most of its long history, P&G has been obe of America's president companies. The firm has developed several mall known brands such as Tide, one of the pioneers in laundry detergents, which was launched in 1946. ad Pampers, the first disposable diaper, which was introduced in 1961, P&G also bailt its brands through its innovative marketing techniques. But by the 1990s, PEG was in danger of becoming mother Eastman Kodak or Xeros, a once-great company that might be lost its way Sales on most of its 18 top brands were sioning as it was being outhnestled by more focused als sechs Kimberly-Clark and Colgate Palmolive. In 1899. P&G decided to bring in Durk 1. Jager to try and make the big changes that are obviously needed to per P&G back on track. But the moves he made generally misfired, sinking the firm into deeper trouble. He introduced expensive new products that never caught on while letting existing brands dit. He also put in place acompanya de rearganization that left many employees perplexed and preoccupied During the fiscal year when be was in charge, eines per share showed an anemic rise of just 35 percent, much lower than in previous years And during that time, the state price is 52 percent. Curting P&G's total market capitalization by 585 billion in 2000, the board of P&Gasked Lasy to taice charge of the treabled firm. He began his temare by breaking down the walls between wagement and employees. Since the 1950, al.f the senior executives at RG used to be located on the 11th floor at the finan's corporate headquarters Les changed this setup.mering all five division presidents to the same floors as their staff He replaced more than half of the company's top 30 mages, more than any P&G boss in memory, and trimmed its workforce by as many as 9,600 jobs. He also moved mere most seir positions. In fact, Lage skipped over 78 general managers with more senionty to name 42-year-old Deborah A. Be to bead P&G's then- troubled North American baby-care division Lawas someply acknowledging the importance of seloping people, particularly those in managerial roles at P&G. For years, the firm has been known to dispatch line managers rather than human resource staffers to do much of its recruiting For the few that get hired their work life becomes a career-long development process. At every level, P&G has a different college" to train individuals and every department has its owneruiry "The general manager's college holds a week-long school term cace a year when there are a basdful of bewy promoted mangen. Under LASE, P&G also continued with its efforts to maintain a comprehensive database for all of its more than 130,000 employees, each of which is tracked carefully through monthly and at talenterien Allgers are essened mot only by their bosses but also by lateral managers who have worked with them. well as to their ons tract reports. Every February, abe entire board meeting is devoted to reviewing the high-level cutives, with goal of recommanding at least the potential candidates for each of the 35 to 40 jobs at the top of the firm Gambling on its Brands Above all Latihad been intento shifting the focus of D&G back to its consumers. At every opportunity, he tried to drill his as and employees to not lost sight of the consumer He felt that P&G often let technology dictate its products rather than consumer needs. He wanted to see the firm work more closely with retailers, the place where consumers first see the product on the shelf And be placed a lot of emphasis on getting a better sense of the consumer's experience with P&G products they actually use them at home Over the decade of Lass leadership. P&G managed to update all of its 200 Grands by adding innovative des products. It began to offer devices that build on its core brands, such as Tide SticBoush, a battery-powered brush for removing stains, and Mr. Clean SutoDox a water groussourced car cleaning system that dries without stresicing P&G also began to approach its brands more creatively. Crest for Stample, which used to be marketed as a toothpaste brand, was redefined an oral care brand. The firm now sells Crest-branded toothbrushes and tooth whiteners. In order to ensure that P&G continues to come up with innovative ideas. Las had also confronted head-on the stubbornly beld notion that everything must be invented within P&G, asserting that half of its new products should come from the outside. Under the new Connect and Developmodel of innovation, the fimm pushed to get almost 50 percent of its new product ideas from outside the form. This could be compared to the 10 percent figure that existed at P&G when Latex had taken charge. A key element of P&G's strategy, however, was to move the firm nay from basic consumer products such as laundry detergents, which can be knocked off by private labels, to higher marrin products. Under Laf. P&Gmade costly acquisitions of Clairol and Ua to complement its Cover Girl and Oil of Olay brands. The firm even moved into prestige fragrances through licenses with Hugo Boss, Gucci, and Dolce & Gabbana When he stepped down, beauty products had risen to account for about a quarter of the firm's total revenues. But P&G's risest moves had been its espansion into services, starting with car washes and dry cleaning. The car washes build on Mr. Clean P&G's popular deaning product. In expanding the brand to car washes, the fire expected to distinguish its outlets from others by offering additional services such as Febrere odor eliminators, lounge with Wi-Fi and big screen television, and spray guns that children can aim at cars passing through the wash Similarly, P&G's dry cleaning outlets are sunted after Tide, its bestelling Inundry detergent. The stores will include drive-through services, 24-hour pickup, and entironmentally benige cleaning methods Losing the Momentum On July 1, 2009. La passed the leadership of P&G to McDonald, who had joined the firm in 1980 and worked his way up through posts in Canada, Japan, the Philippines and Belgium to become chief operating officer, McDonald took over after the start of a calamitous recession, and had to deal with various emerging problems. As consumers in the United States and Ewrope were not willing to pay premium prices, the firm's push to expand in emerging marketa was also yielding few results in the face of stiff competition from Unilever and Colgate-Palmolive, who already had a strong presence Furthermore, commodity prices were surging, even as P&G's products were already too expensive for the struggling middle class that it was targeting everywhere. In poder leth all of these challenges, McDonald replaced Let's clear motto of the consumeris boss with his own slogan of purpose-inspired growth in his own words, this meant that P&G was "touching and improving more consumers' lives in more parts of the world, more completely." "Purpose" was an undeniably laudable ambition, but many exployees simply could not fathom how to translate this rhetoric into action Dick Antoine, P&G's bad of bransan resources from 1998 to 2008 commented: "Purpose-inspired growth is a wonderful slogan, but it doesn't help allocate assets. In part P&G's troubles also stammed from its inability to launch any major new products As sugit was difficult for the firm totum away from the pressure to cut back on the prices of its established brands. Given the wide range of problems that McDonald faced in terms of pushing for growth across several different businesses across many moshes, he made some effort to try and address all of them simultaneously Al Diadi, a senior analyst at Sanford Bemates commented on this multi-pronged effort by P&G "The strategic problem was that they decided to go after everything But theyre out of ammo too quickly. By the middle of 2012, it was becoming obvious that P&Gw2a struggling under NacDonald's leadership. Koonn for its reliable performance the firm was forced to lower its profit guidelines three times in six months frustrating malysts and im.estors alike. Even wat the firm, any executives realized that McDonald would not be able to take the bold moves that may allow the firm to recover from its shamp Activist investor Bill Ackerman commented: "We're delighted to see the company's made some progress. But P&G deserves to be led by one of the best CEO's in the world Striving for Agility Shareholder dissatisfaction with lack of improvement in performance led P&G to push McDonald out and bring back Ligi May 2013. As soon as he stepped back in. Lase was under pressure to respond to intester concerns that P&G had become too large and bloated to respond quickly to changing consume demands. In April 2014, he began the process of streamlining the fin by selling off most of its pet food brands including less and Bukaute - Mars for $2.9 billion A few months later, in August 2014. Later took a bolder step He announced that the firm would unload as many as 100 of its brands in the a better focus on 60 to 70 of its biggest ones-such as Tide detergent and Pampen diapers--that generate about 90 percent of its 583 billion in a sales and over 95 percent of its protit (see Exhibits 4 and 5). At the same tinte. La insisted that sales will not be the only criteria for shedding brands. He stated that some large brands will be jettisoned if they doo' fit with the firm's core business it's not a core brand don't care whether it's a $2 billion brand will be dirested" Although malysts were receptive to the reduction of brands, they pointed out that P&G has already sold off more than 30 established brands over the past 15 years that we supposedly hindering growth. Many of these sold of brands have been performing well with other time. IM Smucker, for example, that bought Crisco shortening Folsera coffee, and if peanut butter, has had 50 percent sales growth since 2009. Some critics charge that P&G, which was once was most successful in building and managing brands, has lost its touch. In large part, the focus is on the cumbersome centralized and bureaucratic structure that has developed at P&G. Unlike many of its newer competitors, the form still tends to rely less on working with outside partners. The Connect and Develop program that had been started by Lalls to bring in new ideas from outsiders has led to 50 percent of its new technologies coming from outside, but these are the revoked or modified by P&G's internal R&D group. This has stifled innovation, with most of the fom's growth coming from line extensions of existing brands or from costly acquisitions. On November 1, 2015. La stepped down, pasting the reins to David Taylor, who had built his career at P&G. He had most recently been assigned to take over the firm's struggling beauty unit Taylor continued with a strategy of cutting back on P&G's brands. The sale of 43 of the firm's beauty brands to Coty in a 312 billion deal was completed in October 2016 A few months earlier, P&G had completed the transfer of Duracell to Berkshire Hathaway through an exchange of shares Reportable Segments of Net Sales 4 of Net Earnings Product Categories (Sub-Categories) Major Brands Beauty 19%23% Hair Care Skin and Personal Care Head & Shoulders, Pantene, Rejoice Olay, Old Spice, Safeguard. SK II Grooming 10% 14% Shave Care - Female Blades & Rarors, Male Blades & Resors, et Braun, Fusion, Gillette, Mach3 Predobasko. Venus Health Care 12% 13% Oral Care Personal Health Care Crest, Oral-B Metamucil, Prilosec. Vicks Fabric & Home Care 32% 27% Laundry Products Cleansers Ariel, Downy, Gain, Tide Cascade, Dawn, Febrere, Mr. Clean, Swiffer Baby, Feminine, & Family Care 27% 23% Baby Care Feminine Care Paper Towels, Tissues, etc Lurs, Pampers Always. Tanpa Bounty, Charmin, Puffs Fighting for its Iconic Status Under Taylor, P&G has been trying to find ways to revive the prospects of its mostly aging brands. For years, P&G had spent heavily to build on its success with legacy soap and detergent brands to acquire hundreds of additional brands in de businesses that it hoped could also become part of consumers' daily routines. The latest effort to jettison over half of its brands indicated that the strategy was not working anymore. In particular. Pag has been struggling with its pusb to place more emphasis on products that carry higher margins to move it away from its dependence on household staples. Above all, it is clear that the recent push to expand into new categories with acquired brands did not produce the desired results. The firm's appressive push into beauty, for sample, has struggled to show much prowth. Lahad tried to build the fim's presence in this business for years, regarding it as a high margin, faster growing complement to the fimm score household products. The firm has struggled to show growth in this business and it has been generating the lowest profit marins. Sales of Olay skin care products and Pantene hair care products have mostly sanged in recent years. Its efforts to build a line of perfumes around licenses with Dolce & Gabbana, Gucci, and Hugo Boss were also running into problems Analysts noping that the decision to restructure P&G will address long-standing problems that the firm has been facing The new organization will give more responsibility for its different product Categories to separate business units, giving them control over their sales for the largest 10 geographic markets, including the United States, China, Russia, and Germany. Such a push for decentralization would give these units more freedom to adjust their strategies to the bends of the different product categories in each of the markets. We are accelerating the pace of change and stepping up esecution to meet the challenges of today's dynamic world." said Taylor Global Segment Results Net Sales Earnings (Loss) from Continuing Operations Before Income Taxes Net Earnings (Loss) from Continuing Operations Depreciation and Amortization Total Assets Capital Expenditures BEAUTY 2013 $12,406 $3,042 $2,320 $ 236 $4,709 $ 766 2017 11.429 2.546 1.914 220 4,184 500 2016 11,477 2,636 1.975 218 3,863 435 GROOMING 2015 6,561 1,801 1,432 447 22,609 364 2017 6.542 1.985 1,532 433 22.750 341 2016 6,815 2,009 1.548 451 22,319 383 HEALTH CARE 2018 7.867 1.922 1,283 230 5,254 330 2017 7,513 1,899 1,898 209 5.104 283 2016 7,350 1.812 1.250 204 5,139 240 FABRIC & HOME CARE 2015 21,441 4191 2,708 534 7,295 1,020 2017 20,1714.249 2,713 313 6.896 797 2016 20.730 4.249 2,778 531 6919 672 BABY FEMONINE, & FAMILY CARE 2018 15 080 3,5272261 899 9,682 1,016 2017 18.252 3.865 2,503 874 9,920 1.197 201615,505 4,042 2,650 $869,863 1.261 CORPORATE 2018 497 (1,157) (133) 489 68,761 221 2017 505 (1,289) 247 571 71,463 167 2016 422 (1,379) (174) 788 78,508 323 TOTAL COMPANY 2018 $66,832 $13,326 $ 9,861 $2,834 $118,310 83,717 2017 65,058 13.257 10.194 2,820 120,406 3,384 2016 65,299 13,369 10,0273,078 127.1363,314

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock