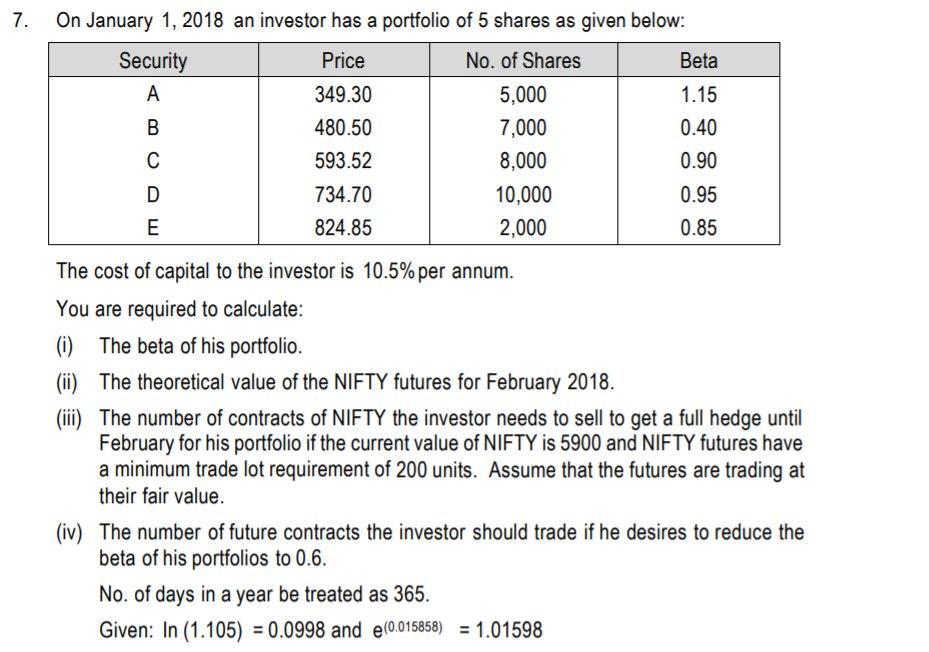

Question: 7. On January 1, 2018 an investor has a portfolio of 5 shares as given below: Price No. of Shares 349.30 5,000 480.50 7,000

7. On January 1, 2018 an investor has a portfolio of 5 shares as given below: Price No. of Shares 349.30 5,000 480.50 7,000 593.52 8,000 734.70 10,000 824.85 2,000 Security A B C D E Beta 1.15 0.40 0.90 0.95 0.85 The cost of capital to the investor is 10.5% per annum. You are required to calculate: (i) The beta of his portfolio. (ii) The theoretical value of the NIFTY futures for February 2018. (iii) The number of contracts of NIFTY the investor needs to sell to get a full hedge until February for his portfolio if the current value of NIFTY is 5900 and NIFTY futures have a minimum trade lot requirement of 200 units. Assume that the futures are trading at their fair value. (iv) The number of future contracts the investor should trade if he desires to reduce the beta of his portfolios to 0.6. No. of days in a year be treated as 365. Given: In (1.105) = 0.0998 and e(0.015858) = 1.01598

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Peta of his Portfolio Security Price g the stock a 3493 4805 59352 73470 82485 A B Nog Sharel b 5000 ... View full answer

Get step-by-step solutions from verified subject matter experts