Question: What can you about hedging and hedging relationships Hedging Hedging is a method of offsetting a potential financial loss of the structuring of a transaction

What can you about hedging and hedging relationships

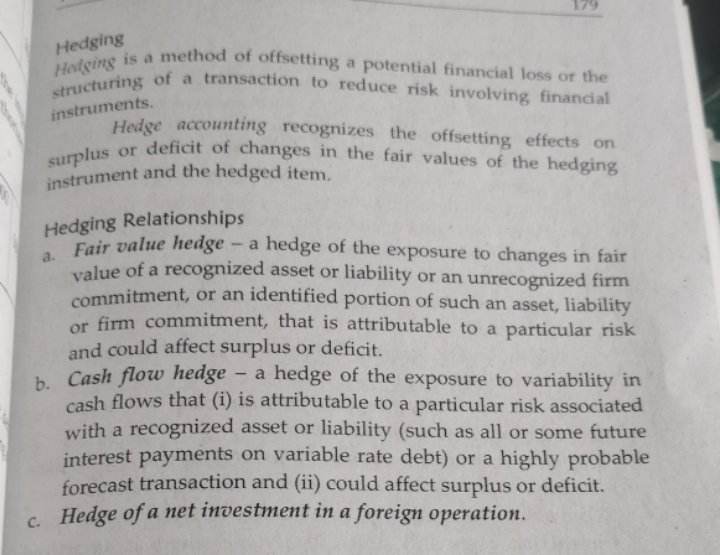

Hedging Hedging is a method of offsetting a potential financial loss of the structuring of a transaction to reduce risk involving finandal instruments. Hedge accounting recognizes the offsetting effects on surplus or deficit of changes in the fair values of the hedging instrument and the hedged item. Hedging Relationships a Fair value hedge - a hedge of the exposure to changes in fair value of a recognized asset or liability or an unrecognized firm commitment, or an identified portion of such an asset, liability or firm commitment, that is attributable to a particular risk and could affect surplus or deficit. b. Cash flow hedge - a hedge of the exposure to variability in cash flows that (i) is attributable to a particular risk associated with a recognized asset or liability (such as all or some future interest payments on variable rate debt) or a highly probable forecast transaction and (ii) could affect surplus or deficit. c. Hedge of a net investment in a foreign operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts