Question: What does a proper loan structure accomplish for the borrower and the lender? Minimizes interest fees; speeds up the approval process Maximizes available funds; charges

What does a proper loan structure accomplish for the borrower and the lender?

Minimizes interest fees; speeds up the approval process

Maximizes available funds; charges the highest interest rate

Satisfies financial needs; optimizes profitability

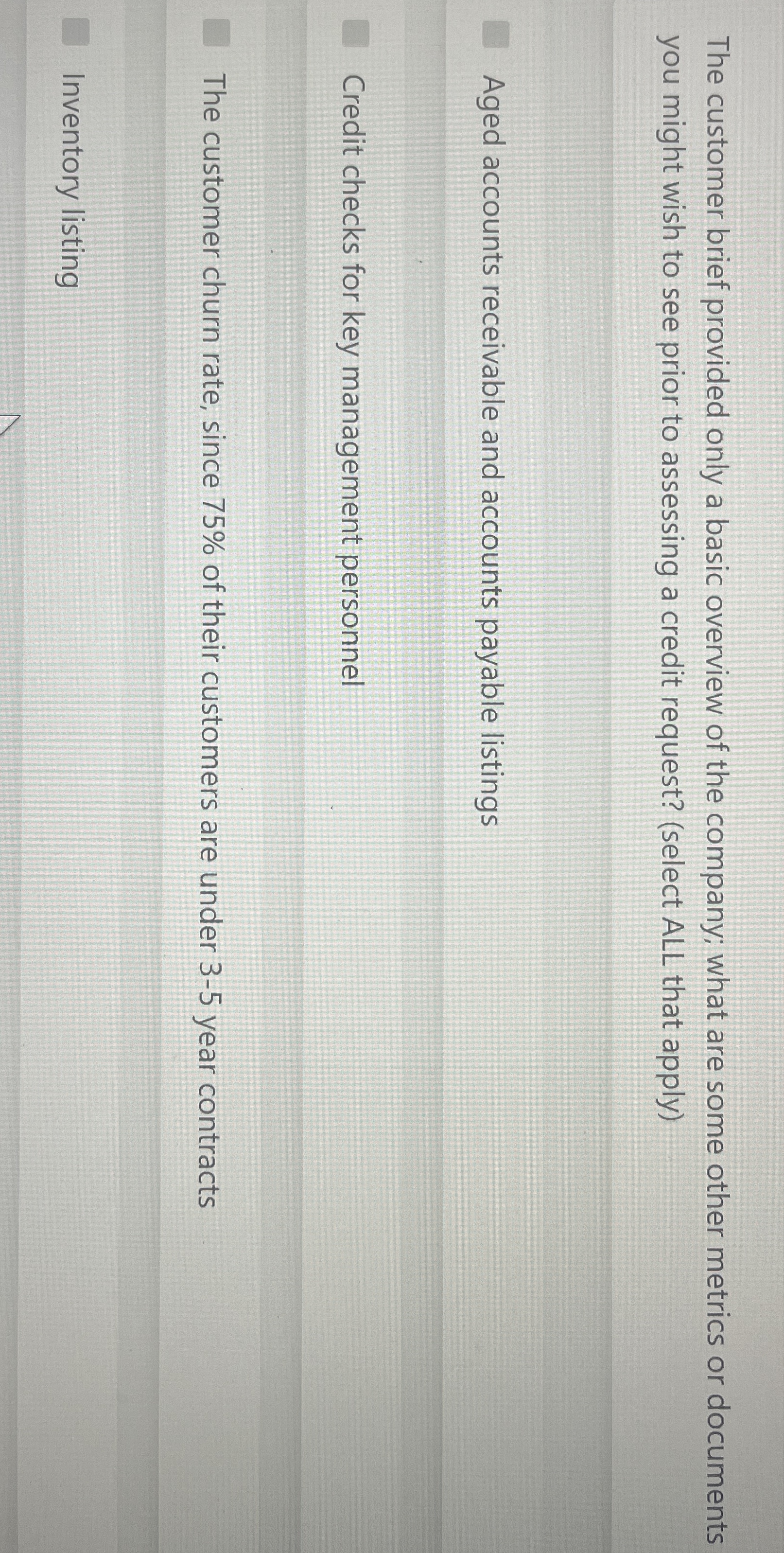

Solves working capital shortfalls; increases account monitoring efficiencyThe customer brief provided only a basic overview of the company; what are some other metrics or documents you might wish to see prior to assessing a credit request? select ALL that apply

Aged accounts receivable and accounts payable listings

Credit checks for key management personnel

The customer churn rate, since of their customers are under year contracts

Inventory listingThe customer brief provided only a basic overview of the company; what are some other metrics or documents you might wish to see prior to assessing a credit request? select ALL that apply

Aged accounts receivable and accounts payable listings

Credit checks for key management personnel

The customer churn rate, since of their customers are under year contracts

Inventory listing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock