Question: what each cell reference should be? Thank you 118 234 fx A B C D E F A company acquired an asset for $1,200,000 in

what each cell reference should be?

Thank you

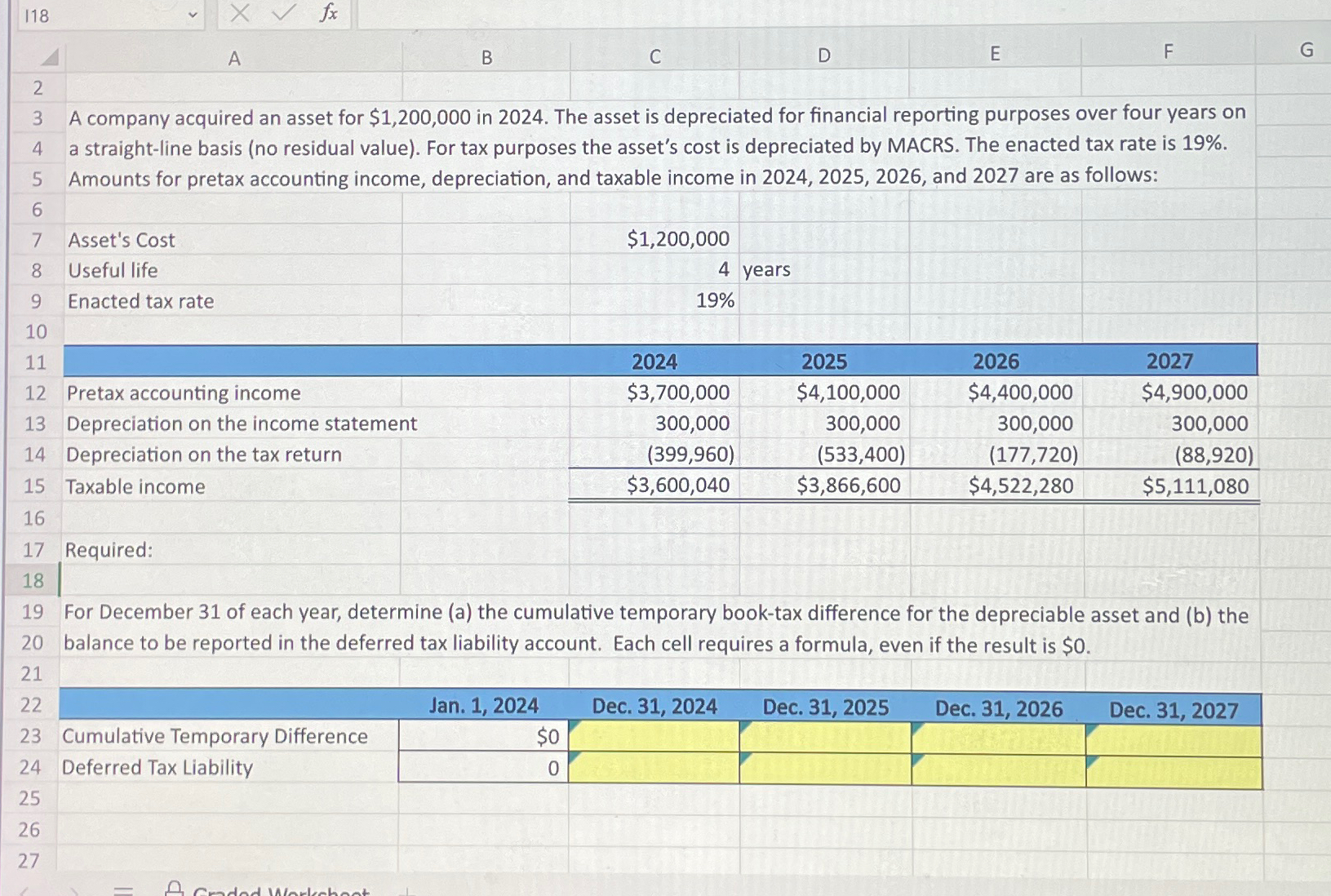

118 234 fx A B C D E F A company acquired an asset for $1,200,000 in 2024. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 19%. Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows: 5 6 7 Asset's Cost 8 Useful life 9 Enacted tax rate 10 11 $1,200,000 4 years 19% 12 Pretax accounting income 2024 $3,700,000 2025 $4,100,000 2026 $4,400,000 2027 $4,900,000 13 Depreciation on the income statement 300,000 300,000 300,000 300,000 14 Depreciation on the tax return (399,960) (533,400) (177,720) (88,920) 16 55 15 Taxable income $3,600,040 $3,866,600 $4,522,280 $5,111,080 17 Required: 18 G 21 22222222 19 For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the 20 balance to be reported in the deferred tax liability account. Each cell requires a formula, even if the result is $0. Jan. 1, 2024 Dec. 31, 2024 Dec. 31, 2025 Dec. 31, 2026 Dec. 31, 2027 23 Cumulative Temporary Difference $0 24 Deferred Tax Liability 0 25 26 27 Graded Worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts